Amazon, by more than one account, wants to become a big competitor in advertising against the likes of Facebook and Google, but its approach to how it will do this is something of a moving target, with pieces coming and going. In the latest development, the company has quietly announced that it is retiring by the end of September an ad product called CPM Ads. CPM Ads were first launched in 2014 and represented an early foray into display advertising for Amazon, allowing smaller web publishers that were a part of the company’s Amazon Associates affiliate program to run banner and other ads on a cost-per-impression (CPM) model on their sites.

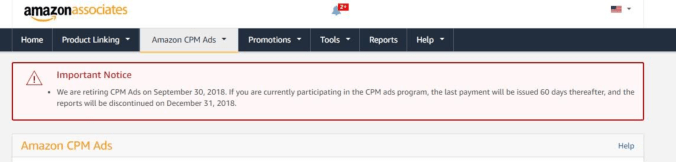

Amazon notified Associates with an alert on their dashboards today (see above) and it has also provided a note on the retirement in its help topics for affiliates. It notes that CPM Ads will be stopped on September 30, 2018, with the last payments coming by November 30, and reports on ads getting discontinued on December 31.

Amazon does not explain why it has decided to phase out CPM Ads — we have contacted the company to ask — but one reason could be because the company is either moving more publishers to other ad units and/or these have not proven to be as popular as expected. The retirement note suggests publishers consider its Unified Ad Marketplace and Native Shopping Ads, if they qualify to use them.

Those who we have spoken to who were using the CPM ads described them as giving great returns (“easy money” was how one described them), and filling a gap that others were not.

Amazon describes the Unified Ad Marketplace as another display ad product that brings together Amazon and supply-side platforms (which aggregate ad space from many publishers; examples include AppNexus, DoubleClick and the Rubicon Project). But it appears that it seems to be geared to larger sites, rather than smaller publishers, as CPM Ads were.

Native Shopping Ads is another Associates product, and as such it is aimed at the same publishers that were using the CPM Ads. But (as with all native ads) these don’t come in the form of banners, but as product placements either within or just below text, and are meant to be for products that are triggered by content on the page.

Amazon’s retiring of CPM Ads comes at a time when many are predicting that the company wants to take a bigger, not smaller, step into the ad world.

There have been reports that Amazon is gearing up to launch a retargeting ad product aimed to compete against the likes of Google and Criteo. Retargeted ads are based on your browsing and follow you around the web in the hopes of bringing you back eventually to buy products, in this case on Amazon. If you have spent five minutes on Amazon or another e-commerce site, and have then seen your browsing history from those sites presented back to you in the form of ads for days afterwards, then you know what retargeting is. Amazon was a big user of retargeting ads on other networks; now, it seems, it wants to run ads like this on its own network.

Others have predicted that the company is planning more search and video-related advertising formats on its own platforms; and that the company is looking to work with third parties to develop ad products for mobile and TV screens.

Amazon made some $4 billion in advertising revenues in 2017, and it is projected to make $9.5 billion this year. These are still modest numbers: as a point of comparison, Google pulled in $95 billion in 2017.

Nevertheless, Amazon remains a huge competitor to Google in other areas, and since a leadership position can sometimes seemingly evaporate overnight, Google is not sitting idly. It has been working on ways of improving its own direct shopping links in areas like search, bringing its platform (and its advertising) a little closer to how Amazon does business.

Updated with some customer response.