Things are not going so well for Blue Apron this morning after reporting its second-quarter earnings (its first earnings report ever), and the stock is crashing as a result of it.

The company’s stock is down more than 14 percent on the earnings report, which came in pretty mixed compared to what Wall Street wanted. Blue Apron is looking to pull back on its marketing spend as it tries to get its burn under control, which resulted in a drop in its number of customers. The company was able to squeeze out a small profit in a past life, but since then it began to aggressively spend on marketing as it sought to acquire customers.

The problem quickly became getting those customers to stick around and keep buying meals. This time around, the company was able to improve the health of its customer base as they are spending more money and buying slightly more meals, but it still has to show that it can grow that base even as it starts to pull back on marketing. The company reported a loss of 47 cents per share on revenue of $238.1 million, while Wall Street was looking for a loss of 30 cents per share on $235.8 million.

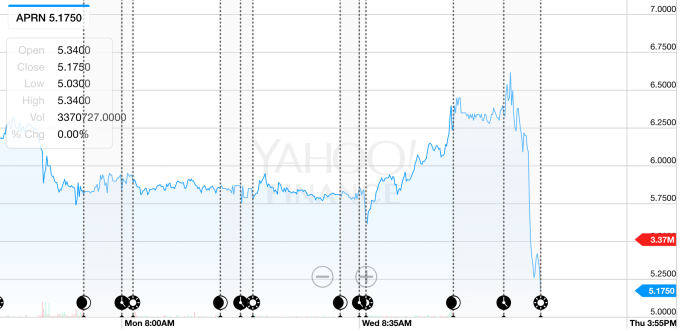

Chart time:

So, better than expected revenue but with a widening loss even, as it pares back its marketing expense. The company gave off some negative signals about its next quarter, forecasting a loss between $121 million and $128 million in the second half, according to Business Insider. These comments were likely made on the earnings call, which we’re reviewing right now. But those kinds of negative signals are going to punish a freshly-IPO’d company, especially amid a period of wild uncertainty with the decline of Snap and possible fading appetite for new IPOs.

If Blue Apron sees some turbulence heading into the back half of the year, the persistent threat of Amazon definitely isn’t going to help. Information is slowly dripping out that Amazon is gunning for the meal-kit delivery space, which has crushed the stock over time. The company went public at $10 per share, but has since collapsed and lost nearly half its value.

Still, the IPOs will continue to come. Dropbox is reportedly inching closer to an IPO, and TechCrunch previously reported that Stitch Fix has confidentially filed for an IPO.