The small nice-ish story Twitter had going for itself for the past few quarters was that, at the very least, its monthly active users were growing quarter-over-quarter.

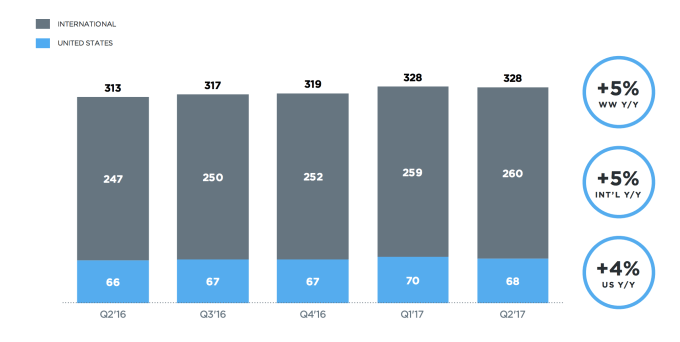

While MAUs might not be the right number to look at these days, for better or worse it’s one of the core metrics that Twitter is judged on for now — and that didn’t pan out when it reported its earnings today as its users were flat quarter-over-quarter (and up around 5% compared to the same quarter last year). Perhaps more importantly, the company’s MAUs in the United States fell slightly though the loss was made up by international users.

So, in very Twitter fashion, the stock fell on its face as it dropped more than 8% after the report came out. Here’s the money chart:

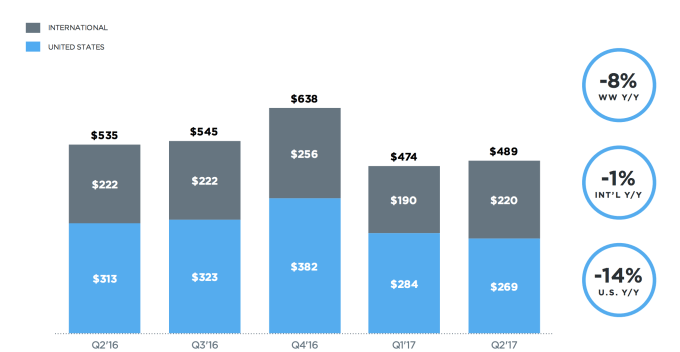

The rest of Twitter’s business looked more or less fine, but it seems that Wall Street was still relying on Twitter to continue that even small user growth. Its revenue is still falling, coming down to $574 million as its advertising business continues to decline. Its data licensing is still growing, but not yet fast enough (or large enough) to offset that decline. Twitter said it brought in earnings of 12 cents per share, while analysts were looking for earnings of 5 cents per share on revenue of $536.6 million.

Here’s one reason why that number in the U.S. falling would be bad for Twitter: it’s probably its most efficient market (as it is for many other companies) in terms of monetization. Its U.S. users are a fraction of its total users, but they make up a majority of its advertising revenue. It’s the same kind of problem that Netflix has had to grapple with as it tries to grow even as it may be reaching a saturation point — where everyone who could potentially want to use Twitter is already on Twitter. (The below is advertising revenue.)

In a grander scope, Twitter has sought to bill itself as an indispensable live service that can evolve into a long-term independent company. Snap’s shoddy performance since going public may have altered the calculus of how the market views advertising products outside of Facebook and Google, but Twitter may see an opportunity to capitalize on its (well, large) niche and sell high-priced video advertising products.

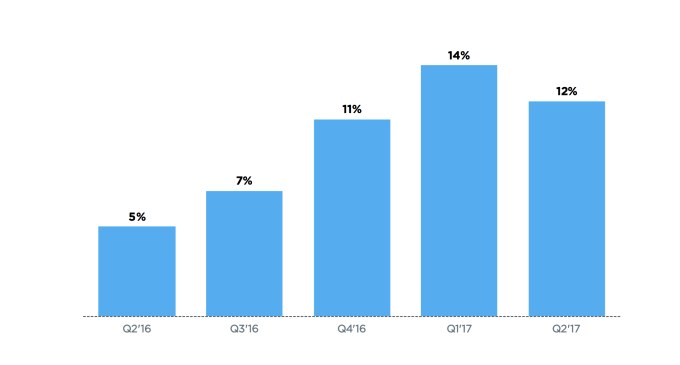

To that extent, the company touted that it had 55 million unique video viewers. It’s also tried to show that its daily user count is growing, though it was with this bizarre mystery chart with no actual daily active user number (but hey, this is tech — we don’t need a Y axis):

So far this year, that pitch may be working. Even with even more changes at the top — though the most recent one was an addition with a new head of live video business — the company’s stock is still up around 20%. Twitter announced earlier this month it brought on a new CFO after Anthony Noto took over as the chief operating officer. But if it’s going to continue to sell itself, it apparently still needs to do more to get that user growth going up.

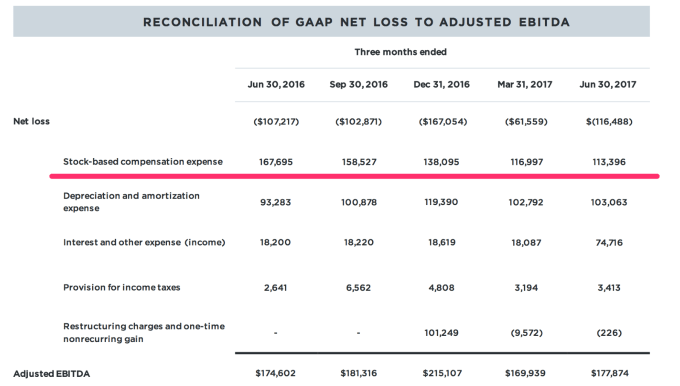

But, hey: at least that stock-based compensation expense number is still going down: