ChowNow, an online food ordering service, has raised a $20 million Series B round led by Catalyst Investors. This round brings ChowNow’s total funding to nearly $40 million.

“We were excited for [Catalyst] to get involved because they were behind Mindbody,” ChowNow CEO Chris Webb told TechCrunch.

Mindbody, a white-label service for health and wellness businesses, went public in 2015. Catalyst was an early investor and top shareholder in the company.

“It’s a different vertical but the commonality is that we’re building software for small businesses,” Webb said. “It seemed like a natural fit.”

ChowNow also recently unveiled its first branded mobile app to help its customers with restaurant discovery. Webb described it as a bit of a matchmaking service between restaurants and customers. He noted how restaurants want to expand and get additional customers, and how customers who make orders via ChowNow want to find other restaurants that use ChowNow.

“The value we are creating is delivering customers to them for the first time,” Webb said. “We will take a finder’s fee but from there on, the restaurant will own that customer.”

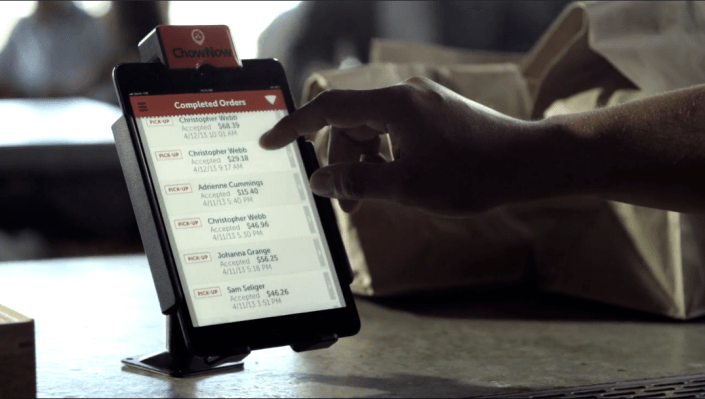

That means after the first order via ChowNow’s app, ChowNow will not monetize individual orders. ChowNow prides itself on being different from the likes of GrubHub and Seamless. ChowNow’s flagship service offers restaurants a white-label platform that enables restaurants to own their customer data, and feel confident their customers aren’t constantly fending off menus and discounts from competitors. Unlike its competitors, ChowNow charges an upfront monthly cost of $150/month per location instead of taking a commission on all orders.

Since launching in 2011, ChowNow has brought on more than 8,000 restaurants as customers throughout the U.S. and Canada. This year, ChowNow expects to process $300 million in orders. About half of the orders ChowNow processes are delivery, while the other half are pick-up.

“We do not have our own [delivery] fleet,” Webb said. “We’re just a software company at the end of the day. We have no ambitions to have a delivery fleet at all.”

That’s probably a good move, given that GrubHub is currently in court around its practices of employing delivery drivers as 1099 contractors rather than W-2 employees.

“Yes, our software supports delivery but we have a unique place in the restaurant where we don’t play in the delivery space outright,” Webb said. “We’re also not a traditional marketplace either. Shopify for restaurants is an accurate way to describe us. Restaurants can plug in to our system and integrate it into their delivery backend.”