Plum, the fintech startup co-founded by early TransferWise employee Victor Trokoudes, is continuing its mission to help you manage your finances and save money. The AI-powered Messenger chatbot already offers savings functionality, including round-ups and regular savings, and today is launching an investment tool that lets you choose fund investments based on themes, such as ethical companies or technology.

Similar to competitors Cleo and Chip, Plum connects to your bank accounts and its algorithm then analyses your spending patterns to work out how much you can afford to set aside. It is able to identify things like income and bills, and can take a number of actions on your behalf.

This includes ‘micro-savings’ — rounding up any purchases you make — and other forms of regular saving, in which money is moved from your bank account to a segregated Plum savings account. From there you’re able to optionally put money into RateSetter, the peer-to-peer lending platform, if you wish to earn interest.

However, savings is only one pillar of Plum’s three pillar strategy. The other two are investments and spotting when you are paying too much for things like credit or utilities. Investing is getting an official launch today (having been announced in wait-list form a few months ago), and Trokoudes tells me energy switching, in partnership with green energy company Octopus, has been live for a while. If Plum detects that a user could reduce their home energy bill, it sends them a message offering to initiate the switch on their behalf.

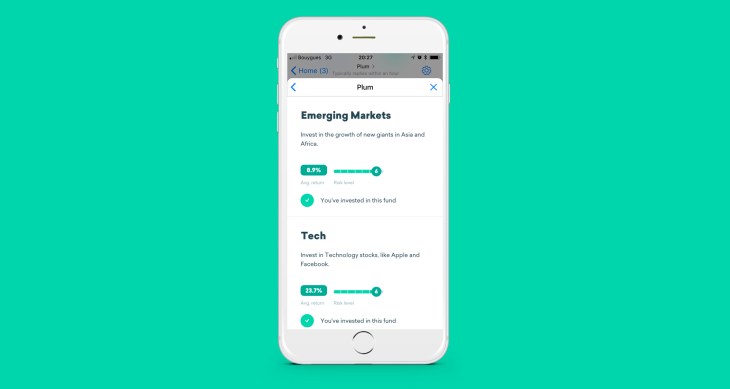

Along with letting you invest at three different risk levels, Plum’s new investment tool provides theme-based investing. At launch these are ‘Tech’, ‘Emerging Markets’, and ‘Ethical Companies’. Other themes the platform will add in the coming months include ‘AI’, ‘Nutrition’, and ‘Robotics’. You can invest from as little as £1.

Notably, Plum is charging a monthly fee of £1 for accessing the feature, along with 0.15 percent annually on the amount you have invested. If you choose the themed fund option there is an additional fund fee. However, Trokoudes says investing via Plum is still one of the cheapest options on the market, where higher percentage annual management fees soon add up.

Plum is also disclosing its latest user numbers. In the last year, the chatbot has grown from 22,000 users to 130,000. That’s arguably decent growth for what was quite a limited product feature-wise, so it will be interesting to see the take up for Plum’s new investment tool and what effect that has on overall user numbers. As a comparison, competitor Cleo — which offers a raft of functionality but not yet investing — hit 200,000 users in April and said at the time it was growing by 3,000 users per day.

Meanwhile, Plum isn’t the only savings or PFM-type app that lets you invest based on themes. Oval Money (see our previous coverage) has quietly launched an investment marketplace, starting with three funds.

The “Women at the Table” fund will allow investors to support companies that ensure that at least 20 percent of board members are women. A “Belong but Work Remote” fund promotes the growing “flexible jobs economy”. Lastly, “Generation Millennials” will track leading consumer brands that are particularly popular with millennials.

The move is said to reflect research Oval Money has conducted into the “increasing appetite younger savers have to invest in causes they believe in, rather than basing decisions only on traditional risk-return factors”.