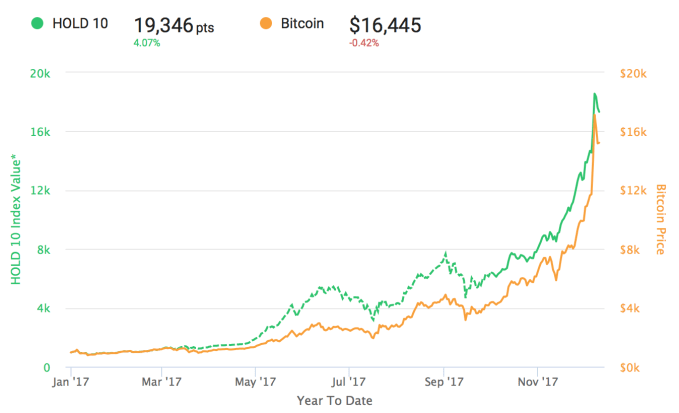

Last month San Francisco-based Bitwise Investments announced a passively managed index fund comprised of the top 10 cryptocurrencies by market capitalization. The fund rebalances once a month, and all assets are held in cold storage. Essentially its an easy way for investors to gain some passive exposure to cryptocurrency without having to worry about which ones to choose and how to buy and store them.

Today the startup announced they’re raising $4M in seed funding to build out the team and work on developing new investment products. Investors include Khosla Ventures, General Catalyst, Naval Ravikant, Elad Gil and others. Bitwise is also accepting investors as of today, with baskets being created every two weeks going forward.

The startup plans to use the funding to hire 10 new employees – five on the engineering side and five on investors relations and business development. While five engineers seems like a lot for a small passively managed fund, Bitwise wants to build out a software platform so it can stand out from other traditional asset management firms. This means the startup will provide products like a real-time dashboard for investors (as opposed to a monthly emailed PDF) but also focus on complicated engineering issues like optimizing cold storage procedures.

Right now investors have to be U.S-based and accredited since it’s a private investment vehicle and not an ETF. The minimum investment is $10,000 – which is generally much less than a crypto-focused hedge fund would require. Going forward they’re planning on launching a Cayman Island vehicle so international investors can participate.

You can read more about Bitwise Investments and their first fund in our original launch post here.