Last week, Reuters reported that the U.S. government is considering placing new restrictions on Chinese investment into American companies developing artificial intelligence, machine learning and other technologies with strategic importance to the United States. The report, based off of documents that haven’t been released publicly, suggests that, in the view of Reuters, the “U.S. government is now looking to strengthen the role of the Committee on Foreign Investment in the United States (CFIUS), the inter-agency committee that reviews foreign acquisitions of U.S. companies on national security grounds.”

If put into effect, the new rules would expand the scope of the CFIUS’s review processes to include other kinds of transactions that, for now, the committee hasn’t actively examined. According to the report, these new transaction types include the formation of joint ventures, taking minority yet material equity stakes, and investments in early-stage startups in industries the U.S. Government considers sensitive, like artificial intelligence.

Here, we’re going to take a step back from the politics of the situation and look at some cold, hard numbers to assess the current state of cross-border investment and other transactional activity between the U.S. and China. But, of course, not all Chinese investments in U.S. companies go into sensitive industries like AI.

We’ll look at one particular type of transaction that could be affected: venture capital investments. We’ll show the “big picture,” encompassing all manner of industries, and a narrowed down analysis of transactions in artificial intelligence, machine learning, computer vision and related sectors.

The state of cross-border venture capital activity

Despite an increasingly tense relationship between the U.S. and China, there’s a history of significant cross-border venture capital investment between the two countries.

The big picture

No surprise here: Venture investors in the two largest sovereign economies in the world, the U.S. and China, do a lot of deals with one another. But our question is, how has that investment relationship changed in recent years?

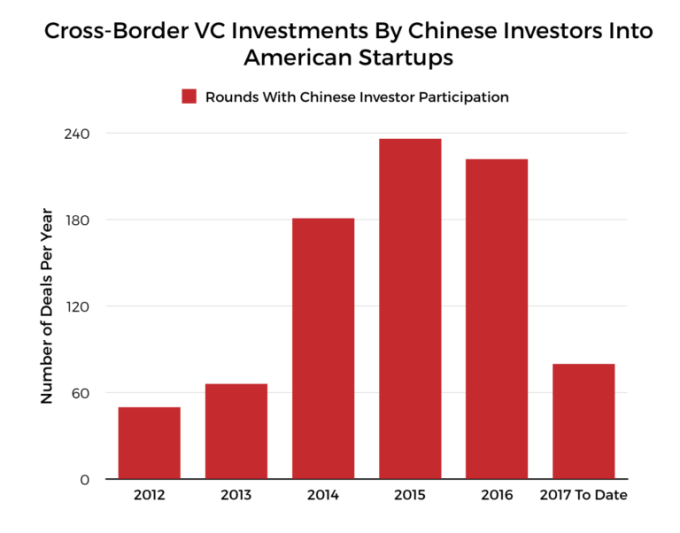

Between 2012 and today, Crunchbase has recorded more than 830 venture deals in which Chinese investors participated in a funding round being raised by an American company. The chart below shows the remarkable growth in the number of rounds in which Chinese investors have participated:

Between 2012 and its peak in 2015, the number of VC funding rounds raised by American companies that also saw participation by Chinese investors more than quadrupled, from 50 recorded rounds to 236, an increase of 372 percent in the space of just a few years.

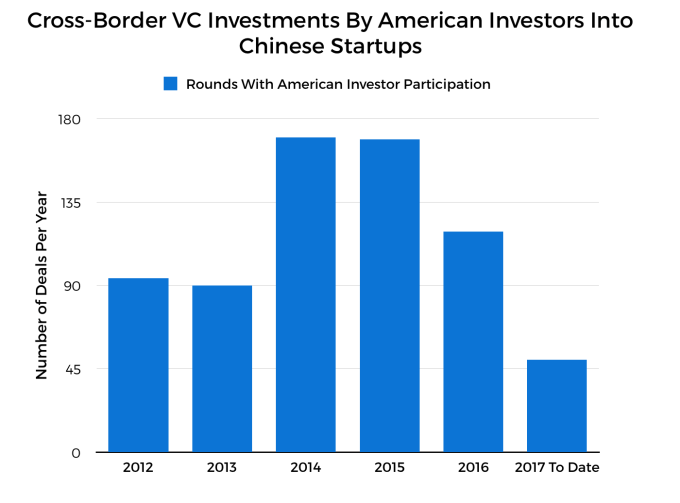

But by the same token, there was a similarly rapid increase in American investors’ participation in Chinese companies’ funding rounds. The chart below also shows a significant, albeit much more tempered, increase in the number of cross-border investments by American investors in Chinese companies’ venture rounds:

Crunchbase data recorded just under 700 Chinese venture rounds that saw participation from U.S. investors. Between 2012 and 2015, the same period we previously compared, the number of cross-border venture deals participated in by American investors grew by around 80 percent. And although the year-to-year growth isn’t nearly as consistent or dramatic as the capital flows going the other direction, it’d be considered exceptional in almost any other context.

Shifting patterns

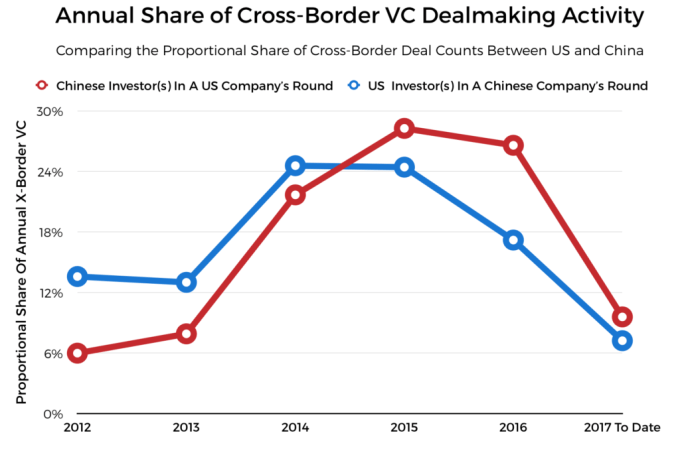

How did the two-way flow of capital across the Pacific change over time? Although the number of American and Chinese venture rounds is similar, it’s not exactly the same, so to make an apples-to-apples comparison of the pace of deal making between each country’s investors we’re comparing the proportional share of deal counts between the six years in our analytical window.

Below, you’ll find that chart:

Again, we’re looking at the proportional share of deal making from year to year. If everything remained constant, we’d expect to see a flat-as-a-pancake line at right about the 17 percent mark (because 100 percent of deals divided evenly between six years would be 16.66 percent). Using this view, we can see that American investors’ participation in Chinese venture rounds peaked earlier (in 2014) and that its rise was somewhat less dramatic.

The rate at which Chinese investors began piling into American startups’ rounds, well, that’s a different story altogether. Using this proportional view, the dramatic growth in cross-border venture investment activity from China becomes much more apparent. And although there was a decline in overall activity in 2016, it’s smaller than one might expect, given the generally underwhelming performance of the global venture capital market in 2016, China’s historic stock market volatility and hints that the Chinese economy’s remarkable growth rate is beginning to slow as it matures.

In general, despite both domestic and international macroeconomic setbacks, Chinese venture investors still saw a bright spot in American companies, and it seems like most are willing to continue their cross-border investing.

That is, unless a geopolitical roadblock from the United States slows their roll.

Chinese VC investment in American AI and related technologies

By now, it’s common knowledge that “artificial intelligence” and related fields like machine learning and computer vision are the new hotness, and not just in the rarified circles of Silicon Valley.

As maturing economies seek the benefits of automation and optimization, investment in the core technologies that enable those gains are almost sure to follow. At least that’s what Philip Ng, partner and head of technology at KPMG China, suggested in a press release about the firm’s Q4 2016 venture capital report. Ng commented, “Investors in Asia are shifting their investment focus. While there has previously been a lot of attention paid to O2O [Online to Offline], the second half of 2016 saw investors more focused on artificial intelligence, robotics and big data. […]”

And this focus on emerging, enabling technologies has, for the most part, held fast both for domestic investments inside China and for cross-border investments, too.

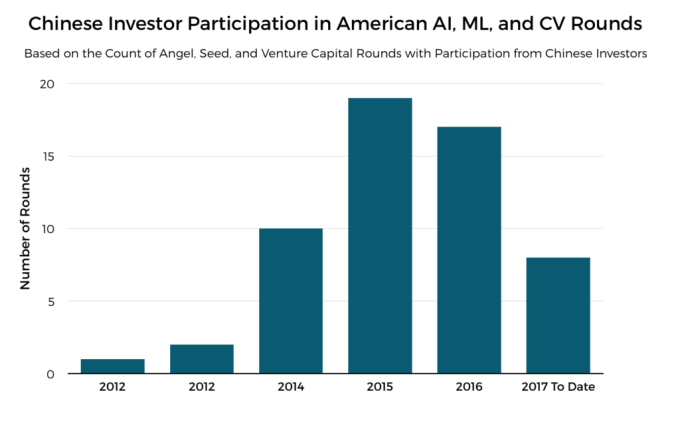

Below, we’ve charted cross-border deal making activity between Chinese investors and American companies in the artificial intelligence (AI), machine learning (ML) and computer vision (CV) categories. Although with a sample size of just under 60 deals there aren’t a lot of data points to make strong claims with, it’s easy to see that interest in cross-border deals in the AI space grew both significantly and swiftly.

At time of writing, we’re a little over halfway through 2017, and if the pace of cross-border deal making continues unabated, it’s likely that there will be slightly fewer deals struck by Chinese investors with American AI, ML and CV companies this year.

Let’s take a look at which investors have already gotten in.

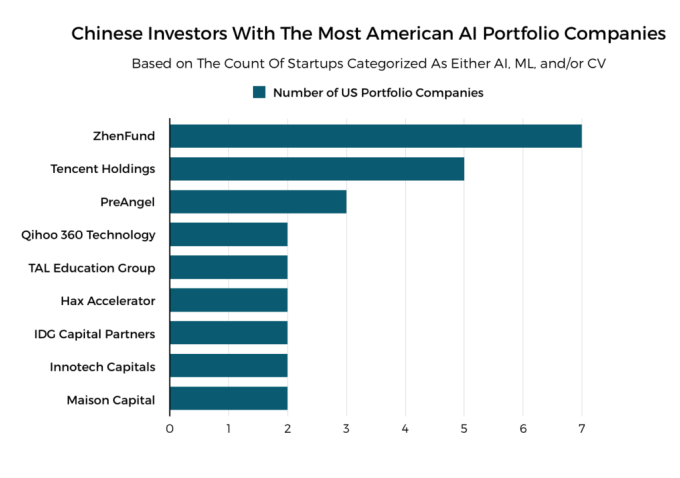

Based on an analysis of 1,712 unique investors in 1,206 American companies in the AI, ML and CV categories, we identified more than 30 Chinese investors who have at least one U.S.-based AI company in their portfolio. And here are all of the investors with more than one:

As far as pure VC goes, Beijing-based ZhenFund is far and away the most prolific Chinese investor in American AI, machine learning and computer vision companies we found in our analysis. With portfolio companies like uBiome, Mosaic, NovuMind and Osaro, as well as syndicate partners like Sean Parker, Yahoo founder Jerry Yang, Joe Lonsdale’s 8VC, Scott Banister and Peter Thiel, ZhenFund appears to be well-entrenched in Silicon Valley.

Tencent Holdings, the corporation behind the mind-bogglingly successful WeChat app and other online utilities popular in China, comes in second with three U.S.-based portfolio companies in the AI sector. Note that Baidu only has one U.S.-based portfolio company listed in Crunchbase’s AI, ML and CV categories.

It’s investors like these that are most likely to bear the brunt of any increased scrutiny of Chinese investment in American AI companies. Of course, this doesn’t count U.S.-based funds founded or operated by Chinese nationals, nor does it take into account the investment by Chinese corporations that have set up offices in Silicon Valley and elsewhere in the U.S. for the purpose of drawing from the AI talent pool that American companies can access.

Frosty relations in context

Here, we’ve documented two significant trends. In general, Chinese investors still have a relatively robust appetite for American startup equity. Second, both foreign and domestic investors have taken a particular liking to American artificial intelligence, machine learning and computer vision startups, and Chinese investors have been swept up by the AI enthusiasm in a big way.

Although implementing additional oversight on Chinese investment in these cutting-edge areas is unlikely to bring cross-border investment to a screeching and untimely halt, it’s likely that they would slow the pace of investment by a fair amount. A good deal (almost) always finds a way to happen.

The documents cited by Phil Stewart, the Reuters journalist, haven’t been finalized. And the policy proposals contained within them may never be implemented. At this point, there are still too many unknowns about the administration’s plans.

Even if we assume that the draft protections are warranted — that valuable intellectual property and sensitive technology created by early-stage startups really is being misappropriated — a blocking measure around foreign venture capital investment in sensitive technologies like AI would be a significant departure from the status quo. Suffice it to say that, for now, concerns that the U.S. plans to shut China out of a bunch of VC deals is much ado about, well, not all that much, at least for now.

That being said, the U.S. would do well to not succumb to the temptations of technological protectionism that its chief economic rival and most frequent foreign VC co-investor has historically embraced.