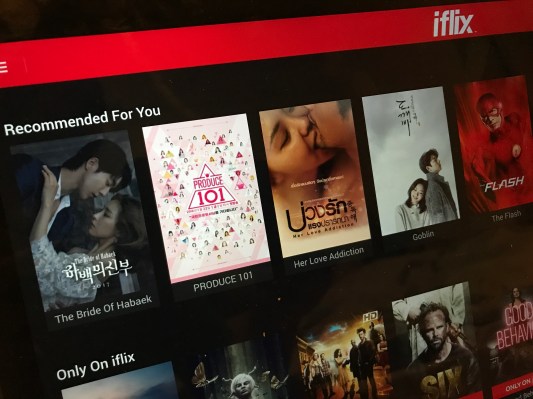

Iflix, an Asia-based startup providing Netflix-like streaming services in emerging markets, has landed $133 million in fresh funding to accelerate its business.

The investment was led by U.S. media conglomerate Hearst, which counts BuzzFeed, Vice and Roku among its investment portfolio. The group was joined by another new backer EDBI — the corporate investment arm of the Singapore Economic Development Board — alongside undisclosed clients of Singapore-based DBS bank. Existing investors joining included Evolution Media, UK broadcaster Sky, Malaysia’s Catcha Group, Liberty Global, Jungle Ventures and PLDT.

Iflix was started in May 2015, initially in selected Asian markets. Today its streaming service is priced around $3 per month and available in 19 countries thanks to expansions into the Middle East and Africa. The business has raised close to $300 million from investors to date. It started out with a $30 million pre-launch round in 2015, before adding $45 million from Sky last year and completing a $90 million raise in March of this year.

That most recent round valued the company at $500 million, but there’s no word on what the valuation following this new financing is. (We’re working on getting that detail.)

Netflix is the most obvious rival to Iflix but, with over 100 million paying subscribers and 5.2 million new additions in the last quarter alone, few can rival the U.S. media giant. In that respect, more regional competition includes Singapore’s HOOQ, which is backed by telecom firm Singtel, and PCCW Media-owned Vuclip, as well as local single-country streaming services are more valid comparisons.

Iflix said it had five million registered users back in March, but it isn’t giving an update on that this time around. It instead hailed “tremendous growth” which it said includes a 3X increase in subscriber numbers and 2X rise in user engagement over the past year. Revenue, it said, is up 230 percent year-on-year, but it is keeping quiet on raw figures.

In an interview with TechCrunch, Iflix CEO Mark Britt played down inevitable comparisons with Netflix, insisting that the services do not share the same target audience.

“We very genuinely don’t see Netflix as a competitor, we see ourselves as providing a new service for the mass markets,” he said.

Britt explained that Netflix’s model targets the global elite, those with high-end devices like an iPhone, disposable income and a credit card for payment. Iflix, he claimed, is aimed at those with lower-end devices and poorer quality internet access, but a desire to always consume on mobile.

“If Netflix is the iPhone of content streaming, our aspiration is to be the Android,” Britt added. “We’d love to be a secondary choice to the upper socials — if you love Netflix you should probably get Iflix as an addition — but for the mass market, the majority of their consumption is on a mobile device.”

Iflix chairman Patrick Grove at a promotional event in Bangkok, Thailand, earlier this year

There’s certainly plenty of pie to fight for. A recent report from Media Partners Asia forecast that online video consumption in Asia alone could surpass $20 billion by 2020, although the figure falls to $3.2 billion when China — which is dominated by local players, and where Iflix is not present — is removed.

Nonetheless, Iflix has taken steps that are similar to Netflix. This year it began broadcasting its own original programming — bringing an underground comedy series from Malaysia to its platform earlier this year — and that is expanding to a dozen countries. While in March it hired Sean Carey, who was formerly VP of global television for Netflix, as its own chief content officer. It has also moved into live sport, having captured the rights to Indonesia’s soccer league, and Britt said it is focusing on acquiring more local content, including first releases from cinema’s and local productions.

“We’ve realized the key for us is local content, not the Western content studios — the majority of our top 10 content is regional or local,” he told TechCrunch. “Western content sets the bar for binge-watching, but in terms of reaching the mass market, what’s having a bigger impact is taking content from local cinemas or distributors.”

That’s where this new funding is likely to be put to work, growing that local collection with a focus on exclusives and first-runs. Britt said that Iflix may also look to enter new regions, too, with Latin America on the list of potential entries thanks to its similarities with regions where Iflix already plays.

“The opportunity is very real in emerging markets globally,” he added. “TV has gone from stalling in the last few years to actual decline in most emerging markets. Our understanding of that is that it is actually yesterday’s product [since] the majority of the emerging classes worldwide are aged under 25.”

“We’re the only platform talking with [studios and producers] about what this new experience should look like for these 1.3 billion people [in emerging markets] in the next few years,” Britt said.