Asian streaming company M17 Entertainment, which recently merged with Singapore-based dating startup Paktor, has closed a $40 million Series A round.

This new funding will be used to increase M17’s roster of streaming talent — the company agrees contracts with its streamers and celebs, much like a talent agency — and expand into new genres, such as reality TV, variety shows and music, the company said. M17 will also launch its service in new markets in Asia.

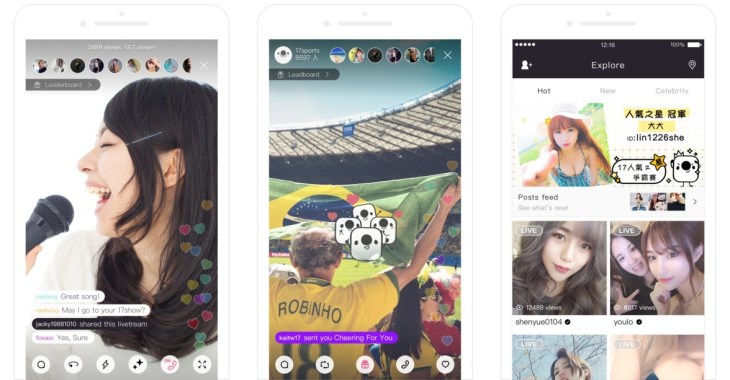

Taiwan-based M17 claims to have 30 million users while it counted over 50,000 streamers — aka content producers — as of April. Its streaming service is currently available in Taiwan, Hong Kong and Southeast Asia, but it currently includes only streamers from Taiwan. TechCrunch understands the plan is to open it up to streamers based in Japan, Hong Kong and Indonesia in the near future. China is another target, despite intense competition from well-funded rivals and government regulation.

Beyond the money, it has inked a partnership with KKBOX Group, which operates Asia-focused music/video streaming services and a talent agency. The idea is to help promote new talent, while leaning on the group’s media to give M17 streamers further exposure.

“KKBOX Group will work with M17 Entertainment to invest in original content creators. The content will be broadcasted on KKBOX’s media channels. We will also assist in music production, lending more exposure to music talents as well as giving them a chance to fulfill their aspirations as a singer,” KKBOX founder Chris Lin said in a statement.

The round was led by existing investor Infinity Venture Partners from Japan, with other existing backers Vertex Ventures, Yahoo Japan, and Majuven. New investors Golden Summit Capital and Korea’s KTB Ventures joined, too.

Thanks to the merger deal, M17 has quite a complicated cap table. M17 had previously raised $33 million from investors, while Paktor, which operates Tinder-like dating apps in Asia and across other global markets, took in over $75 million.

M17 CEO Joseph Phua told TechCrunch in April — the time of the merger — that the company was on track to gross $100 million in annual revenue with streaming a major contributor. There’s no update on that figure for now.

While live-streaming is a feature for the likes of Facebook and Twitter in the West, it has developed into a very promising and lucrative industry of its own in Asia. Chinese companies such as Momo, which started in dating but is raking in money from live-streaming, and Kuaishou, which recently raised $350 million led by Tencent, have blazed the path that M17 seems to be following.

The company looks like it is dipping into that Chinese live-streaming playbook for the rest of Asia, but it is up against competitors. The prominent rival is Bigo Live, which has dominated the genre in Southeast Asia. It has raised $180 million from investors to date, including major financing from asset management firm Ping An at a $400 million valuation.

Note: the original version of this article was updated to correct the amount raised.