Founders are a special breed — independent, self-reliant, and resourceful. Yet these same attributes, critical in taking an idea from zero to one, can eventually cause first-time founders to misjudge situations and tackle problems without appropriate guidance. This is particularly true (sometimes tragically so) in the legal arena, where founders generally have little or no experience and the risks are difficult to quantify.

To solve this, Extra Crunch is offering up well-sourced lists of the best lawyers for startups, alongside articles and resources written by experts who navigate tricky legal issues for startups on a daily basis. This article is the first of a five-part series covering the legal terrain you should endeavor to navigate with the help of an experienced guide, including:

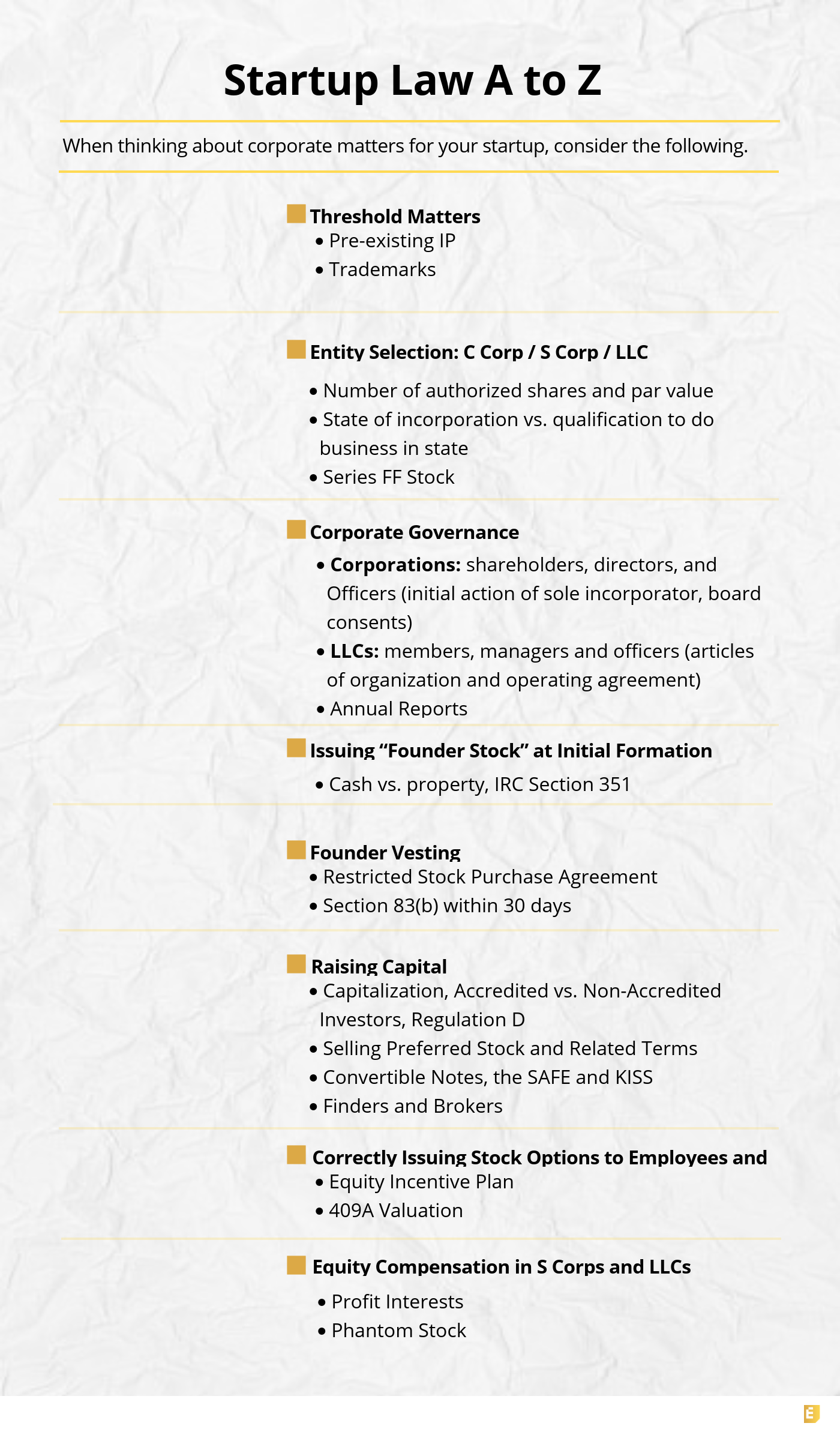

- Corporate: Business Formation, Capitalization and Financing, Securities and Options, etc.

- Intellectual Property: Patents, Trade Secrets, Trademarks, and Copyright, etc.

- Business Transactions: Master Services / SaaS Agreements, Terms of Use, NDAs, etc.

- Compliance and Regulatory: Business Qualification, Privacy, and FTC Regulation, etc.

- Human Resources: Employee Compensation, Contractors, Discrimination, Immigration, etc.

While none of this will be legal advice per se, it is perhaps the next best thing: a simple checklist followed by in-depth summaries helpful to evaluate whether and when formal legal counsel is needed in key areas. With the information from this article and those to follow, alongside other Extra Crunch resources, you can analyze your business circumstances and evaluate your risk exposure. Should you identify legal risks in the above or related areas, simply reference the list of best startup lawyers compiled by Extra Crunch, then reach out to those lawyers focused on serving companies at your stage with experience in the matters at hand.

This article will examine “corporate law” as it relates to startups, which includes the body of laws, rules and practices that govern the formation and operation of corporations, including most importantly for founders, ownership and investment in securities (or stock) of a company. Yuval Harari, author of Sapiens, calls corporations (and limited liability companies more broadly) “among humanity’s most ingenious inventions” — so it is worth knowing a thing or two about them.

Two final caveats here: first, TechCrunch readers include everyone from first-time founders still bootstrapping a concept on nights and weekends to serial entrepreneurs with multiple large exits behind them. Overall this article will skew in the direction of the former, since those with more experience should have less need for guidance in these areas, but even experienced entrepreneurs should find this and subsequent articles helpful.

Second, for those unfamiliar with the legal profession, there is an important distinction between transactional and litigation practice. Most TechCrunch readers already understand this difference, but simply to address it here: transactional lawyers do deals and ensure compliance with laws and regulations, while litigators file lawsuits and go to court. That’s an over-simplification, but understand that great transactional lawyers are not likely to be especially great litigators in case you become involved in a lawsuit.

This and subsequent articles will focus on transactional issues, but litigation could arise within any of the five areas above and in that unfortunate event you should seek a lawyer (or team of lawyers) focused on litigating within the specific area(s) relevant to your lawsuit.

Read on for the official Extra Crunch corporate law checklist for startups.

Threshold matters: Pre-existing IP and trademarks

Although technically not matters of corporate law, two threshold items relating to intellectual property should be mentioned from the outset. First, make sure you understand whether the intellectual property you are creating is subject to any claims from the prior or existing employers of the founders. We’ll discuss this topic further in a later article, but it is worth mentioning now so it is on your radar.

Second, because your startup will need to brand itself to attract customers and/or users, put some effort in on the front end to make sure your business name is available and it will not result in trademark disputes down the road. This is easy enough to do using the USPTO’s trademark database, for example, but ultimately it could be a state-by-state question.

Entity selection and incorporation – C corp/S corp/LLC

While many types of legal business structures exist, assuming you are interested in starting a high-growth technology company, really only two matter: the corporation and the limited liability company, or “LLC.” Each allows for multiple individuals to share in the ownership of the company and most of the time will shield owners’ personal assets from the obligations of the business — that is, unless otherwise agreed by the owners themselves, or due to some malfeasance of the owners (such as mixing personal and business expenses, something which founders have been known to do unfortunately). In the latter case, where a business owner’s personal assets can be held to account for liabilities of the company, courts have creatively termed this “piercing the corporate veil.”

For startups ultimately looking to pursue a traditional VC route, incorporating in Delaware as a C corp is the obvious choice — there is no reason to overthink it. Under your certificate of incorporation (sometimes called a “charter”), you’ll typically want to authorize 10 million shares of stock at a “par value” price of $0.00001. (“Par value” is simply the lowest price at which a corporation may issue shares upon initial offering.) Of these 10 million “authorized” shares, only about 4-6 million shares of common stock are typically “issued” to founders from the outset (and don’t worry, percentage ownership is calculated based only on the issued shares).

This will leave available additional “authorized but unissued” shares which can later be issued to create a stock option pool for incentivizing employees, or issued as preferred stock to investors in exchange for cash. With respect to the latter use specifically, it is generally not necessary to specifically authorize a separate class of preferred stock upon initial formation — this can always be done by amending the charter in connection with the actual investment round later on, since the round is likely to require a charter amendment in any case.

One final note on initial formation: more recently, a new class of stock called “Series FF Stock” is sometimes included during initial formation for issuance to founders (essentially, a hybrid of common and preferred stock) in order to later facilitate stock sales by the founders themselves to investors in future equity financings, effectively allowing founders to personally realize some liquidity before an actual sale or IPO. If this sounds appealing to you as a founder, which it should, it is definitely worth asking your lawyer about.

If you are not looking at a traditional VC path, however, S corps and LLCs can provide better options in certain situations, particularly if your business will remain relatively small over the long term (tens of employees and not hundreds). In terms of tax treatment, these entities are typically advantageous, especially in the early years, since business income and losses are “passed through” to the owners and taxed on an individual basis using Schedule K-1, with no separate layer of tax liability for the company itself.

Also, in states like Delaware, California, and others that allow for “statutory conversion,” LLCs can relatively easily convert to a C corp later down the road, should the need arise, through a tax-free transaction under Internal Revenue Code Section 351; provided, however, that the operating agreement is initially well-drafted to anticipate this event (for example, using “membership units” rather than simple percentages to indicate the ownership interests of members).

Finally, if you incorporate outside the state where you will be primarily running the business, you will also need to “qualify as a foreign entity” in your home state (in this case, “foreign” means different state, not country). Put differently, you will need to register your “foreign” company with the state where you are primarily “transacting business” and perhaps your specific county too depending on the nature of your business and any required business licenses. In both cases, the process is very simple (see, for example, New York and California) and most of the time a lawyer is not truly required here, but many, many founders just skip this step entirely, creating problems later on.

Corporate governance

From a high level, a corporation is owned by the shareholders, who in turn have the power to elect individuals to the Board of Directors. The “Directors” govern the corporation on important matters outside the “ordinary course of business” and have the power to elect (and remove) the “Officers” of the corporation, who are responsible for day-to-day management of the business. The following offices must generally be filled right from the start: President (often the CEO), Treasurer (often the CFO or COO), and Secretary.

That said, all three offices can usually be filled by the same person; for example, in California and Delaware both, a corporation may have only a single shareholder and Director. In California, however, once a corporation has two shareholders, it must have at least two board members, and once it has three shareholders or more, it must have at least three board members. Corporations must also typically hold certain required meetings wherein formal minutes are recorded, including in most states at least one annual meeting of the Board of Directors and one annual meeting of the Stockholders (or written consents in lieu thereof).

Since the Board of Directors is the governing body of a corporation, a shareholder owning even a majority of the shares can be outvoted at the Board level with respect to important governing matters (e.g., sales of additional stock or election/removal of officers). Shareholders can remove Directors, of course, but this is a relatively drastic move, so selecting those who will occupy seats on the Board of Directors is extremely important for founders. In the beginning, the Board of Directors should only include founders and ideally an odd number of them to avoid voting deadlock on important company decisions. If you must have an even number of Directors on the Board, e.g., two 50/50 co-founders, then at least make sure you’ve included specific “tie-breaker” provisions in the governing documents of the company. Now, once the “certificate of incorporation” (or “charter”) is filed with the Secretary of State, the initial Directors of the company will be formally appointed by a written document called the “Initial Action by the Sole Incorporator” (often company counsel will perform this action). The initial Directors will then elect the Officers, authorize and issue stock to the founders, authorize the opening of a business bank account including establishing a federal Employment Identification Number (EIN), and paying expenses, etc. All of this is generally done through a “unanimous written consent” of the Board of Directors, which is a document signed by all Directors, rather than through votes taken in a formal in-person organizational meeting.

Other matters often addressed through this first “unanimous written consent” may include adoption of the following:

- Bylaws, which set out board election and voting procedures;

- Restricted Stock Purchase Agreement, which imposes “vesting” and rights of first refusal on founder/employee stock, as well as an assignment of pre-existing intellectual property to the company in certain cases;

- Equity Incentive Plan (i.e., stock option plan), which sets forth the terms on which stock options can be granted and exercised;

- Proprietary Information and Invention Assignment Agreement (PIIA), which will be signed by all founders, employees, and consultants, assigning to the company ownership of all intellectual property created in the business;

- Selection of applicable fiscal year; and

- Election of S Corp tax treatment (if desired).

Note finally, going forward, separate from any income taxes owed, corporations (as well as LLCs) must generally file certain information with the Secretary of State and pay franchise taxes each year as well (e.g., see Delaware’s Annual Report and California’s Statement of Information). For further discussion of corporate governance structure, see Holloway Guides.

For LLCs, rather than shareholders, each owner is called a “member” and instead of the “certificate of incorporation” and “bylaws,” the LLC is governed by the “articles of organization” and an “operating agreement” respectively. The operating agreement is often a lengthy, comprehensive contract detailing each member’s ownership interest (either percentage-based, or preferably, measured in ownership units), economic rights (distribution of profits and losses), governance and voting rights (addressing “tie-breaker” scenarios if necessary), and rights between members with respect to ownership interests (e.g., right of first refusal, buy-sell agreements, or other restrictions on transfers).

LLCs can either be “member managed” (all members approve major decisions and can act on behalf of the LLC) or “manager managed” (members may elect one or more managers with ultimate decision-making authority, but otherwise have no governance authority themselves). In the latter case, managers may also delegate responsibility for day-to-day business operations to officers, similar to the Board of Directors and Officers in a corporation. Since the operating agreement is essentially a contract between the members, which can be drafted with almost infinite variation, LLCs are known for being extremely flexible, but therefore less predictable for outside investors.

Since the operating agreement is less susceptible to standardization, it is wise to consult an experienced attorney to establish the desired governance and capitalization structure. Also, since equity issuance and compensation is less straightforward in the LLC context, most of the remaining sections below (except for the last) are specific to corporations, though many of the underlying principles may still apply.

All of that is to say, upon formation, you should have a clear understanding of what roles each founder will play, what time commitment is expected, what the ownership structure will look like, and who will serve on the Board of Directors (or serve as managers of the LLC) and therefore how decisions will ultimately be made. In the Delaware corporation context specifically, the Delaware Incorporation Package from Cooley Go, or services like Clerky, provide founders streamlined options and helpful resources to understand the steps involved; and again, if you’re thinking about going the LLC route, consult with a knowledgeable lawyer to ensure you don’t foreclose or complicate viable investment options later on.

Issuing “founder stock” at initial formation

“Founders Stock” is simply the common stock issued to founders when a corporation is initially formed; if done correctly, it is non-taxable because: (1) it is equal in value to the small amount of cash founders pay into the company in exchange for receiving the stock at par value (another good reason to set the par value very low, again say, $0.00001, allowing for minimal cash outlay); or (2) “property” has been contributed to the company in exchange for the stock under Section 351 of the Internal Revenue Code, which provides that no gain or loss is recognized if property is transferred to a corporation by a person or persons who together own at least 80% of the corporation.

“Property” has been broadly defined to include legally protectable know-how and trade secrets, but this definition is not infinite in scope, so don’t get carried away trying to avoid paying the par value price for the stock in cash. Instead, one recommended hybrid approach involves each founder paying a portion of the par value purchase price of their stock to the company in cash, with the remainder covered by or attributable to an assignment by each founder to the company of their pre-existing intellectual property. This approach covers all the bases in terms of valid consideration (i.e., the cash payment) while ensuring that the pre-existing intellectual property of each founder is properly owned by the company.

Founder vesting and section 83(b) within 30 days

Where co-founders have contributed cash or other property to the company in exchange for their shares at par value, they own the stock outright. Thus, to achieve vesting and protect all founders from any particular co-founder leaving early with a large chunk of the company, each founder should enter a “Restricted Stock Purchase Agreement” (directly with the company), which gives the company the right to buy back that founder’s shares, often at par value. This right gradually lapses over time with respect to more and more of the founder’s shares, creating the effect of vesting for those shares no longer subject to the company’s repurchase right.

For co-founders involved immediately upon initial formation, you could reasonably argue that a “cliff” is not necessarily required, but the typical vesting schedule is 4 years, with 25% of the total shares vesting after the first year in a single chunk (this first year representing the “cliff” since nothing will vest if this one-year mark is not reached) then monthly vesting thereafter. Founders should also be aware of single and double-trigger acceleration provisions, which typically become more relevant once institutional investors are involved — more on that via Cooley Go.

Once the Restricted Stock Purchase Agreement is signed, however, certain tax implications are raised, because technically the founder’s stock is now at a “substantial risk of forfeiture” (since founders might forfeit stock if they leave the company). This means that by the time the stock actually “vests” it will almost certainly be worth more than the par value for which it was purchased. The IRS will want taxes paid on that delta, since technically that increase in value is taxable gain.

The solution? Internal Revenue Code Section 83(b), which allows founders and employees to elect treatment of non-vested shares as fully transferred at the very beginning of the vesting schedule, rather than over time as the shares vest. This allows for immediate taxation at the relatively lower current value, which in the case of a newly formed corporation is only some nominal amount based on the par value. This Section 83(b) election must be made in a written document actually signed and filed by the taxpayer within 30 days of the date the stock was made subject to restriction (or in the case of stock options, the date granted). While relatively simple to carry out, this process is important enough that getting oversight from experienced corporate counsel is prudent. See Holloway Guides for more discussion.

Raising capital

Capitalization, accredited vs. non-accredited investors. “Capitalization” in the startup context generally means the funding necessary for a startup to open for business, while “capital structure” refers to the types of capital (broadly, either equity or debt) available to fund business operations. Capital structure often consists of common stock and preferred stock (equity), as well as convertible notes (debt). A “capitalization table” (or “cap table”) will provide a summary of all securities (stock) issued by the company, along with the fully diluted percentage ownership of each shareholder based on all issued shares (not the total authorized shares).

Capitalization of your startup may include issuance of convertible notes or the sale of preferred stock and other securities, all of which are subject to the federal “Securities Act of 1933” as well as various “Blue Sky” state laws, essentially intended to prevent fraudsters from selling shares in worthless companies to unwitting investors. In determining compliance with these laws, the distinction between ‘Accredited’ and ‘Non-Accredited’ investors is important; in brief, raising money from accredited investors generally means there is less to worry about.

“Accredited Investors” by definition must have net worth of $1 million (excluding a principal residence) or annual income for the current and past two years of at least $200,000 (or $300,000 jointly with a spouse). If you are planning on raising money from Non-Accredited Investors, which founders should NOT do but often will do anyway, then in addition to familiarizing yourself with Rule 502(b)(1) and related Rules 504-506 of Regulation D (which provide relevant exemptions in this context), you should absolutely consult with an experienced securities attorney to make sure your reliance on these rules is not misplaced, as they are deceptively complex, though essentially can be summarized as follows:

- Rule 504 provides an exemption for the sale of up to $1 million in securities within any 12 month period;

- Rule 505 provides an exemption for the sale of up to $5 million in securities within any 12 month period to any number of accredited investors and up to 35 unaccredited investors; and

- Rule 506 provides an exemption to an unlimited number of accredited investors and up to 35 other purchases, provided, however, that all non-accredited investors are “sophisticated” — having sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment.

Failure to comply with federal and state securities laws is a big deal: non-compliance gives rise to a rescission right for investors (legally they can demand their money back) and there are serious civil and criminal penalties for any materially false statements or omissions made during the offer or sale of any securities.

Selling preferred stock. Once you’ve found investors, outside of convertible notes and similar instruments discussed below, you should only be selling preferred stock to them, typically in the context of a “priced round.” If you sell common stock to investors, you will be setting the price of the common stock too high for purposes of granting attractive stock options to employees / advisers later on — that is, the “strike” or exercise price for the options will simply reflect the enterprise value of the company when sold, eliminating any real upside for employees (as well as the incentive to work extra hard) since there will be little or no spread between the strike price of the option and the ultimate price per share in an acquisition.

Selling preferred stock to investors in the context of a “priced round” requires that the company be assigned a specific valuation, however, which can be difficult and time consuming at the beginning of a company’s life. This is why convertible notes and SAFEs (discussed below) are so popular in the very early stages.

Preferred stock is so called because it carries certain “liquidation preferences” — meaning that if the company is sold or liquidated and there is not enough money to pay out all shareholders (e.g., the total investment was greater than the final acquisition price), then preferred shareholders get their money back before the common shareholders, i.e., the founders, will receive anything. The exact terms of the liquidation preference is negotiated (usually one to three times the amount of cash invested) and may be either “participating” or “nonparticipating” — though founders will want the “nonparticipating” variety.

A number of other special rights are also negotiated for preferred stock in a priced round, including those listed below; more info at Cooley Go, but for now, simply understand that these terms are complex enough that experienced corporate counsel is absolutely required when selling preferred stock in a priced round to investors:

- Valuation/Dilution (pre/post-money)

- Dividend preferences;

- Redemption rights;

- Conversion rights;

- Anti-dilution protections (in order of most to least founder-friendly: “weighted average — broad based,” “weighted average – narrow based,” or “ratchet based”);

- Voting rights (election of “x” number of members to the Board of Directors, approval of a sale or merger, issuing more shares, etc);

- Registration rights;

- Protective provisions, which can include certain affirmative covenants (e.g., investor access to financial information of the company) and certain negative covenants (e.g., agreement not to take certain actions without approval of the preferred shareholders)

- Right of first refusal; and

- Co-sale rights.

Convertible notes. For startups looking to raise less than ~$500K (sometimes more), rather than selling preferred stock and negotiating all the particulars above, alternatives exist which do not require setting a specific company valuation, namely:

Convertible Notes: As in “promissory note,” so technically a loan and therefore debt which carries interest, which in most circumstances converts to equity as preferred stock upon a later “qualified financing” when preferred stock is sold at a specific price. Usually the note converts at a 10%-30% “discount” to the preferred share price, or subject to a valuation “cap” that is effectively lower than the preferred share price, in order to reward the earlier investment for the additional risk. More info via 500 Startups.

KISS and SAFE Instruments: The relatively more recent “KISS” (from 500 Startups) and “SAFE” (from Y-Combinator) both remove the debt element of the convertible note, but otherwise operate in a similar fashion. Even more recently, Y-Combinator adjusted the terms of its SAFE from a “pre-money” to “post-money” valuation cap structure, which effectively means the new SAFE structure is now relatively more dilutive to current stockholders when issued (often the founders and early employees), but it is also now easier to calculate the amount of ownership sold to investors via the SAFE on a percentage basis (because the percentage no longer changes based on the potential addition or increases to the employee option pool in a later priced round).

“Finders” and brokers. The startup ecosystem is filled with certain people — known as “finders” or “connectors” — who promise to find investment for startups in exchange for a fee. These “finders” typically are not registered securities brokers, so technically they should not do any of the following: participate in negotiations with respect to investing in securities, provide counsel to investors or recommend securities as investments, and perhaps most of all, receive percentage-based compensation on amounts invested.

If presented with a written agreement from a “finder” who is offering to assist in fundraising, be sure that the agreement is non-exclusive and that there is no percentage-based compensation on the funds raised; instead, seek true “advisors” who can offer real business insights, have deep industry knowledge and connections, then pay them via an hourly rate, monthly retainer, and/or properly issued stock options, generally 0.10% to 1% vesting over 2-3 years.

Correctly issuing stock options to employees and advisers

Stock options are not stock, but merely the option to buy a certain amount of stock at a given price — the “exercise” or “strike” price. Employee stock options typically vest over four years, subject to a one-year “cliff” (i.e., the employee must work for at least one year to meet the “cliff” in order to vest any options at all; after that, vesting continues in monthly increments).

Startups generally get into trouble here for two reasons: (1) they fail to establish and formally adopt through appropriate corporation action (i.e., written board consent) a written “Equity Incentive Compensation Plan” (or “option plan”) pursuant to which the options are granted; and (2) they make a promise to grant stock options at a certain time (which implies a certain strike price at that time), but then do not take the necessary corporate action to actually make the stock option grant; namely, a written board consent approving the option grant with an exercise price equal to the fair market value of the stock, as determined by the board of directors, as of the date of grant (ideally with reference to a recent and valid 409A valuation).

It is critical that the board of directors accurately set the exercise price of the stock option to be equal to the fair market value of the optioned stock as of the date of grant. The 409A valuation, when done by a qualified third-party, is really the only way to completely safeguard the Board of Directors’ determination of fair market value of the stock in this regard should the IRS or some other financial auditor later take interest. Not getting this right could later blow up crucial deals — including investment rounds and potential acquisitions — due to the accounting and tax implications. Fortunately, there are now a number of companies which provide 409A valuation services at affordable rates, including Carta, Capshare, and more recently Meld Valuation.

Moreover, unless you want to commit securities fraud, you cannot “backdate” option grants (so that the option granted reflects a previous, lower price). That said, you can set the vesting commencement date to some point in the past in order to give credit for time served. Also, for those interested, there is an important distinction, with corresponding tax implications, between Statutory or Incentive Stock Options (“ISOs”), which can only be issued to employees, and Nonstatutory or Non-Qualified Stock Options (“NSOs”), sometimes issued to non-employee advisors — more on that via the Internal Revenue Service and Investopedia.

One last point worth mentioning in this section: very early on, when company valuation is still extremely low, it is possible and still practical (since tax liability will be minimal in light of the low valuation) to grant “restricted stock” even to non-founders – though you still need an Equity Incentive Plan in place first. In fact, restricted stock is the best option for non-founders involved in the very beginning of a startup’s life because aside from some immediate tax liability (which again, should be light given the relatively low valuation of a new company), ultimate tax treatment will likely be at capital gain rates and so much more favorable as compared to stock options, which usually end up being taxed as ordinary income.

Check out Holloway Guides for more discussion of equity compensation topics.

S Corp and LLC equity compensation

In the S corp and LLC contexts respectively, stock options or equivalent instruments are not as easily issued, and thus again, corporate counsel is appropriate. In the case of the S corp, if an option holder exercises an option who is not a qualified S corp shareholder (e.g., they are a nonresident alien), the S corp could lose its “S election” for pass-through taxation entirely. For LLCs, exercising an option on an interest in the LLC requires complex accounting entries, plus the person exercising the option will then become a member of the LLC, so they will receive “IRS Form 1065, Schedule K-1” and may be required to pay tax on the income of the LLC (in some cases whether or not they actually receive it).

While LLCs can create “profit interests” for its employees, which may entitle recipients to receive a percentage of the future appreciation in enterprise value, these plans are fairly complex to administer. A simpler alternative, used by many S corps and LLCs alike, is “phantom stock” which can be placed on a vesting schedule as well. Phantom stock is essentially a creature of contract, promising that a certain amount of the company’s ultimate acquisition price shall be reserved for distribution to holders of the “phantom stock units.” The amount so reserved is then divided by the number of phantom stock units established in the operating agreement and taken “off the top” from the final acquisition price, to be distributed to each phantom stock holder in accordance with the number of phantom stock units held.

Conclusion

Admittedly, the foregoing covered a bit of ground. As a founder, it is important that you have at least basic familiarity with an incredibly broad range of legal topics — corporate law being one of the most important. Such familiarity will allow you to identify and distinguish between situations that your team can readily handle internally, from those that require outside legal counsel. If you’ve made it this far, a congrats are in order — you are well on your way to startup success.

Daniel T. McKenzie, Esq., manages the Law Office of Daniel McKenzie, specializing in the representation of startups and startup founders. Prior to establishing his law office, Daniel McKenzie co-founded and served as lead in-house counsel for Reelio, Inc., backed by eVentures, and acquired in 2018 by Fullscreen (a subsidiary of Otter Media and AT&T).

Thank you to Stephane Levy, a partner at Cooley, for providing comments on this article.

DISCLAIMER: This post discusses general legal issues, but it does not constitute legal advice in any respect. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel in the relevant jurisdiction. TechCrunch, the author and the author’s law firm, expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post.