French startup Lydia is raising a $16.1 million round (€13 million) led by CNP Assurances with existing investors XAnge, New Alpha AM, Oddo BHF and Groupe Duval also participating.

Lydia isn’t the first startup that wants to replace PayPal, and also probably not the last one. But it’s clear that the company is slowly becoming mainstream in France. The company first focused on Venmo-like peer-to-peer payments but is now branching out to cover all sorts of transactions.

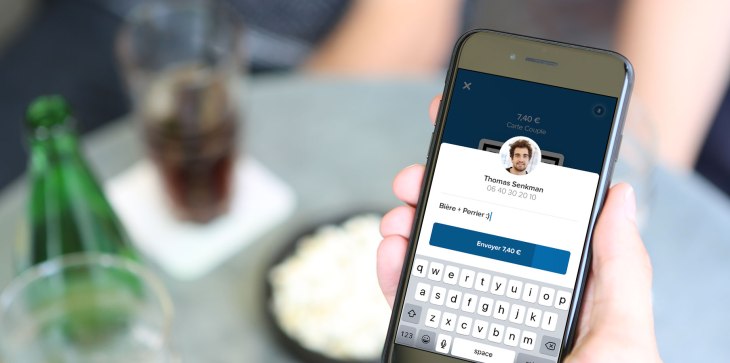

The product roadmap is quite simple. First, Lydia grabs new users thanks to free and instant transactions to pay back your friends. And now, the company is letting you use your Lydia account to pay in store, online and more.

For instance, you can pay on Cdiscount with your Lydia account, France’s second e-commerce website behind Amazon.fr. E-commerce websites usually ask you for your phone number for the delivery. When you choose Lydia as your payment method, you receive a push notification on your phone as your Lydia account is already linked to your phone number. After unlocking the app, you can use your Lydia balance or pay with your debit card without having to enter your card information on the e-commerce website.

When you want to pay in store, you first enter the amount and show a QR code to the cashier. For instance, it works in all Franprix supermarkets in France. The cashier can use the same barcode reader as they would use to scan products.

The idea is that you’re already using your phone when you’re waiting in line. With Lydia, you don’t have to put your phone back in your pocket or bag to find a card.

But what about Apple Pay and places that don’t accept Lydia? Lydia has launched a good old plastic card that is connected to your Lydia account. You can top up your Lydia balance with your personal IBAN, activate or deactivate features in real time and more. And if you don’t want yet another card, you can just enable the virtual card and add it to Apple Pay.

Overall, Lydia processes around 1 million transactions per month, or around €25 million in monthly volume. While newer users still mostly use the peer-to-peer payment feature, older users and card users use Lydia more and more to pay businesses.

With more than a million registered users, Lydia is the leader in this space in France. The company has recently launched its product in the U.K., Ireland, Spain and Portugal. More importantly, more than 2,000 people sign up to Lydia every day.

“We’ve never grown so fast,” co-founder and CEO Cyril Chiche told me. “In 2018, we’re probably going to grow more quickly than PayPal in France.”

“What’s interesting in particular is that the growth rate for transactions is higher than the user growth rate,” he added. In other words, the number of transactions per month per user is growing.

That’s an impressive growth rate for a European fintech startup. In November 2017, Revolut had around 3,000 to 3,500 signups per day. In August 2017, N26 reported 1,500 signups per day. While those numbers are outdated, it’s interesting to compare Lydia to N26 and Revolut.

And Lydia still plans to expand beyond its five current markets. Germany and Austria are next on the list, with more European countries to follow. Lydia hires native country managers who fly back and forth between the main office in Paris and those new markets.

There are now around 40 employees at Lydia. The startup plans to be working with 60 employees by the end of 2018, and 90 employees by the end of 2019. When it comes to product, Chiche told me the startup would have more to share in the coming weeks.

Disclosure: I share a personal connection with an executive at CNP Assurances.