In the five years since its product was showcased onstage at TechCrunch Disrupt New York’s hackathon, Plaid has emerged as one of the most critical contributors to financial technology’s evolution — and one of the most under the radar.

That is, until now. The company is today announcing a $250 million Series C investment led by famed venture capitalist and the author of the Internet Trends report Mary Meeker, who will join its board of directors as part of the deal. The funds were raised at a valuation of $2.65 billion, according to sources close to the company. Capital from Meeker’s investment came from Kleiner Perkins’ growth fund — where Meeker has been a partner since 2010 — not from the reported billion-dollar-plus solo fund she’s in the process of raising.

New investors Andreessen Horowitz, Index Ventures, Norwest Venture Partners and Coatue Management also participated, as did existing investors Goldman Sachs, NEA and Spark Capital. The financing brings Plaid’s total raised to $310 million and provides a major boost to its valuation, which was just over $200 million with its 2016 Series B.

Making money easier for everyone

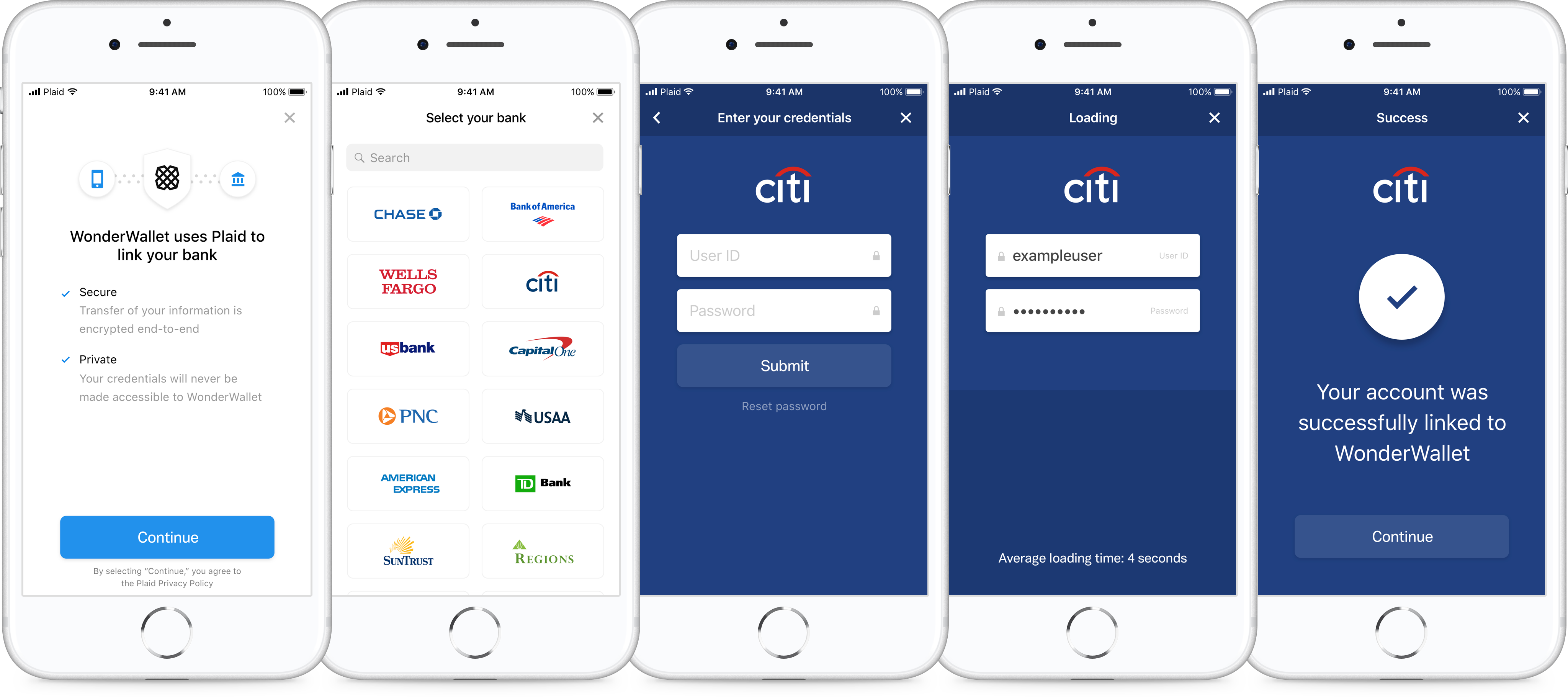

Plaid builds infrastructure that allows a consumer to interact with their bank account on the web through a number of third-party applications, like Venmo, Robinhood, Coinbase, Acorns and LendingClub. The San Francisco-based startup has integrated with 10,000 banks in the U.S. and Canada and says 25 percent of people living in those countries with bank accounts have linked with Plaid through at least one of the hundreds of apps that leverage Plaid’s application program interfaces (APIs) — an increase from 13 percent last year.

The platform allows companies to create financial services applications without having to hire their own team of engineers to build out a tool that connects apps to its users’ bank accounts, something Plaid’s founders themselves lacked when they set out to build a fintech startup years ago. Plaid was founded by a pair of former Bain consultants, William Hockey and Zach Perret, the chief technology officer and chief executive officer, respectively, in 2012.

“We were always really infatuated with the concept of financial services,” Hockey told TechCrunch. “We thought it had so much power to impact and improve people’s lives but at the time it really wasn’t … We quickly realized building financial services was almost impossible to do because there wasn’t the tooling or the infrastructure, so we turned around and started building that infrastructure.”

Plaid closed a $44 million Series B in mid-2016 and has since seen its valuation increase more than tenfold. On top of that, it doubled its customer base this year, launched in Canada — its first market outside the U.S. — opened its third office, expanded its overall headcount to 175 employees and debuted a digital mortgage product called Assets.

Hockey and Perret say the new funding will be used to continue expanding the team in San Francisco, Salt Lake City and New York. Plaid, given how essential its tools are to any technology companies that deals with payments in any fashion, which these days is the vast majority of businesses, is a company to watch going into 2019.

“When we think about our long-term goals, we want to make money easier for everyone,” Perret told TechCrunch. “We want everyone to lives these simple, straightforward digitally enabled financial lives and for us, that means supporting these tech innovators in the space and these large incumbents. We want to be able to help them create great consumer financial experiences so consumers can live simpler financial lives.”