Portify, a London fintech startup that offers an app and various financial products to help gig economy workers better manage their finances and in turn improve financial well-being, has raised £1.3 million in seed investment. The round was led by Kindred Capital and company builder and investor Entrepreneur First (EF), with participation from various unnamed angel investors.

Founded in May last year by EF alumni Sho Sugihara (CEO) and Chris Butcher (CTO), Portify is setting out to address the financial volatility many flexible or so-called gig economy workers face. The startup offers a number of tailored financial products, accessible via its mobile app, to help flexible workers get insights into their current financial status and income, as well as do short and long-term financial planning.

The app — primarily a B2B2C play — is distributed in partnership with various gig economy platforms and also includes earning “rewards” at partnering merchants or service providers. The current Portify website lists TransferWise, Amazon and Spotify as rewards.

“Portify’s vision is to enable financial security and well-being for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“Portify’s vision is to enable financial security and well-being for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“We work with companies to help build access to financial products that enable this security and progression, and offer this through a mobile app which workers can port between different jobs.”

Sugihara says there are three elements to Portify’s mission: helping flexible workers control “immediate income volatility,” helping them budget effectively on a day-to-day basis and support with financial planning for the long term.

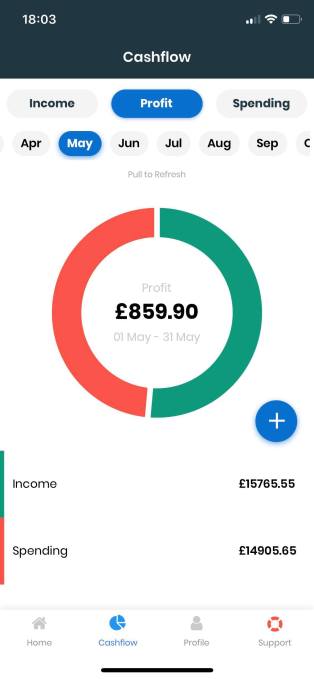

“Once a user gets access to our app, the first thing they do is securely connect their bank account,” he explains. “We then help control volatility by offering emergency credit with select stores to buy essential products if required. We also help our users manage cash flow and budget for tax and other recurring expenses. By building up financial security and well-being from the ground up, our goal is to improve our user’s financial standing over the long term, whether through saving for retirement or helping them invest into their own businesses and careers.”

To that end, Sugihara says Portify is currently being used by independent workers in the gig economy and temp staffing sector. This covers couriers, ride-hailing drivers, retail shop floor staff and hospitality workers, amongst others. Its B2B customers span large gig economy platforms and digital temporary staffing agencies “with global coverage.”