Current announced today it has raised $5 million in Series A funding for its debit card aimed at kids that parents can control with an app. The company first introduced its Visa debit to the market in May. Kids can use the card to shop in stores or online using funds from their own bank account linked to the card, after receiving a digital allowance from mom or dad.

The new round was led by QED Investors and included participation from Cota Capital. In addition, QED’s Founding Partner Frank Rotman will join Current’s Board of Directors.

The company, incubated out of Expa Studio, had previously raised $3.6 million from Expa and Human Ventures in March, 2017.

The idea behind Current is to help shift tweens and teens from cash to digital funds at an earlier age. This is reflective of the larger transition to a more cashless society – at least here in the U.S., where you can use a debit card to pay for almost anything these days.

The system works by offering a Visa debit card that’s linked to the child’s account with the funds. Parents can fund the child’s account by transferring money from their own bank account.

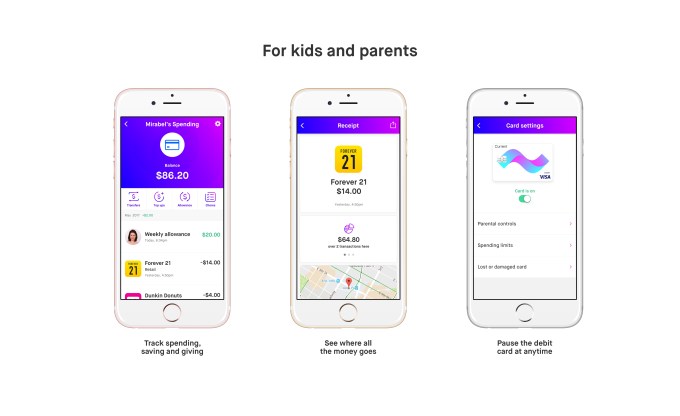

But what sets Current apart from prior “kid debit cards” – like Visa Buxx, for example – is its mobile app. The app isn’t just for managing the money transfers, it also allows parents to set up a chore list that need be completed and reviewed before the allowance is paid, if they choose. Parents can opt for weekly auto-transfers as well.

In addition, while the card allows kids to have a sense of autonomy, parents can also manage the child’s spending by setting daily spending limits, limits on ATM withdrawals, and can block certain categories of spending, like plane tickets or casinos. (Though, arguably, if your kids are buying airline tickets and are out gambling without your knowledge, you may have problems that a debit card can’t fix.)

“More and more consumers and retailers are eschewing cash for digital payments, yet the market seems to want teenagers to start-off with a traditional checking account,” said Current Founder and CEO Stuart Sopp, in a statement released alongside today’s funding news.

“For Current, the focus on teens was a strategic decision and one of our paths to differentiation. Not only do we see an opportunity to create solutions for problems families were having with money that were not being addressed by the marketplace, we see an opportunity to work with a customer demographic that has never been exposed to traditional banking,” he added, in an email to TechCrunch.

“It is an untouched audience that is open to and interested in a pretty different financial experience than previous generations.”

Current also noted there are 30 million teens in the U.S., with 5 million aging into the demographic every year. And this generation is abandoning cash more quickly than their parents did – using it half as often. Plus, teens’ ATM transactions only account for less than four percent of their transactions, Current said, and they’re twice as likely to shop online as adults.

That makes a fairly compelling argument for a kid-and-parent friendly debit card.

However, Current declined to share its subscriber numbers, citing competitive reasons.

“While the need for a Family Banking product has been around for decades, the available technology wasn’t able to address these needs. With the proliferation of smartphones and the increase in digital payments being accepted universally, the timing is perfect for a company like Current to emerge,“ stated Current’s new board member, QED’s Frank Rotman. “Traditional bank products designed on top of legacy infrastructure can’t solve the problem. Current can,” he said.

Rotman may be exaggerating about a lack of Family Banking products. These exist, but they don’t necessarily have all the components that newer startups like Current offer.

That is to say, Current’ card is not without its competition. In addition to legacy players, like Bluebird, other newcomers are operating in this space, like Greenlight, whose debit card also works outside the U.S.

The company says it will use the funding to invest in the business, customer acquisition and product development.