During the last quarter, observers of the venture capital industry have noted that something was slipping away — namely, seed and early-stage venture activity.

The discussion picked up volume as 2017 came to a close. In the latter months of last year, AVC’s Fred Wilson noted a response to Victor Basta’s article describing an “implosion” in seed and early-stage venture capital activity. Back in October, TechCrunch contributor Jon Evans laid out an uncomfortably compelling case for why seed and early-stage ventures could face an even tougher start in life. The Crunchbase News team has also shined a light on the shrinking watering hole for early-stage startups, as well.

But here’s the thing: All of this hullabaloo had primarily concerned the U.S. market, with only a few explicitly noting a global trend. According to projections from Crunchbase reported by Crunchbase News, Q3 2017 set new post-1990s records for deal and dollar volume around the world. In the last quarter of the year, not so much.

Crunchbase News’s report for Q4 finds that global venture activity snapped a year-long growth spurt, with declines led by seed and early-stage deals across certain key metrics. Although deal and dollar volume are up compared to the same time period last year, Q4 brought the first quarterly declines in a year.

Seed and angel deal volume gets its wings clipped

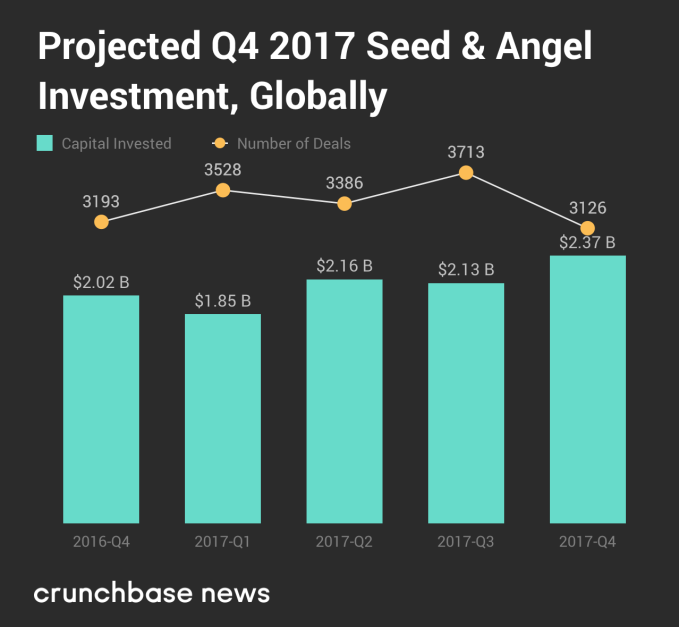

Below, we’ve plotted Crunchbase’s projections for seed and angel-stage deal and dollar volume, which also includes equity crowdfunding rounds and a few other round types.

This is a small but mighty asset class. Although seed and angel-stage deals accounted for just 4.4 percent of total dollar volume in Q4 2017, they represented 58.5 percent of the total deal volume.

When comparing Q4’s performance to Q3, angel and seed-stage deals also are the only bright spot in the global venture funding ecosystem. Dollar volume into seed and angel-stage deals present one of the few bright spots in early funding activity with quarterly growth of 11.3 percent. For all other stages, dollar volume was down on a quarterly basis. Compared to Q4 2016, projected dollar volume is up roughly 17.5 percent.

However, this bright spot is somewhat tarnished by a downswing in deal volume. Compared to the high point of Q3 2017, there was quarter-over-quarter downswing of 15.8 percent in seed and angel-stage deal volume. Relative to the same time last year, deal volume is also down 2.1 percent from a projected 3,193 seed and angel-stage rounds in Q4 2016 to 3,126 rounds in Q4 2017.

Global early-stage deal and dollar volume hollowed out

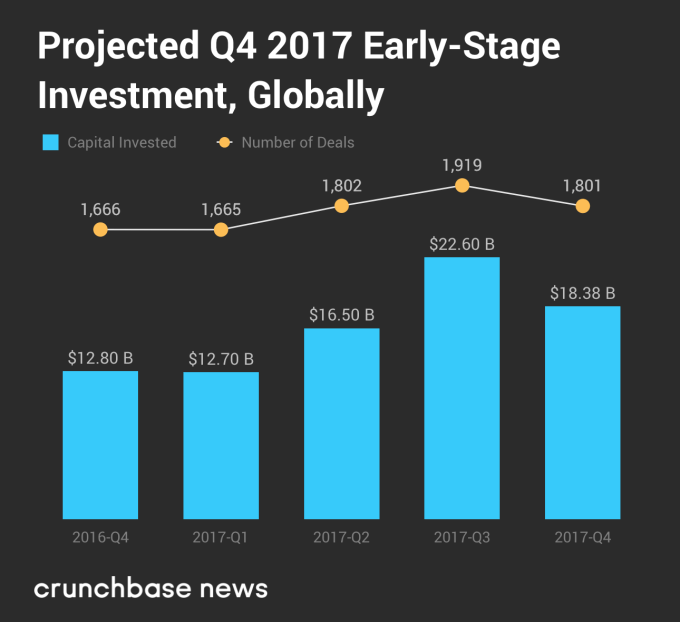

Early-stage — primarily Series A and Series B rounds, with a smattering of others included — is up next. Both deal and dollar volume were down in Q4 despite significant gains earlier in the year.

Below, we charted Crunchbase’s projections for early-stage deal and dollar volume.

Now is where we start to see trends that are more representative of the market as a whole. In Q4, early-stage investments accounted for 33.7 percent of the rounds and 34.2 percent of the dollar volume, enough for changes in this segment to affect the performance of the entire market.

So what about those changes? On a quarter-over-quarter basis, deal and dollar volume both declined from previous highs to the tune of 6.15 and 18.7 percent, respectively.

What does this mean?

Obviously, one quarter of declines does not a generalized downtrend make.

But there are some other signals that point to strengthening headwinds going forward.

Despite marked declines in deal volume, the average seed and angel-stage round around the world grew in size by nearly 60 percent since the previous quarter. This could mean that the global seed investor market is starting to shift their sights more downstream, to more mature companies that need more capital to get to Series A and beyond.

A downswing in early-stage funding — which makes up a large portion of both total deal and dollar volume around the world — comes paired with a modest but still noteworthy 6.2 percent drop in average deal size, ending a year of consistent growth.

The U.S. has led the world in venture capital investing in a number of ways, but does the U.S. market also serve as a leading indicator for the rest of the world? It’s something to keep an eye on for the next couple of quarters. Downturns may be contagious, even if they take some time to incubate.

For more on these and other findings, check out the Q4 Global VC Report.