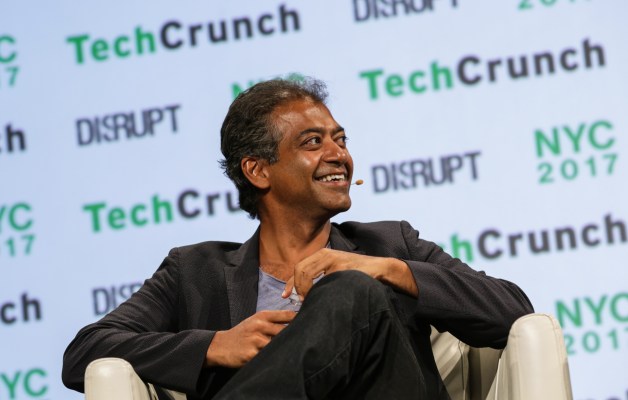

Earlier this week, at TechCrunch’s Disrupt event in New York, we sat down with AngelList cofounder and CEO Naval Ravikant to talk primarily about the platform’s new Angel Funds product, wherein a select number of proven “angel-operators” is being provided capital from AngelList and outside VCs to invest in a basket of startups. (We wrote about that new program here.)

Of course, while we had him in our clutches, we wanted to talk with him about other directions in which AngelList might move over time. What we gleaned: the platform, which is famous for continuously iterating on its approach and offerings, may eventually use its late December acquisition of the popular product platform Product Hunt to create a paid offering for companies looking to buy specific technologies or products. It sounds like AngelList may also eventually dive into the brisk secondaries business, wherein investors buy up earlier investors stakes in certain companies.

Here are some outtakes of that chat, edited for length and clarity:

TC: Recently, a crowdfunding marketplace, Seedrs, announced that it’s going to launch a secondary marketplace. It could be interesting to see AngelList get into this business.

NR: We are obviously always looking at secondary marketplaces. The problem is how much liquidity can you have for these things. Generally, if you have a really well-known company, like a Facebook or a Snapchat, before their IPO, there’s demand from later-stage investors for a secondary marketplace. But it’s usually concentrated in a very few names.

We work at the very early stage where, frankly, people don’t know the companies. If someone wants to sell, it’s such a negative signal; it’s not clear that there’s a buyer on the other side. But 1,500 companies on the platform have already raised half a billion dollars and they’ve gone on to raise over $5 billion [in subsequent fundraising rounds], so they’re getting larger and larger and larger, and there will be a point where some of those names become so hot that there will be secondary demand. And then if those companies are open to it, we’ll work with them to fill that secondary demand.

TC: We’re also wondering what you’re doing with Product Hunt, which you acquired in December.

NR: There’s so much innovation going on, and there are lots of people funding that innovation, but there’s very little innovation on that infrastructure for innovation itself, so we like to do that ourselves to help companies create more tech companies. So what do tech companies need? They need money, they need talent, and they need customers. So AngelList started out with helping them raise money, now we’re the largest startup recruiting marketplace in the world, with 25,000 startups recruiting and about one million candidates. But the missing piece is helping companies find their early customers. And Product Hunt did an amazing job of that. They’ve now launched 90,000 products; they do millions of product discoveries every single month; and it’s kind of the place where teams from Uber and Facebook and Google and lots of startups go to launch their latest apps. So we were always in awe of Product Hunt and we brought them in to kind of complete the third leg of that triad.

TC: It sounds like that could be a revenue-generating product, showing companies [needing products] who they should be talking to, what the various tech stacks are of different startups . . .

NR: Yeah, I think long term it can generate revenue. In the short term, we’ve left the team completely independent. They’re still executing on the same plans as before we merged up. And all the team and the management is still there.

TC: You also spun off a crowdfunding platform for non-accredited investors called Republic last year. Can you tell us a bit more about that and how involved you are?

NR: Crowdfunding is going to happen — it’s happening in the U.S. — it’s just happening a little bit slower than in the U.K. as [the U.S. government] works out the final [regulations]. And Republic is a spin-out that we did with some of our best people to go and start doing that. It’s still very early; Republic has done a couple of deals, but I think we’re still in the first inning of crowdfunding.

TC: What’s your stance on loosening or broadening the definition of accredited investors? Do you ever worry about less sophisticated investors jumping into startup investing?

NR: I think the whole accreditation thing is a guideline left over from the 1934 Securities Exchange Act. What matters much more is sophistication than accreditation. Having a million-dollar net worth doesn’t make you a genius, and having less than a million-dollar net worth doesn’t make you a fool.

For more, including whether AngelList is profitable, and what AngelList’s exit strategy is, you can watch our interview here: