While you can open up your bank app and probably find all the relevant information for your credit cards and bank accounts, there isn’t really a very neat spot for the same information on your drivers’ license or insurance.

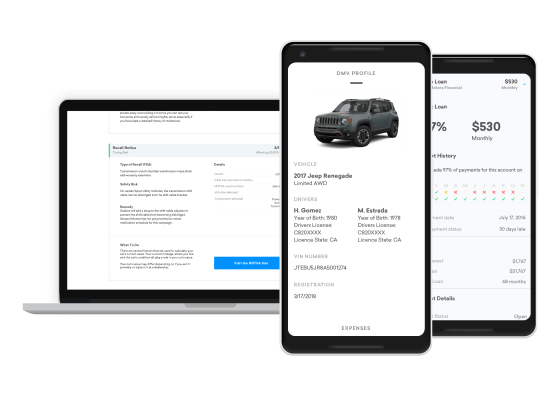

That’s a demand that Credit Karma, normally known for free credit reports with some financial advice layered on top of it, hopes exists and is looking to tap with the launch of a new hub for automotive information. Credit Karma says it is launching an updated center for automotive information that can serve as a one-stop check-in for all the information you might need about your car, whether that’s related to the DMV or to how much you’re paying for your insurance.

“The mission is not to be a credit score provider, it’s to be a financial assistant,” chief product officer Nikhyl Singhal said. “It came down to credit and debt, and it came down to houses and cars. The vast majority of our members have cars. There’s no app on your phone for your car. We want to make sure that we have an easy way for people to optimize the pricing on the two most important categories of expenses — the amount they pay for a loan and their insurance. In this case, we said credit reports were a really powerful way to build an understanding around recommendations, we use the same concept.”

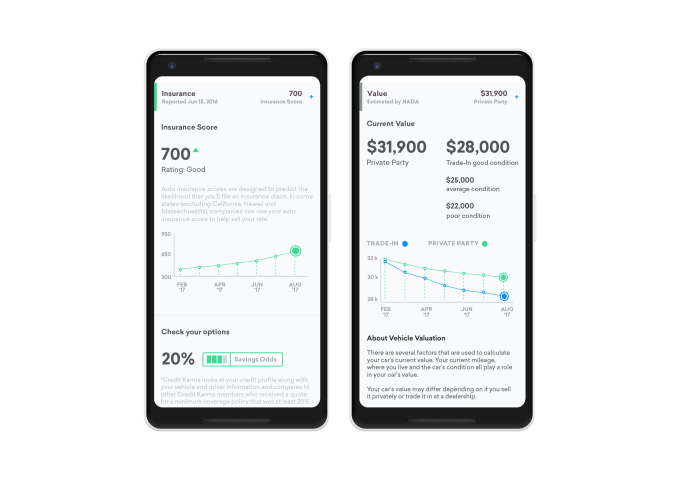

Credit Karma will connect with the DMV — a move Singhal said was probably the only way a product like this would work because it was unlikely the service could convince millions of people to dredge up their car info — and then build out a profile for you and your car after matching it to a loan or lease. After that, you can view a number of things like your DMV profile, the value of your car, and whether or not your model vehicle has been recalled.

But this is still going to remain a part of the Credit Karma experience, sitting in a home where people theoretically will start coming for all things finance. As Credit Karma starts to build out a portfolio of services related to different parts of a consumer’s financial life cycle, like many startups it has to make the decision as to whether tools deserve to be independent apps or baked into a core product — and where they go in that core product. You might want an app one day to open up and pull up your drivers’ license and registration if you, say, get in an accident, and the company is going to be gambling that it belongs in the core Credit Karma experience.

“Some of these questions require us to partner, some are questions as to whether people really want an app on their phone,” Singhal said. “We thought, let’s start with data we know everyone needs. But we really sat down and said, well, we’re not sure what are the surfaces that we’re gonna use for saving money on their loan and insurance. We didn’t know whether it was actually going to be a surface that engages people, like looking for an app. So instead of trying to build deep features in all categories, we built testers.”

The service is targeted to its existing members that own cars, which represents a significant chunk of its user base. Still, it’s a delicate balance to build a new tool that those members are going to find useful and aren’t going to be annoyed. So it’s walking the line between being accessible and a spot that’s worth building a full product for users that are looking to do routine checks or shop around for loans. “We’re not necessarily [going to actively] push notifications. We’re trying to cut that balance, but it’s reasonably passive experience.”

“The target audience really was members on Credit Karma who had an auto loan who’ve had a savings opportunity,” Singhal said. “We put the number at being $2,200 in loan value, which turned out to be over 5 million members of our audience. We started out with this target audience largely due to the inefficiency of how car loans are created. Most car loans are at a dealer, 1 out of 4 are mispriced, and if you do the math it turns out we were in the position to say on average that there are millions of members that can save money. We chose to make it one click. much like credit reports.”

It isn’t going to be alone targeting a niche like this as it seems like pretty low-hanging fruit if it’s possible to integrate with the DMV. But Credit Karma is likely to get a closer look these days after a massive hack at Equifax exposed sensitive information for more than 100 million American consumers, making the process of monitoring your credit activity even more critical than it was just months ago. In June, the company said it generated $500 million in revenue in the last year, with more than 70 million users tapping the company’s free credit report service that’s tied in with a number of other financial advice products.