Right now if you want financial guidance and planning help you basically have two options – shell out thousands (or more) a year for an old-school Wall Street-affiliated advisor, or test your luck with one of the free financial planning chatbot startups that have been popping up over the past few years.

Neither of these are ideal for most people; traditional advisors give good advice but are expensive and decades behind when it comes to using technology to help you track your progress – and chatbots are high-tech but rarely offer personalized advice.

So what would an alternative look like?

Launching this week, Grove wants to provide a solution that falls somewhere in between the two current options. For $600 a year the startup pairs you up with a real-life certified financial advisor to give you personalized financial advice, but also provides you with the tech to visualize and stay on top of the advice you’re given.

The startup was founded by Chris Hutchins, who co-founded Milk with Kevin Rose then went on to be a partner at Google Ventures. He’s raised a $2.1M seed round led by First Round with participation from Lowercase Capital, SV Angel, Box Group and others.

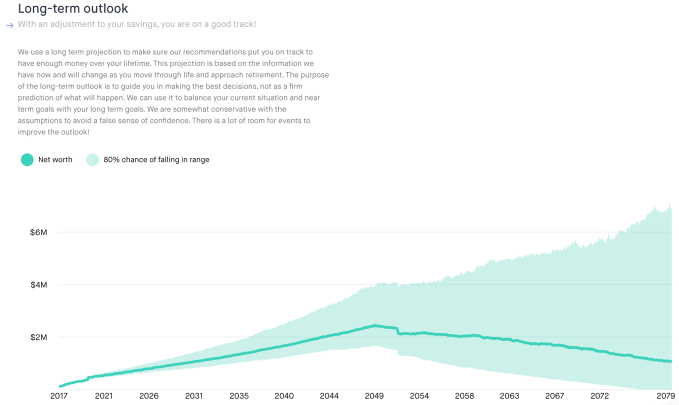

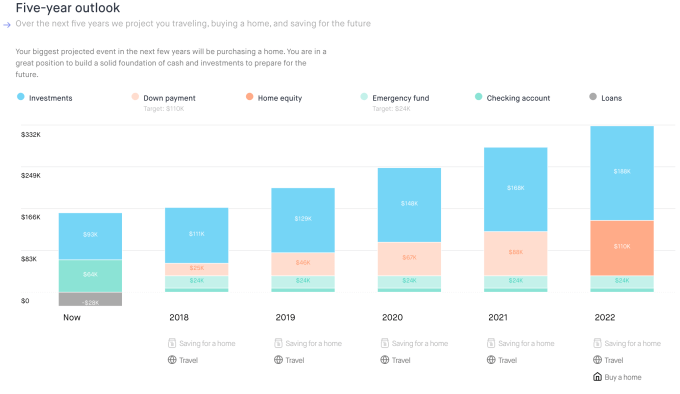

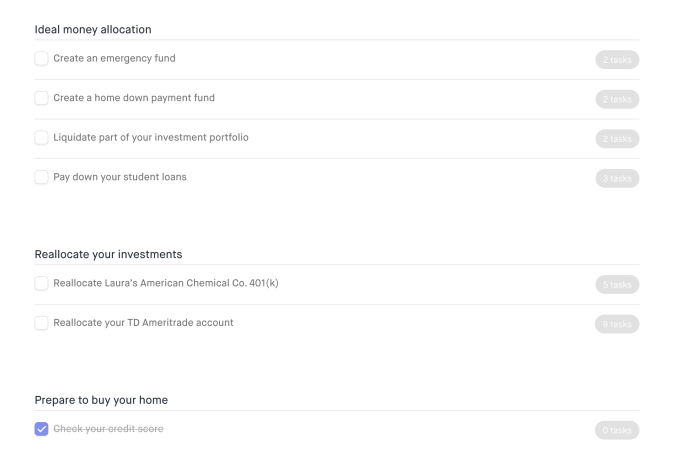

When users first sign up for Grove they are paired with a Certified Financial Planner who will review their situation and create goals moving forward. They also make specific recommendations about how you manage your money, like telling you if it’s more cost effective to use your savings to pay off your student loans ahead of schedule.

These goals go into a dashboard where users can keep track as they complete them, like in the image above. Anytime you need a check in you can message your advisor, and the service also will send you reminders to make sure you’re actually doing what you need to.

Part of the reason Grove can give such accurate advice is that it asks users to connect as many existing financial services as possible to figure out how you spend and save your money. This includes things like credit cards and investment accounts. Grove also has its own investment service (they charge .25% of AUM) so they can manage your investments automatically, but if users want to keep their existing investing portfolio they can just manually make the trades and reallocations that Grove suggests.

That being said, Grove still thinks its main revenue source will be the $600 per year subscription, meaning they don’t plan on pushing users to sign up for additional services or generating referral fees by steering them towards a certain financial product.

The site is live now and users can schedule a time to have an initial consultation with an advisor before committing to a yearly plan.