Two huge pieces of news today from Yelp, the company that shows up first in your Google search for a restaurant: first, GrubHub is acquiring food delivery service Eat24 from the company in a big partnership for $287.5 million; second, the company reported its second-quarter earnings… and they look pretty good.

Let’s tackle the first one. This is probably going to be a boon for Yelp as its sweet spot has always, really, been a base of content centered around users trying to gather information about a restaurant. With a huge amount of competition in food delivery, Eat24 may have been a user behavior mismatch for the company — though, on paper, the notion makes a lot of sense as people might be searching for lunch and decide to just order it. In that way, it might be a better deal for Yelp to have someone else with expertise handle the operational components of food delivery while they focus on their own core expertise.

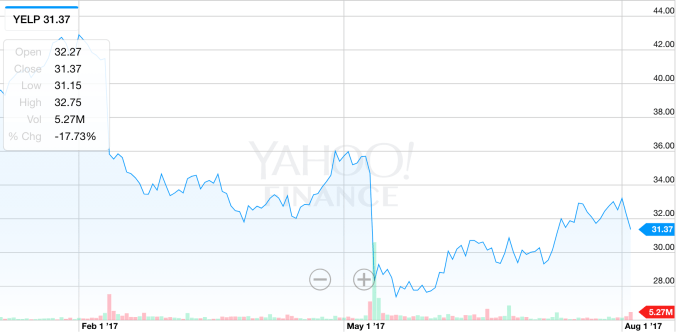

And holy cow, Wall Street is loving this deal. A beat on the company’s revenue, decent growth and this huge proposed deal are sending the stock skyrocketing, with shares up nearly 20 percent now that the news is out. To put that in perspective, Yelp’s shares were down around 17 percent on the year. The company seemed to be treading water a bit — while it’s basically a critical resource for a specific kind of request, it hasn’t quite figured out how to break out of that niche. (We use the word “niche” pretty liberally here, as it’s still a massive market.)

Chart time! Here we go:

Not pictured above: the stock blitzing to $37 and jumping nearly 20 percent after the report came out.

On the earnings front, Yelp brought in revenue of $208.9 million, a 20 percent increase year-over-year. Its advertising revenue, not surprisingly, comprised an overwhelming amount of that revenue at $186.6 million in the second quarter. Wall Street expected the company to bring in around $205 million in revenue.

The Eat24 deal is still subject to customary closing conditions. But it looks like the combination of these two companies — each basically operating where they excel while cross-pollinating — may be the thing that ends up re-igniting growth at Yelp. Yelp has seen its stock rise 20 percent in the past two years, but this kind of a jump in a single day seems like a strong signal that Yelp is suddenly going to have to be evaluated like a different kind of company going forward.