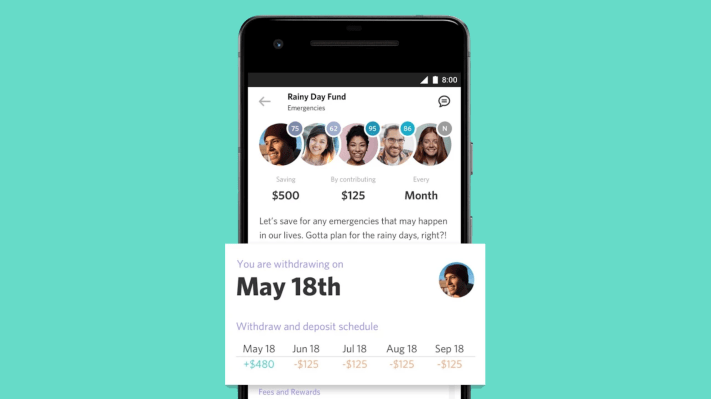

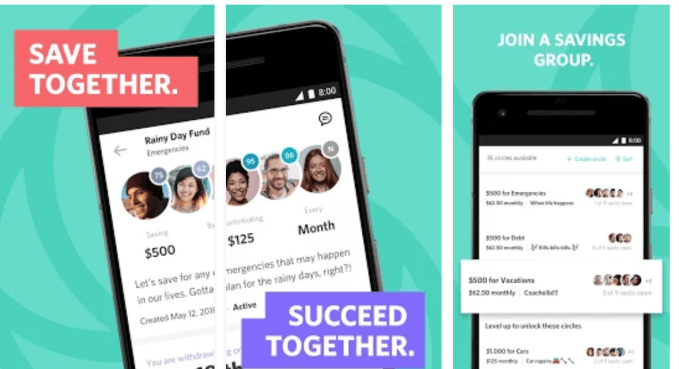

Yahoo Finance today launched a new app called Tanda that allows small groups of either five or nine people to save money together for short-term goals. The app uses the concept of a “money pool” – that is, everyone participating in one Tanda’s collaborative savings circles will pay a fixed amount to the group’s savings pot every month. And every month, one member gets to take home the full pot.

But Tanda is not a gambling app. That is, users are not contributing in the hopes of “winning” the pot of money – everyone in the savings circle gets a chance to take home the full pot at some point.

The app is based on the age-old “rotating savings and credit associations” (ROSCA) concept, which pushes people to save through the use of collective pressure.

In other words, while it’s true that you could just set aside a set a fixed amount of money on your own, Tanda’s makes saving a more collaborative and social construct.

The other difference between saving in Tanda and saving on your own is how the app handles payouts. The first two people to receive their money pay a fee, but the last payout position receives a 2 percent cash bonus. This rewards users who are willing to wait to receive their turn at the pot, though some will want higher positions in order to get the large payout sooner.

A higher position is obviously more desirable if you have a more immediate need for the funds – like buying books for school or replacing a dead laptop, for example. Of course, you still have to pay into Tanda to take money out, so it’s not a direct replacement for a credit card. But, with some planning, it could used as an alternative to charging larger purchases.

[gallery ids="1588800,1588801,1588802,1588803,1588799,1588798"]

As a user participates in Tanda by making contributions, their “Tanda score” increases. With higher scores, the user gains access to higher value savings circles and earlier payout positions. These savings circles can reach up to $2,000.

And if someone drops out, Tanda will step in to cover their positions.

Tanda is also working with its partner Dwolla to vet users before they can begin saving, the company says. Users will be required to submit a valid ID and have a U.S. bank account.

Yahoo says that the app is designed to help individuals achieve their financial goals without racking up more debt.

The company hopes this will allow Tanda to attract a millennial audience, which is already drawn to social apps in the finance space, like Venmo. In addition, this younger demographic is facing a variety of financial struggles, like higher costs of living, difficulties in finding work, and they often struggle to save on their own.

“Thirteen months ago, a national outlet reported 46 percent of our nation can’t come up with a $400 emergency expense,” Simon Khalaf, Head of Media Business & Products, told TechCrunch, when explaining why the company wanted to develop this app.

(The figure he’s citing comes from this 2016 Federal Reserve survey of more than 5,000 Americans about their financial situation. According to its findings, approximately 46 percent of Americans said they would not be able to come up with $400 in an emergency situation.)

“This inspired us to start building Tanda, a mobile world version of a centuries old

community savings tool that we hope provides a solution to many,” Khalaf explained.

The new app is being released under the Yahoo Finance brand.

Yahoo, like (disclosure!) TechCrunch parent company AOL, combined to form Oath, which is now owned by Verizon. But Yahoo continues to maintain its own app store presence through apps like Yahoo Finance, Yahoo Weather, Yahoo Newsroom, Yahoo Sports, Yahoo Fantasy Football, Yahoo Mail, and many others.

Tanda is available today in both English and Spanish on Android, and will arrive on iOS within the next few days.