Broadly, the venture capital industry is thriving. But still, too often, women seeking funding are left out of the boom because of hidden biases, sexism and a general unawareness. Because of this — and recent reports of incredibly low-brow behavior among high-profile investors — it is more important than ever to understand where women founders stand when fundraising.

Since 2015, Crunchbase has reported on gender diversity in venture capital. And, once again, the story for women looking to be funded remains stubbornly predictable. Here’s what the numbers tell us.

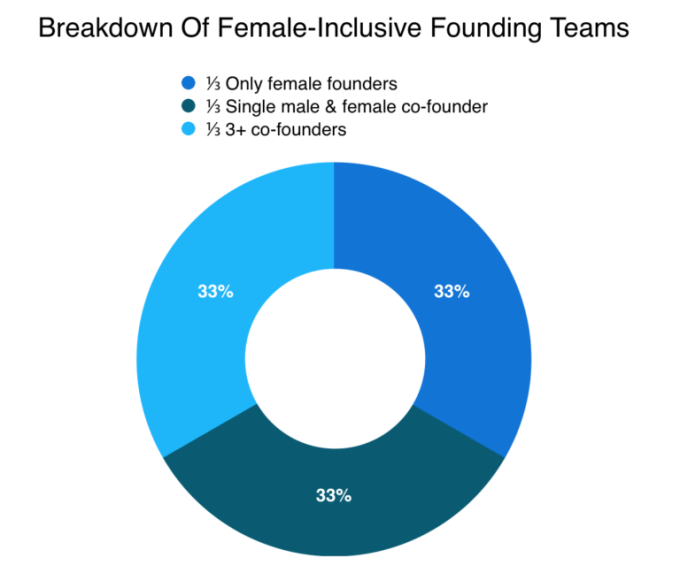

Distribution of women founders

Companies with at least one female founder grew from 9 percent in 2009 to 17 percent since 2012 — a stat that has not changed for five years.

Of the 17 percent of startups with at least one female founder, one-third are made up of teams that have only female founders. Another one-third are teams with two co-founders that include one male and one female. The last third represent teams that have 3+ co-founders with at least one female founder. Two-thirds of these startups, therefore, represent majority or equal female and male-founder representation.

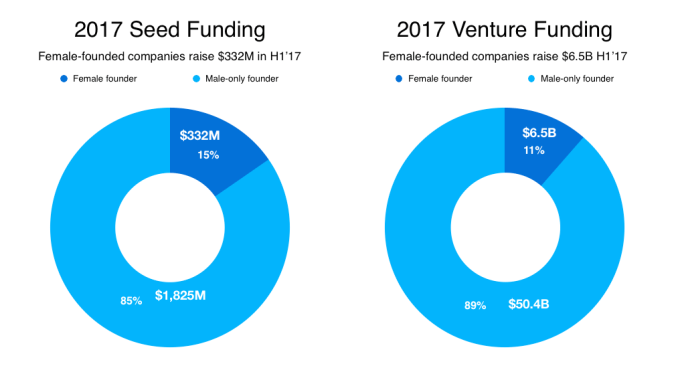

Funding in women-founded startups

For the first two quarters in 2017, startups with a female founder raised $332 million in seed investment, or around 15 percent of all seed funding dollars. Approximately $6.5 billion has been invested in female-founded companies, representing more than 11 percent of all dollars invested in the first two quarters of 2017.

VC lacks women investors, possibly impacting ability to raise

On the investing side, only 7 percent of senior investing partners at the top 100 venture firms are women. Female founders face a greater challenge than male founders when fundraising, as they are required to break into male networks, which predominate at most investment firms.

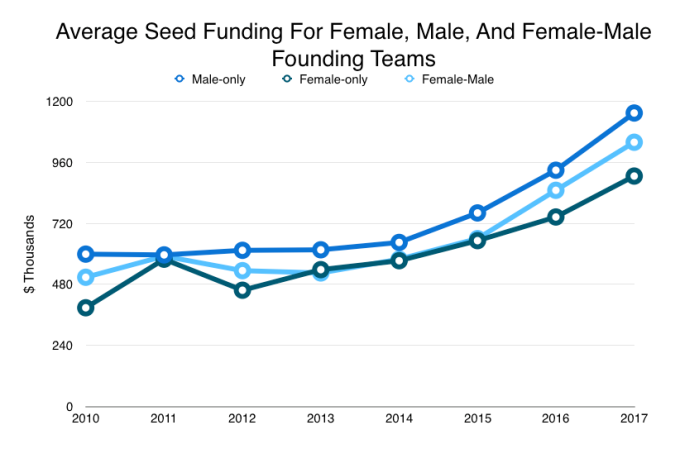

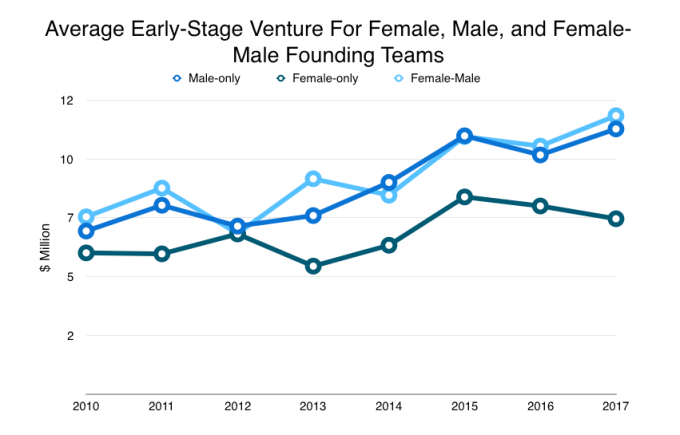

For the first time in our reporting on the funding gap, we looked at seed and early-stage funding since 2010 to see if there is a difference in fundraising for female versus male-only teams. Funding at this stage is risky, with the investor focusing on the founding team and the idea.

Seed averages

As the chart shows, there is a persistent gap between what male-only teams can raise, and what female-only teams can raise. Teams with founders that are both men and women land in the middle, a somewhat new trend that has become more pronounced since 2015.

At the seed stage, we reviewed 2,400 rounds for female-only founding teams and 37,000 rounds for male-only founding teams. Since 2010, for seed-stage funding, women-only teams have raised on average $82 for every $100 a male founded team raises.

Early-stage venture averages

For early-stage venture, we reviewed more than 1,000 rounds for female-only founding teams and 22,000 rounds for male-only founding teams. For early-stage venture rounds, female founders fare worse than the seed stage, as women-only founding teams raise on average $77 for every $100 a male-only founded team raises.

Notably, the gap of funding between women to men wasn’t always so large. In 2014, women raised $89 for every $100 a man raised. But over the past three years, the ratio has continued to drop, and it’s not yet clear whether that pattern will continue.

Backing founders

Because so many investors and founders are men, women are often not related to in the funding process. This lack of familiarity typically means reduced funding for women and a host of other consequences.

As one recent study pointed out, even the way investors frame questions to women can impact funding. According to the Harvard Business Review, female founders are often asked “prevention-oriented” questions focused on safety, responsibility, security and vigilance. Male founders, on the other hand, are often asked “promotion-oriented” questions focused on hopes, achievement, advancement and ideals.

The result of how these questions are asked between the genders? Women ended up with less funding.

This phenomenon is not just limited to investors in the United States. HBR also reviewed 125 pitches made in Sweden, 26 of which were made by female-founded companies. In the analysis, HBR found very different assessments of female versus male founders:

“The financiers rhetorically produce stereotypical images of women as having qualities opposite to those considered important to being an entrepreneur, with VCs questioning their credibility, trustworthiness, experience, and knowledge.”

Due to this line of questioning, women were only awarded 25 percent of their funding requests. Meanwhile, men walked away with more than 50 percent of their funding requests.

With these studies and data in hand, it is time to revisit the “guy in the hoodie” stereotype and recognize entrepreneurship comes in many forms.

Thanks to Matt Kaufman for conceptualizing the fundraising gap charts.

Glossary

- Companies without founders are excluded from this analysis.

- Seed/angel includes financings that are classified as a seed or angel, including accelerator fundings and equity crowdfunding below $5 million.

- Early-stage venture includes financings that are classified as a Series A or B, venture rounds without a designated series that are below $15 million and equity crowdfunding above $5 million.