The name “Piggy” might seem weirdly uninviting for an investment app — which is serious business — but co-founder Nikhil Mantha says it holds a kind of comfort that should attract users in India to start building and tackling their own portfolio.

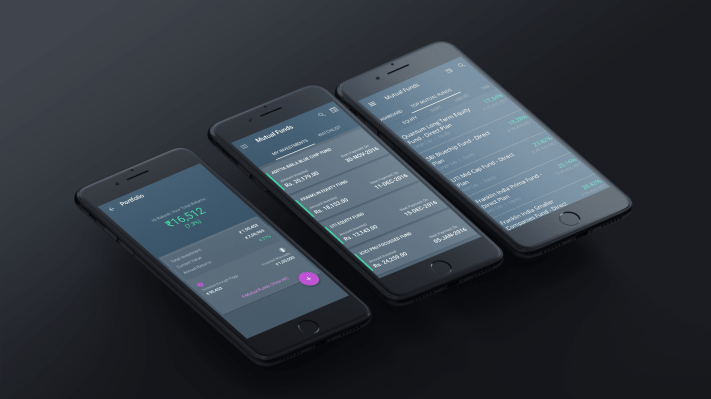

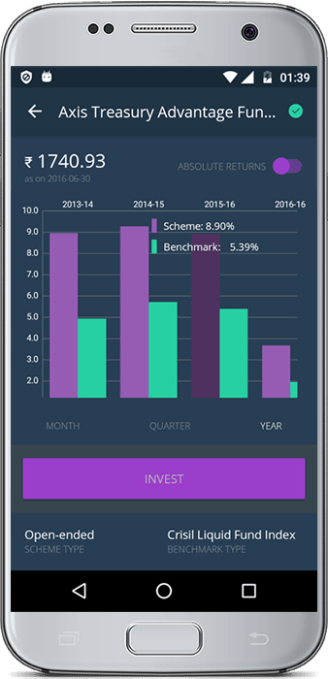

You could probably draw some similarities to Robinhood in the United States, but Mantha says Piggy — an app coming out of Y Combinator’s summer class this year — satisfies some of India’s unique challenges with a different user flow. The principle is still pretty straightforward: build an app to help users easily manage a diverse portfolio of investments that are attractive to the average human and first-time investor.

“When we were looking to solve this problem, we realized a lot of people are very intimidated by anything finance,” Mantha said. “When you say something like a Vanguard, it sounds very intimidating to people. We wanted to create something basic that’s very intuitive for users. We were definitely looking up to design principles in the U.S. We added a lot of our own creative juice. We were looking at the final process and wanted to make it easier for people in India to understand. There are a lot of flows that exist in Robinhood that wouldn’t make sense for India.”

Mantha and his co-founders Ankush Singh and Kunal Sangwan came from various banking backgrounds. At the time, they were giving investing advice to their friends and families, Mantha said, which prompted them to try to build an app that would help people build a personal investing strategy. Piggy currently charges a basic transaction fee for each of the transactions the user makes, similar to other investing apps. Users get an overview of funds available and the app gives them suggestions — hoping to create a simple way for users to start investing right away.

“We act as an intermediary where we provide an easy to use platform,” Mantha said. “You can sign up online, track your portfolio returns and everything else. We want to build the Vanguard for India. We started with this but that is what we look to do in the future. That’s some time away, but there are a lot of steps to the process. The first was to create something simple to use, then create a lot of pro features to aid those investments, and then look to create the investment products that are simple for people to understand.”

Given the size of the business opportunity, there will naturally be challenges. As a clean user interface for investing, for now, Piggy may be vulnerable to other startups picking off a similar bucket of users with their own differentiated user interface. The major fund houses in India will try to push their own investments and may choose to go after the app in their own ways. Just standing as an intermediary puts Piggy in a precarious decision. That was one of the big questions of the Y Combinator interview, where the firm probed Piggy as to how it was going to focus directly on user experience and growth to make the app defensible.

“They were drilling down on how we are focusing on users,” Mantha said. “They already saw that the market has a huge scope, the theme is such that something we pulled off making this app and making it popular organically. They were more focused on how we were narrowing down on the customers we wanted to serve and do that better. In the process of the whole batch, they really taught us to do that.”