Plaid, which is best known for helping financial services customers build applications with direct connections to their users’ bank accounts, announced today that they have released a new SDK to bring that same type of functionality to enterprise developers.

“At a high level we are the middle layer between you and your bank,” Zach Perret, CEO at Plaid told TechCrunch. When a financial services application needs to link to your bank account in a secure fashion, there’s a good chance it could be using Plaid’s tools. The company can also track transactions, verify identity, check your balance and verify income.

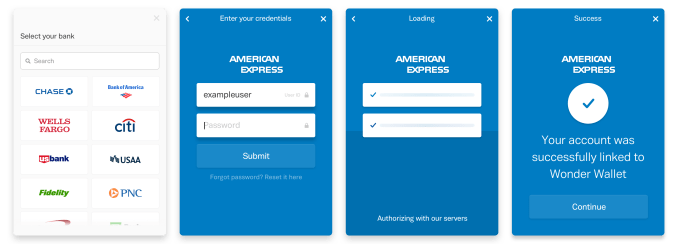

The new Link SDK for enterprise announced today enables enterprise developers with no financial services background to build similar functionality into any application. Given that there are lots of scenarios where it would be useful to link an app to a bank account, having a simple and secure way to do that lets the developers concentrate on their own expertise.

Photo: Plaid

APIs are making it easy for developers to layer a variety of different tools inside an application without having to have the expertise to build it from scratch. It’s a common approach. Stripe does it for payments. Okta does it for identity. Box does it for content services and Twilio does it for communications, as a few examples.

If you’ve ever been to a hackathon, you see how powerful this approach can be. With less than 24 hours to build an application, developers are able to create rich apps with a variety of functionality, but not all SDKs are created equal, and Perret says that Plaid is trying to gain an edge by simplifying the developer experience.

He says a big part of his company’s approach is building an attractive interface that makes it easier to add Plaid features to an app, and while they’ve tuned this version specifically for enterprise developers, they are still using the same developer-centric approach they have been using in the original product.

The company has been around since 2012 and has raised almost $60 million. Its most recent round was a $44 million Series B in June 2016. Investors include Goldman Sachs, NEA and Spark Capital.

Plaid works with 9600 banks including Wells Fargo, Citi, and Chase. One of its earliest customers was Venmo, the app used to send cash from a bank account to any third-party (and which has been used to settle more than a few college bar bills).