Airbnb may have put its foot in its mouth before when it comes to communicating the benefits it brings to cities, but it’s hard to argue with raw, uncut science. A new study from the Internet Association, a trade group comprising many online properties including Airbnb, takes a hard look at housing stats in Seattle and bats away a few issues commonly brought up regarding the service.

One criticism that appears repeatedly, especially in fast-growing cities where gentrification and developers are roundly resented, is that people are buying up housing units just to rent them on Airbnb. It’s simpler and more profitable than long-term rental, and there’s less paperwork — but of course, it could limit housing options for people that, you know, actually live somewhere.

While Airbnb maintains that only a small number of units being rented in Seattle are of this type, multi-unit hosts are the fastest growing category for the area, according to a study of data from 2015 and 2016.

The city conducted its own review of Airbnb data and found that a quarter of the full homes available for rent on the service are not the host’s primary residence. And Inside Airbnb, which tracks rental data in various cities, suggests the numbers may be even higher than that.

When asked for comment, Airbnb didn’t dispute the preceding numbers exactly, but cautioned that the data and methods vary widely, so any analysis (including its own, really) should be examined in context. For example, Inside Airbnb calls any home available for more than 60 days “high availability,” though that’s within the normal range by the company’s reckoning.

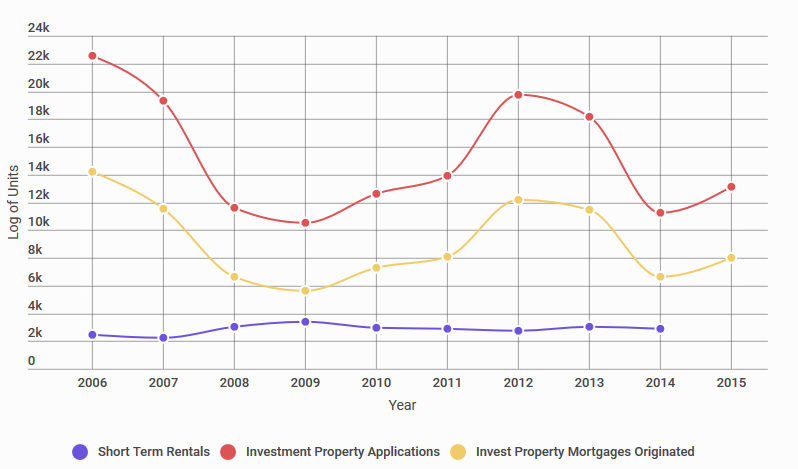

The IA study tackled the multi-unit host criticism by looking for correlations between short-term rentals (STRs) and owner occupancy of housing. The logic is that if Airbnb and other services promote this type of behavior — multiple homes or units being used exclusively as STRs — you’d expect to see a relationship there. The researchers also looked at investment mortgages, the kind of loans you’d take on if you were looking to make a business out of a few cheap homes in your area.

That doesn’t seem to be the case, according to the stats the IA parsed. Chart time:

“Our findings suggest that STRs help Seattleites stay in their homes,” the IA’s Chief Economist and author of the paper, Christopher Hooton, told TechCrunch. “Investment mortgages do not spike because of short-term rental activity. In fact, they are negatively correlated. Nor does owner occupancy decrease or rents increase.”

“Our findings suggest that STRs help Seattleites stay in their homes,” the IA’s Chief Economist and author of the paper, Christopher Hooton, told TechCrunch. “Investment mortgages do not spike because of short-term rental activity. In fact, they are negatively correlated. Nor does owner occupancy decrease or rents increase.”

So while there will likely always be a few examples of this kind of digital property portfolio, it seems that there just isn’t enough of it to have a major effect on rent and housing availability. Other factors in a growing city like Seattle, such as the gazillion ugly, expensive new apartment buildings they’re putting in all over the place, are likely a much greater influence.

(I’m going to be priced out of my place soon in no small part because it’s spitting distance from Amazon HQ. People are happy to pay extortionate rents when they only intend to stay in the city for two years.)

In any case, proposed rules from the city (currently inching their way through the usual red tape) would limit hosts to renting out a total of two units. That would act as an effective damper on multi-unit operations, and if Airbnb’s own spin on this topic (this report included) is taken at face value, the company shouldn’t really care, since it claims very few users are in that commercial class.

In any case, proposed rules from the city (currently inching their way through the usual red tape) would limit hosts to renting out a total of two units. That would act as an effective damper on multi-unit operations, and if Airbnb’s own spin on this topic (this report included) is taken at face value, the company shouldn’t really care, since it claims very few users are in that commercial class.

“The vast majority of our hosts in Seattle are sharing the home in which they live to earn a little extra money,” the company said in a statement. “Hosts with multiple entire home listings make up a small fraction of our community. We’re committed to being good partners with the City of Seattle and are working with city leaders to craft short-term rental regulations that will protect long-term housing stock and allow Seattle families to share their homes.”

The other issue looked at by the IA study is the idea that STRs are interfering with the hotel business. It’s kind of hard to sympathize with the incumbent industry here, but at the same time we want to avoid a situation like Uber’s in which a challenger is mainly competitive because it is cutting corners at every possible opportunity to undercut its opponents. So it’s good to put eyes on potential problem areas like this.

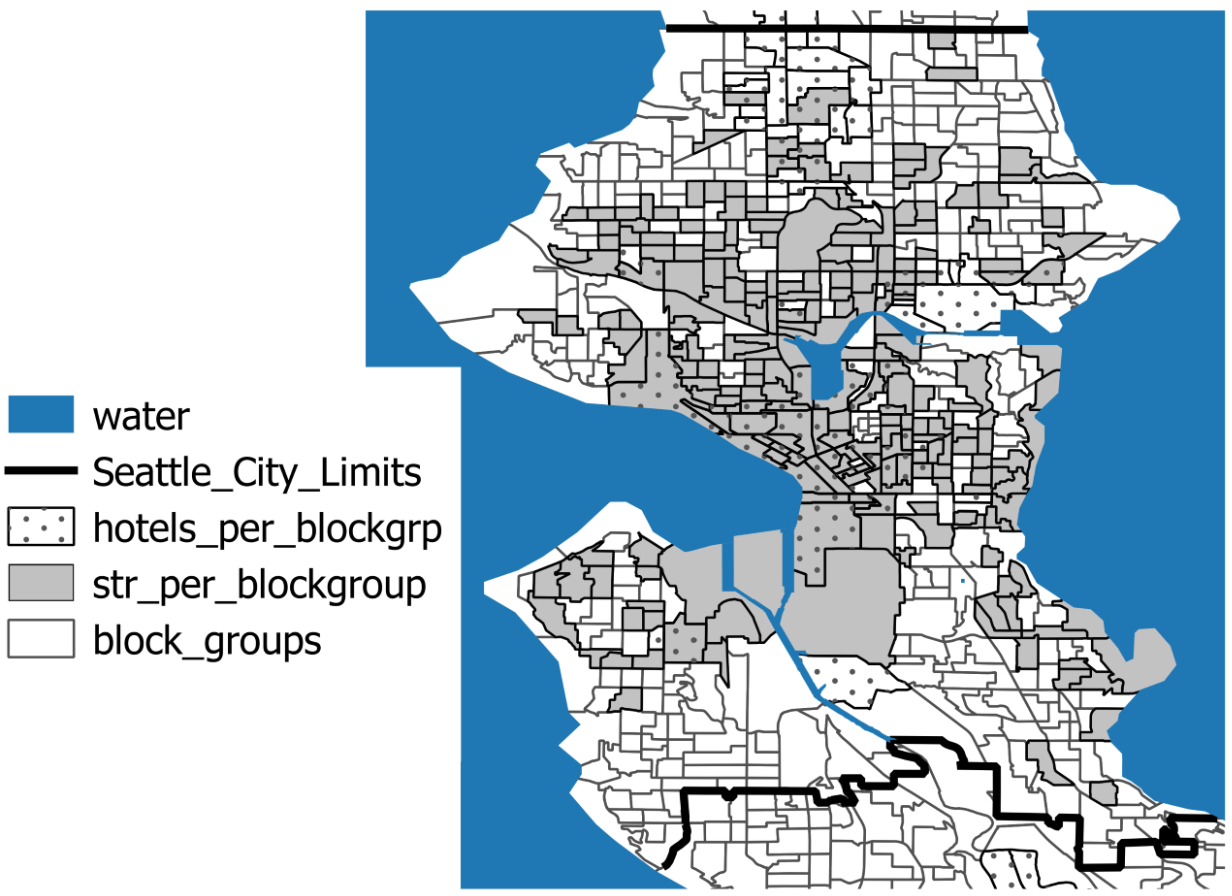

The study shows that there’s actually very little geographical overlap between hotels and home rentals, and this tallies with common sense: are you really going to try to compete with the Marriott on its home turf? No, you rent your neat spot in “scenic” West Seattle for much less and because there are so few hotel options there.

You can see that in this rather strangely colored-in map:

The Seattle rules would also require hosts to get a business license and a city-issued Short Term Rental Operator’s License; proof would also have to be provided that the units to be rented are the host’s primary or secondary residence, that they are up to code, and that basic safety information is available to renters.

Airbnb calls these “unnecessary, complicated barriers to entry,” but they sound like good ideas to me. It’s not like you have to report to the city every time you rent to someone — you just need to get on the radar and show you’re meeting some basic standards. The license and income information would also reduce the government’s total reliance on rental platforms for that data. Plus, you know, taxes.

Like so many new business models, home-sharing presents powerful opportunities to users and unique challenges to businesses and regulators. Different cities require different handling of such things, and New York’s law may differ from Seattle’s greatly but be no less tailored to its own needs. The next couple years will make for something of a global experiment as various methods of regulating short-term rentals (to say nothing of ride-sharing and other “sharing economy” options) and the results should be fascinating — though perhaps more so for users and regulators than the companies affected.