Where’s the best place to start a startup? It’s a perennial and somewhat intractable question entrepreneurs love to ask. And before you get your hopes up, we’ll start by saying there is no one right answer to this question. Like much in the world of startups and venture capital, it depends on a number of factors. But what we can tell is that networks matter.

Networking through the city

In network theory, there’s a concept called “homophily,” the tendency for similar individuals to connect with one another more frequently than two or more dissimilar individuals. The phrase “birds of a feather flock together” is a common, simple explanation of what the term means. So, if an entrepreneur wants their fledgling startup to join the unicorn club — the small but growing number of private companies that reach a $1 billion private valuation prior to a sale, IPO or untimely demise — or just wants to get on a firm financial footing, where is that most likely to happen?

Here, we’ll provide an answer to that question with a bit of a twist.

Finding the metropolitan regions that give rise to the most startups, where most of the unicorns are located or where most of the companies with, say, $50 million or more in funding are located, is a bit too easy and it doesn’t yield particularly interesting results. (Spoiler alert: the SF Bay Area ranks at the top of the list for all three.)

Rather, we’re going to find the American metropolitan regions with the highest rate of producing unicorns and well-capitalized startups. In other words, we’re going to take the number of unicorns and well-capitalized companies in a given region and divide it by the number of companies founded in the region.

Finding “the best” place to start a startup

We’re basing our analysis on a data set, extracted from Crunchbase, containing nearly 33,500 companies from around the U.S. that were founded in or after 2003, the beginning of the Unicorn Era, according to Aileen Lee’s original definition.

This data set excludes companies that are said to have raised rounds of financing before their founding dates (an occasional error in the data that introduces more noise). Because the focus of our analysis are more “typical” software-driven product and services companies, the data set also excludes a number of capital-intensive business categories like energy, petrochemical processing and extraction, pharmaceuticals, medical devices and other life sciences companies.

We then aggregated the data to find the number of companies founded in each metropolitan region since 2003 which meet our criteria. Of course, there are going to be some companies that have been left out, due to missing data about locations or founding years. But we’re looking at a sufficiently large number of companies to narrow the margin of error caused by those omissions to the point of insignificance.

Finding where the unicorns are

We sourced our unicorn data from the Crunchbase Unicorn Leaderboard, focusing exclusively on those $1 billion or more companies that are currently operating and privately held and those that have gone public or have been acquired. We counted a total of 144 current and exited unicorns in the U.S., and here are the top five metropolitan regions where they’re located:

- SF Bay Area: home to 83 unicorns

- New York City: home to 22 unicorns

- Los Angeles: home to 8 unicorns

- Boston & Chicago (tied): each home to 5 unicorns

- Salt Lake City: home to 4 unicorns

No surprises here. However, when you divide the number of unicorns based in each metropolitan region by the number of companies founded in that region since 2003, we’re able to find the regions with the highest prevalence of unicorns in their startup populations.

This way of answering the “where are all the unicorns?” question produces some interesting and unexpected results, which highlight smaller startup ecosystems.

Finding mature and well-capitalized startup ecosystems

Although looking at the distribution of unicorn companies might be fun, such an analysis is inherently limited in what it can tell us. Considering we found 144 companies valued at $1 billion or more in private rounds, the majority of which are located in just one metropolitan region, there isn’t a lot of other data to work with.

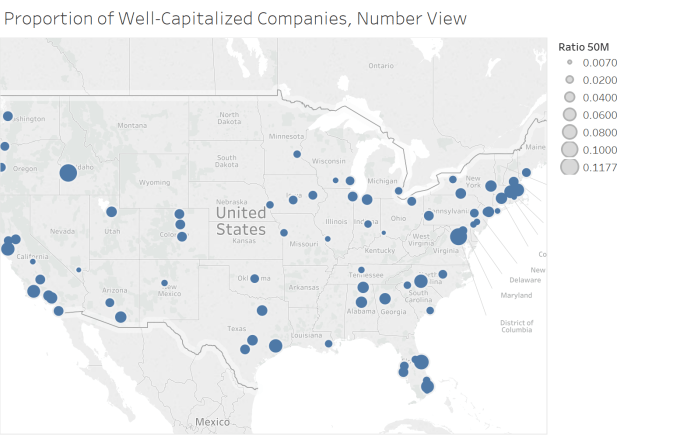

So let’s expand the scope a bit to look at the startup ecosystems with the highest proportion of “well-capitalized” companies. In a map below, we display those cities with a high ratio of well-capitalized companies relative to the region’s broader population of startups founded since 2003. But first, here’s how we chose what to include.

We chose $50 million in total funding as our minimum threshold for being considered well-capitalized. On a company level, nearly all are several years old and have raised at least two rounds of outside funding, meaning that they’re on a reasonably stable path toward an exit, IPO or self-sustained profitability.

On an ecosystem level, a relatively large number of companies with $50 million or more in funding signals that the metropolitan region has a number of investors willing to commit substantial capital to the companies based there. And even if the metro region itself doesn’t have many investors, companies based there are nonetheless able to attract venture capital.

In order to further reduce noise, we set a minimum number of companies founded in that metropolitan region since 2003. Here’s why: If in the last 14 years just five startups have been founded in a particular metropolitan region and just one has successfully attracted $50 million in venture capital funding, it might be technically correct to say that 20 percent of the companies in the region are well-capitalized; however, the population size is so small it doesn’t really matter. Being a whale in a pool with four minnows isn’t a great situation.

For our purposes here, we’re looking at the population of well-capitalized companies in metropolitan regions that have spawned 20 or more startups since 2003. This will reveal even more cities with sustained startup ecosystems, rather than just the lucky few outside of the Bay Area that are home to billion-dollar companies.

Below, you’ll find a static picture of this interactive map that shows the ratio of well-capitalized companies relative to the entire population of startups in the metropolitan region. You can hover over the dots to see the number of companies with more than $50 million in startup funding.

Here you’ll see that some smaller regions have a relatively large share of well-capitalized companies in their borders. Regions like Boise, ID, Alexandria, VA, Florida’s “Space Coast,” and Charlotte, NC all compare very favorably to bigger startup hubs like the Bay Area and Boston. Places like New York City, Chicago and Salt Lake City — which all ranked highly on previous measures, fall toward the back of the pack here.

Conclusion

There is no perfect place to start a startup. Major hubs like San Francisco, New York and Boston — while vibrant and prodigious in their production of highly valued companies — also are expensive and crowded with entrepreneurs, all looking to build their startups into the next billion-dollar businesses.

Smaller ecosystems, like Charlotte, Salt Lake City, Houston and others may be slightly less expensive and appear to have a higher hit-rate than the Bay Area and NYC, but the fact remains that these are still smaller ponds stocked with fewer, smaller fish. The presence of a metaphorical whale is, if you’ll forgive the pun, often just a fluke.

To be clear, it’s probably not a good idea to start a startup based purely on the number of unicorns and other well-capitalized companies in a region. These companies are the product of a rich and thriving ecosystem, not necessarily its cause. To join an already large and vibrant ecosystem, where the money and connections come easier, or to contribute to the growth of a new one, is a choice entrepreneurs will have to make on their own.