Intel declared $14.8 billion in revenue this afternoon and earnings per share of 72 cents. This represents a solid beat as analysts had expected revenues of $14.41 billion and EPS of 68 cents.

The company’s stock finished up 22 cents and 0.63 percent to $34.97 per share in regular trading. In the moments after the company released its earnings, Intel’s stock shot up 3.43 percent. It is currently trading at $36.17 in after-hours trading (~1:05pm PST).

Intel is in an interesting spot as a company. It knows that in the future its fate is sealed in its ability to execute on artificial intelligence. It will win or die on Wall Street depending on whether it can convert its $15.3 billion purchase of Mobileye into a thriving business unit serving the needs of the soon to be massive autonomous vehicle industry. Intel says its acquisition of Mobileye is expected to close in Q3 2017.

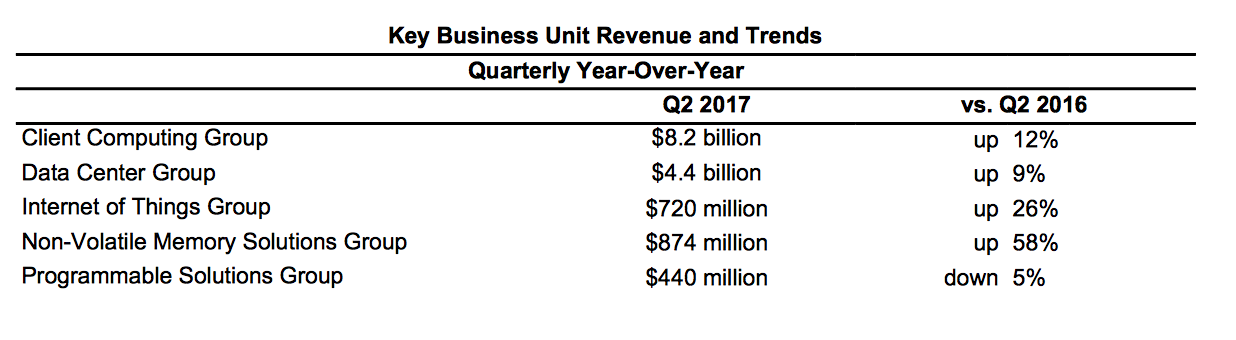

But today, despite three acquisitions — Mobileye, Movidius and Nervana — the important conversation is still data centers. Intel has long dominated the data center with its x86 chips. With increasing pressure from AMD, it’s unclear how much longer Intel will be able to nap, undisturbed, on top of the data center market. But for now, Intel was able to present 9 percent growth in the business unit.

In Q2 2016, Intel reported revenue of $13.5 billion. At the time that represented a 3 percent year-over-year improvement. Today’s Q2 2017 report reflects a 9 percent year-over-year improvement in revenue.

“Based on our strong first-half results and higher expectations for the PC business, we’re raising our full-year revenue and EPS forecast,” Bob Swan, Intel’s CFO, noted in the company’s Q2 2017 press release.

Intel expects to see $15.7 billion in revenue for Q3 2017 and EPS of 80 cents per share. On the year, Intel is projecting $61.3 billion in revenue and $3.00 EPS. Some of this value will be generated by Mobileye once the acquisition is complete.

The company reiterated on its earnings call that it aims to focus on increasing operating margins throughout the year.

We will be listening in to Intel’s investor relations call and will add additional context as we obtain it.