Tesla CEO Elon Musk trolled the U.S. Securities and Exchange Commission in a tweet Thursday afternoon, poking the bear that just days before had agreed to settle securities fraud charges against the billionaire entrepreneur.

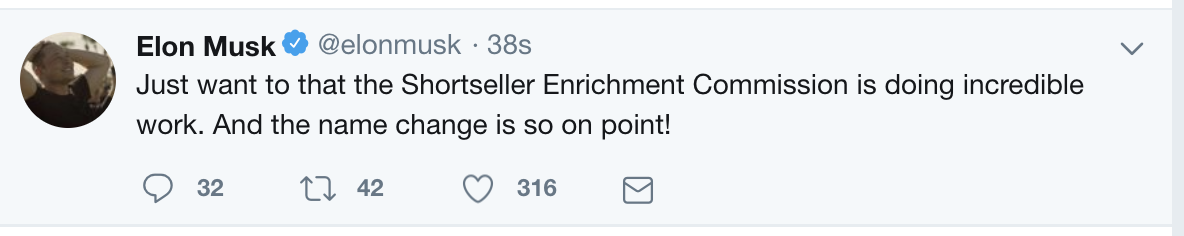

The tweet, sent out at 1:16 pm PT Thursday, says:

“Just want to that the Shortseller Enrichment Commission is doing incredible work. And the name change is so on point!”

The SEC declined to comment. Tesla has not yet responded to a request for comment.

Tesla shares, which closed down 4.4%, fell another 2.5% in after-hours trading before recovering slightly.

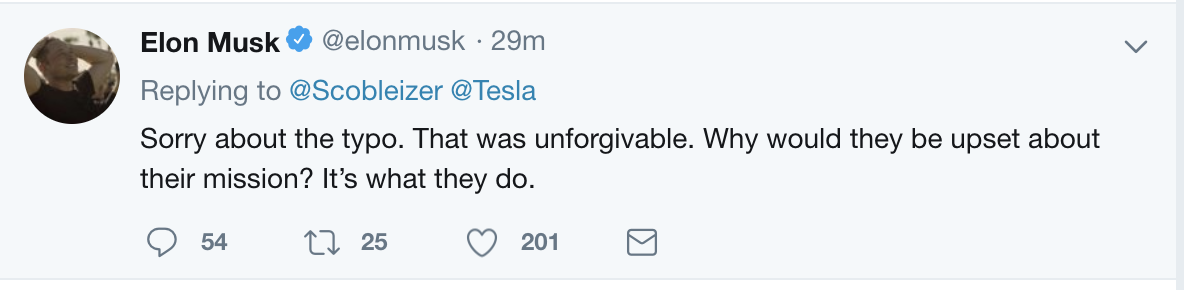

Musk later apologized. But not for the mocking tweet. Instead he doubled down on this trollery and apologized for the typo.

Not all of his supporters appreciated the tweets, calling the CEO out for hurting the stock. Musk’s advice: “Hang in there. If you are truly long-term, it will be fine.”

Just days before, Musk settled a securities fraud complaint filed by the SEC that could have been disastrous for Tesla and its shareholders. Musk agreed, in a settlement reached on September 29, to step down as chairman of Tesla and pay a $20 million fine.

Despite the penalties, it has been largely viewed as a sweet deal that allowed Musk to keep his CEO position as well as a seat on the board. Musk didn’t have to admit or deny the SEC’s allegations either.

Musk is supposed to resign from his role as chairman of the Tesla board within 45 days of the agreement. He cannot seek reelection or accept an appointment as chairman for three years. An independent chairman will be appointed, under the settlement agreement.

Tesla agreed to pay a separate $20 million penalty, according to the SEC. The SEC said the charge and fine against Tesla is for failing to require disclosure controls and procedures relating to Musk’s tweets.

The SEC alleged in its complaint that Musk lied when he tweeted on August 7 that he had “funding secured” for a private takeover of the company at $420 per share. Federal securities regulators reportedly served Tesla with a subpoena just a week after the tweet. Charges were filed just six weeks later.

The charges were filed after Musk and Tesla’s board abruptly walked away from an agreement with the SEC. The board not only pulled out of the agreement, it issued a bold statement of support for Musk after the charges were filed. The NYT reported that Musk had given an ultimatum to the board and threatened to resign if the board pushed him to settle.

A settlement was eventually reached anyway, albeit with stiffer penalties than the original agreement.

Still, the agreement was treated as good news by Wall Street, which sent Tesla shares higher and erased previous losses caused by the SEC complaint.

The series of tweets on Thursday followed an order by a federal judge that asked the SEC and Tesla to submit a joint letter explaining why the court should approve the consent judgment.

U.S. District Judge Alison Nathan, who wrote that the district court must determine whether as consent judgment is “fair and reasonable,” gave the two parties until October 11 to submit the explanation.

It’s not clear if Musk’s tweets are a reaction to the judge’s order.