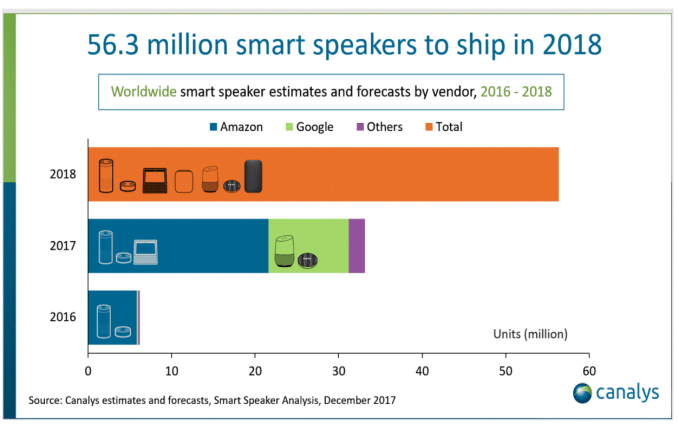

Amazon and Google were willing to lose money on smart speaker sales over the holidays by discounting their hardware in order to gain market share. The reason? Smart speakers are now the fastest-growing consumer technology – faster than any other recent consumer technology, including AR, VR or wearables, according to a new report today from Canalys, which pegs smart speaker shipments to top 50 million in 2018.

Specifically, analysts expect the market to grow by 56.3 million this year, with both Amazon and Google leading the way via their Echo and Home product lines.

The U.S. will also continue to be the most important market for smart speakers, the report says, with shipments expected to reach 38.4 million in 2018. China will be a distant second with 4.4 million units.

The U.S. is expected to continue its lead through 2020, the report noted, thanks to a combination of factors including broadband penetration, U.S. consumers’ willingness to adopt new technologies, smart home integrations that make the speakers more useful, and the lowered price points for the hardware.

In China, however, Amazon and Google won’t have as much success. Instead, local vendors like Alibaba, JD.com and Xiaomi will lead for the time being.

With increased smart speaker adoption, the companies in this space will also begin to tackle monetization – that is, beyond sales of the hardware itself.

“While 2017 has been a banner year for smart speakers in terms of hardware sales, especially for Google and Amazon, smart speakers in 2018 will move beyond hardware, with strategic attempts to monetize the growing installed base in the US and beyond,” noted Canalys Research Analyst Lucio Chen. “The possibilities to do this are endless, be it discreet advertising, content subscription bundles, premium services or enterprise solutions. The technology is still in transition, and increased investments from multiple players of the ecosystem will fuel growth,” Chen said.

We’ve already seen Amazon take action on this front, to some extent.

The company in October introduced paid subscriptions for Alexa skills, then added in-skill purchases in November. More recently, there’s been chatter about Amazon’s discussions with brands on how they can advertise on the Alexa platform – for example, by bidding to become the first recommended product when a consumer places an Amazon order via voice.

Combined with Amazon’s reported plans to unify its advertising across Twitch, Fire TV, and Amazon.com, voice could lead Amazon to become a new ad giant.

That trend is underway, as well – even before Alexa turns into an ad platform.

In fact, the retailer was estimated to earn $1.7 billion in U.S. ad revenue in 2017, up nearly 50 percent over last year. Today, Amazon leads Snapchat and Twitter, but it has a long way to go to before toppling Facebook and Google, which combined will account for more than $45 billion in U.S. ad revenue in 2017, said a recent AdAge report, citing eMarketer data.

Betting on Alexa, however, is a bet on the future of advertising and a bet on a new age of computing – one where consumers interact with the web, with retail, with applications, with other devices in their home, and with brands and ads, just by speaking. Plus, with some devices now adding screens – as with Echo Show and Spot – there’s the potential for in-home video ads, as well.