On Tuesday, when Bitcoin Cash hit Coinbase, the popular user-friendly U.S.-based exchange, cryptocurrency’s reputation as the financial wild west was on full display.

While anyone following along was well aware that Coinbase planned to add Bitcoin Cash, the currency created in August’s Bitcoin hard fork, things still got weird immediately. After some suspicious pre-launch climbing, Bitcoin Cash’s Coinbase launch immediately saw prices soar to almost three times those listed on other exchanges.

That “significant volatility” led Coinbase to freeze transactions for its newest asset, creating plenty of confusion in the process. Just a few hours later, the company disclosed that the chaos had prompted an insider trading investigation, a surprising concession after some in the cryptocurrency world cried foul (to be fair, they are often crying foul).

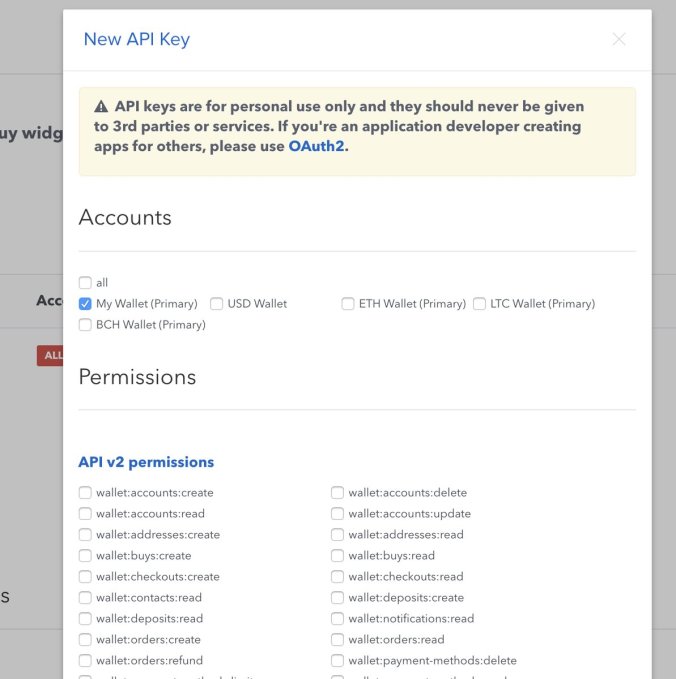

While it’s not yet wholly clear what was going on, many digital currency enthusiasts have pointed to a Reddit thread from three days ago titled “ATTN: Bitcoin Cash added to Coinbase API (EXTREMELY BULLISH)” that claims to have spotted evidence of Bitcoin Cash’s addition on a Coinbase API key permissions screen.

Given its broad disinterest in regulatory norms and preponderance of first-time investors, doctored screenshots trying to nudge prices one way or another are fairly common within the cryptocurrency community. Still, many Reddit users appeared to lend this particular thread enough credence to check it out for themselves. (Unfortunately, as Bitcoin Cash is now live, we weren’t able to verify the listing’s early appearance in the API.)

Again, Coinbase users knew that Bitcoin Cash was coming by January 1, 2018 — the deadline Coinbase gave itself in August — but most users assumed that the new coin would be withdrawal-only, letting Coinbase users who stored Bitcoin on the exchange at the time of the fork get their trapped Bitcoin Cash out of the platform. As Coinbase stated in its August 3 blog post:

We are planning to have support for bitcoin cash by January 1, 2018, assuming no additional risks emerge during that time.

Once supported, customers will be able to withdraw bitcoin cash. We’ll make a determination at a later date about adding trading support. In the meantime, customer bitcoin cash will remain safely stored on Coinbase.

Reddit’s /r/btc community took the API breadcrumb as a signal that both narrowed Bitcoin Cash’s looming Coinbase timeline and provided evidence that Coinbase intended to add trade options for the currency — a significant sign of adoption that would surely influence the altcoin’s price across exchanges. “If you’re a programmer you know this is a very strong sign that Bitcoin Cash will receive full integration and not just withdrawals,” one Redditor stated in the thread’s replies.

Given its mainstream appeal and extreme ease of use relative to other exchanges, Coinbase is something of a cryptocurrency kingmaker. For any digital currency gaining Coinbase trading support, volume and prices would widely be expected to soar as the news spread. Obviously, anyone paying attention to potential Coinbase API hints or other subtle backend signals is likely doing so with the intent to cash in on such a surge.

“We can’t verify the screenshot. But we publicly announced we would be supporting Bitcoin Cash in August, so it would be expected that Bitcoin Cash would appear on the API at some point,” a Coinbase spokesperson told TechCrunch in response to questions about the incident.

Whatever really went down, the situation demonstrates how Coinbase’s decision to add any cryptocurrency makes for a very delicate rollout indeed. The company plans to introduce more altcoins on its platform in the coming year, so it will have ample opportunity to learn from its rocky, semi-surprise introduction of Bitcoin Cash on December 19.

Like many things in the digital currency world, cryptocurrency market forces are often even stranger and more inscrutable than their traditional financial counterparts. There might not be one single explanation for Bitcoin Cash’s controversial pop on Tuesday, but the situation serves as yet another cautionary tale of the unique chaos of cryptocurrency, a financial realm where the rules are being written as they’re broken.

Disclosure: The author holds a small position in some cryptocurrencies, mostly because it seemed like a fun idea back in 2013 and then she forgot about it. Regrettably, it is not enough for a Lambo.