There are a lot of reports hitting the ‘net this morning in reviews of the Apple Watch Series 3, which indicate that there are some LTE connectivity issues — causing Apple to take a small dip this morning and a speed bump in its march to $1 trillion.

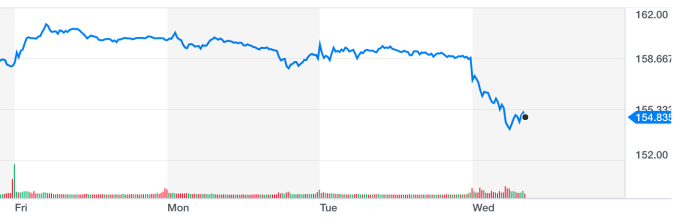

Shares of Apple fell around 2.5% this morning, which for Apple is a pretty substantial ding for the company despite the deceptively small number. Apple is a company worth more than $800 billion, so such a small drop can erase tens of billions in value — the equivalent of a Snap, Twitter, or some other smaller market-cap company. Here’s the chart:

The new Apple Watch Series 3, the iPhone 8, and the iPhone 8 Plus will hit the markets soon. After that, we’ll see the kind of impact crater of those two critical new products that are supposed to set up a pretty big quarter for Apple. All eyes are more or less on the iPhone X, but the new watches and incremental iPhone updates still represent a critical part of Apple’s upcoming growth.

Apple told The Verge that the issues stemmed from “when Apple Watch Series 3 joins unauthenticated Wi-Fi networks without connectivity, it may at times prevent the watch from using cellular.” The company also told The Verge that it is “investigating a fix for a future software release.”

Wall Street is looking for Apple to once again rev up its growth engine, which is primarily driven by the iPhone. The company unveiled the iPhone X, a big redesign of its iPhone lineup with a very hefty price tag. Apple’s hopes of becoming a $1 trillion company, which isn’t entirely out of the realm of possibility, rest on its ability to build up a portfolio of niche products like the HomePod, AirPods and new Apple Watch products as well as a blockbuster iPhone release.

This quarter will be a big one for Apple, but the next one is going to be even more crucial. Coming out with a new product that hits a snag with connectivity issues, however, is not a good look as it tries to convince consumers and Wall Street that it’s about to re-ignite demand in a smartphone market that is starting to hit a saturation point — hence the dumping of a few billions of dollars in value.