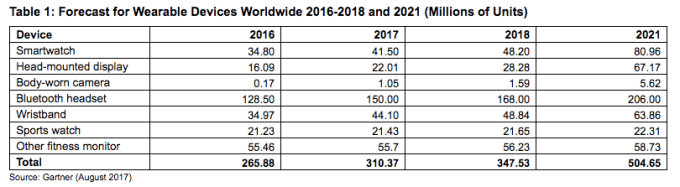

Analyst Gartner is expecting to see growth of 16.7 per cent, year-over-year, across the global wearables market this year, which encompasses a variety of device types and form factors — from smartwatches to body-worn cameras and even head-mounted displays.

Its forecast projects sales of 310.4M wearable devices worldwide this year, generating a total of $30.5BN in revenue — of which it expects $9.3BN to come from the smartwatch category specifically, where the Apple Watch currently leads over rivals like Samsung’s Gear smartwatch.

Apple is expected to announce a new model of its smartwatch this September — adding direct cellular connectivity and meaning the Apple Watch will be able to support using its Siri voice assistant, messaging and transferring sensor data without needing an iPhone in close proximity — thereby expanding its utility and potentially giving the product’s prospects with consumers a boost.

The company does not break out unit sales of the Watch, but reporting its latest earnings earlier this month CEO Tim Cook said sales of the wearable were up 50 per cent, year-over-year. (Apple reports earnings for Watch within an ‘other products’ category — which also includes the likes of Apple TVs, Beats electronics devices, iPods and Apple-branded accessories — and the category as a whole earned it $2.74BN in its last quarter.)

Gartner says it expects a total of 41.5M smartwatches to be sold this year, adding that the device type is “on pace” to account for the highest unit sales of all wearable form factors from 2019 to 2021, with the exception of Bluetooth headsets.

By 2021, Gartner estimates that sales of smartwatches will total nearly 81M units — representing 16 per cent of total wearable device sales, according to its forecast.

It notes that smartwatch revenue is bolstered by the relatively stable average selling prices (ASPs) of Apple Watch — a wrist-mounted wearable whose entry price starts at $269.

“The overall ASP of the smartwatch category will drop from $223.25 in 2017 to $214.99 in 2021 as higher volumes lead to slight reductions in manufacturing and component costs, but strong brands such as Apple and Fossil will keep pricing consistent with price bands of traditional watches,” noted Gartner research director, Angela McIntyre, in a statement.

While expecting Apple to continue to lead the smartwatch category, Gartner predicts Cupertino’s share will decline in the coming years — dropping from approximately a third in 2016 to a quarter in 2021 — as more providers enter the market. (Though other brands, such as Asus, Huawei, LG, Samsung and Sony, will still have a lower share — it’s expecting they will account for only 15 per cent in 2021.)

Interestingly, smartphones for children is a sub-category that Gartner’s expecting to perform well — representing 30 per cent of total smartwatch unit shipments in 2021, according to its calculations.

These are wearables aimed at children in the two to 13 year-old range, with makers targeting parents who don’t yet want their child to have a fully fledged smartphone.

The analyst also expects uplift in the traditional watch brand/luxury/fashion smartwatch segment — which it forecasts accounting for 25 percent of smartwatch units by 2021 — as long-standing brands attempt to attract younger customers.

Meanwhile, startup and while-label smartwatch brands, such as Archos, Cogito, Compal, Martian, Omate and Quanta, which will account for five per cent of unit sales in 2021.

Elsewhere in the wearables space, Bluetooth headsets will remain the biggest sub-category, accounting for almost half (48 per cent) of all wearables sold in 2017. The analyst also expects the audio devices to continue to be the most sold type of wearables through 2021, when it projects sales of 206M.

Growth here is being driven by the elimination of the headphone jack by “major smartphone providers”, according to Gartner. And while Apple kicked off that shift — and does of course have a pair of Bluetooth-powered, Siri-primed, premium-priced wireless earbuds to sell you instead (AirPods) — the analyst’s assumption is that by 2021 almost all premium mobile phones will no longer have the 3.5 mm jack. RIP trusty old pairs of headphones the world over.

Meanwhile, one of the tiddler technologies of today’s wearable market — head-mount displays (HMDs) which support augmented reality applications that do not fully block the wearer’s vision (as a full VR headset does) — will continue to be a small player through the next five or so years, according to the analyst.

Gartner forecasts that HMDs will account for just 7 per cent of all wearable devices shipped this year, and says they will not reach mainstream adoption with consumers or industrial customers through 2021. (Which amounts to a bearish view on AR startup Magic Leap‘s near-term prospects — the company still doesn’t have a wearable in the market, though its founder has hinted one could be coming this year.)

Near-term opportunities for HMDs that Gartner points to include: for video game players; for various industrial and business use-cases such as for workers performing equipment repair, inspections and maintenance, or to help with manufacturing, training, design and customer interactions; as well as for entertainment use-cases such as in theme parks, theaters and sports venues, to enhance an experience or provide supplementary information.

“Current low adoption by mainstream consumers shows that the market is still in its infancy, not that it lacks longer-term potential,” added McIntyre of HMDs.