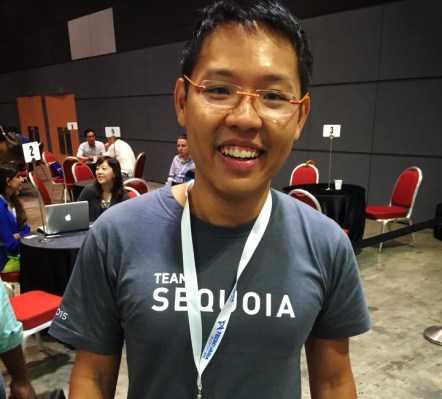

Yinglan Tan, a Sequoia venture partner based out of Singapore, has left the firm following a five-year stint and is now launching his own fund. Both Tan and Sequoia confirmed that he departed earlier this year.

Tan, who joined Sequoia in 2012 from Singapore’s National Research Fund and is the author of two books on tech and investment, was part of Sequoia’s presence in Southeast Asia.

Now, however, is he focused on his own firm which is called Insignia Venture Partners, according to his LinkedIn profile. E27 reported that the firm is near to closing its maiden fund, but Tan declined to comment on the specifics when we asked.

“I enjoyed my time at Sequoia greatly. I finally have some down time to pursue my interest to holiday in Southeast Asia and spend more time with my kids. More importantly, I have got some time to shape my thinking. I am starting to crystallise my thoughts for Southeast Asia,” he said.

“The startup ecosystem in Southeast Asia is booming and now is the right time to do something. I am hatching my plans, but nothing concrete yet. Give me some time and stay tuned,” Tan added.

Sequoia is one of the few investment funds that operates in the Series A and Series B spaces in Southeast Asia. Despite that and growing interest in the region from major tech companies, with recent deals from Alibaba, Tencent, SoftBank and Expedia, it doesn’t have a dedicated fund. Instead, its Southeast Asia deals are covered by the Sequoia India fund. The current India fund, the firm’s fourth, is the country’s largest VC fund with a total corpus of over $850 million.

Earlier this summer, Sequoia secured $4 billion in fresh financing, including $2 billion for its growth funds, according to a U.S. filing. The firm decline to provide details on how the capital will be allocated, but a good bet is that a large chunk will be put to work in Asia. Indeed, according to report, $125 million of that fresh allocation was funneled into the current India fund.

Note: The original version of this post has been updated with corrections.