There’s been pause since Southeast Asia last welcomed fresh venture capital, but one reload is on its way after NSI Ventures, an early investor in Indonesian unicorn and Uber rival Go-Jek, announced a first close of its second fund. The target is $125 million, which represents a significant increase on its first fund of $90 million.

The firm said it has pulled in $75 million of committed capital from existing LPs for the new fund. A full close is expected in the first half of 2018.

Beyond an early investment in Go-Jek, which is closing in on new investment at a valuation exceeding $2.5 billion, NSI’s maiden fund backed health-focused insurance brokerage CXA Group, online credit service FinAccel and restaurant reservation startup Chope among others in Southeast Asia.

The plan is to continue the same investment thesis in fund two, which will mean a typical check size of $3 million to $5 million for Series A deals onwards with a focus on Southeast Asian startups operating marketplaces and/or the e-commerce space. This time around, the Singapore-based firm is also broadening out to target emerging verticals like fintech, health tech and education.

On that note, it announced a first investment from the new vehicle: leading a $5 million Series A fundraise for Biofourmis, a Singapore-based company that has developed a health analytics platform. Aviva co-led the round via its investment arm while Biofourmis announced a partnership with Mayo Clinic.

There has never been more venture capital in Southeast Asia, a region with more than 600 million consumers and more internet users than there are people in the U.S., but further progress is required.

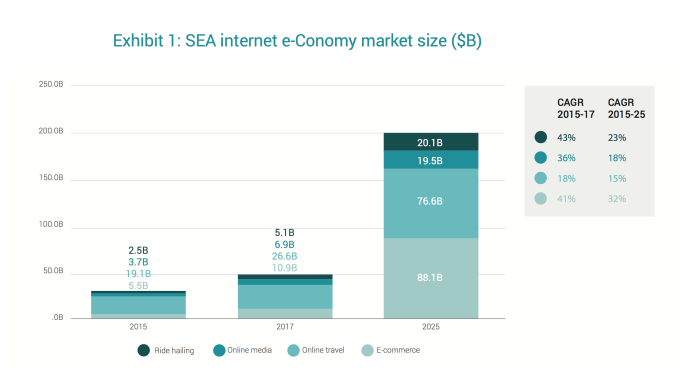

A new report co-authored by Google that was released this week showed the region is making big strides to become a $200 billion per year ‘internet economy’ by 2025. The region’s digital landscape is tipped to generate $50 billion this year, but one critical component to it hitting the lofty 2025 forecast is increased investment.

Data from a Google-Temasek study on Southeast Asia

Some $12 billion has been put in the region’s startups over the last two years, but three-quarters of that went to its billion-dollar companies, according to the report. Google and its research partner Temasek predict that as much as $37 billion more is needed for the digital economy to realize its full potential, and that capital will need to roll down beyond the biggest players to reach fledgling projects with bags of potential to grow.

The signs are certainly promising with investors from outside of the region paying more attention than ever before. Indeed, China’s top two internet companies — Alibaba and Tencent — are already prowling Southeast Asia in search of out its most promising tech companies which can aid their expansion plans.

“Southeast Asian tech continues to be an opportunity that is gaining momentum amongst investors,” NSI founding partner Hian Goh told TechCrunch.

“We are excited to have been able to get our global institutional investor base to participate in fund two in under five months,” Goh, who sold his previous startup Asian Food Channel to listed U.S. TV network Scripps in 2013, added.

NSI’s team with founding partners Shane Chesson and Hian Goh (seated middle, left to right)

Beyond more money to work with, NSI is also moving deeper into core markets with the addition of new faces. Those include Nichapat Ark, formerly MD and executive committee member at Standard Chartered Bank, who becomes a special advisor based in Thailand, and ex-Sternbridge analyst Arum Kalbuadi who has joined its Indonesia team.

“We believe execution capabilities is key in supporting entrepreneurs, which is why we continue to expand the team to include Nichapat in Thailand as well as other operational partners in Singapore,” Shane Chesson, the firm’s other founding partner, told us.