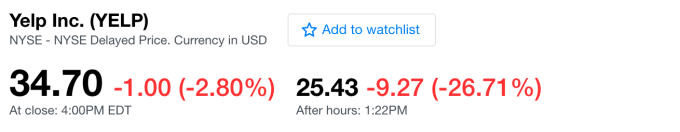

Yelp shares are down more than 25 percent after the company reported its first-quarter earnings report today, where it reduced its full-year guidance that it set in the previous quarter.

The company said it would bring in between $850 million and $865 million in revenue for the full fiscal year of 2017. In the fourth quarter (reported in February), Yelp said net revenue was expected to be in the range of $880 million to $900 million. That means even though the company’s revenue fell only a little short of what Wall Street was expecting, the company is signaling slower growth than expected.

So, this happened:

This isn’t all that surprising. Yelp is going to face increased competition as it finds itself increasingly competing with core platforms like Apple Maps and Google. But beyond even that, Yelp is going to have to figure out ways to put its data in front of users in the ways that they want — such as through a voice interface like Hound or Siri or Alexa. That gives Yelp less flexibility to work its business magic on its core site, meaning it may have to shift its approach and model going forward.

While Yelp is out on the market acquiring companies and unleashing smiling robots for food delivery, its core value — the data it has assembled over time — still seems to be what represents most of what Yelp is worth. It’s going to have to diversify its business beyond just that with products like Eat24, but for now it appears that it’s going to take a while to grow into that.

Really the only reaction here is a 🤔. Yelp’s story in the past year has been one of at least a partial recovery, with shares up around 37 percent over the past 12 months. Yelp made a name for itself as the go-to place to find reviews of various venues around the world. And, sure, some of the reviews may be frustratingly vague (and everything is 4 stars), but it still represented a huge well of data for reviews and information about restaurants and the like.

Still, Yelp has seen slowing revenue growth for some time now. If the company itself is paring back its growth expectations, that means it’s trying to set some model closer to reality for Wall Street — which is inevitably going to make industry observers reset their own models, and the valuation for the company along with it. Before today’s fall off a cliff, Yelp was valued at around $2.8 billion.

[graphiq id=”9tsXM18tQyx” title=”Yelp Inc. (YELP) Quarterly Revenue & Growth Rate” width=”650″ height=”584″ url=”https://sw.graphiq.com/w/9tsXM18tQyx” frozen=”true”]

Yelp is going to have to figure out how to monetize users as it serves, for now, as a very robust pool of data that’s accessed in ways that don’t involve go directly to the Yelp app or website. Whether Yelp turns out to be a utility or a product — a similar question Foursquare has faced — is going to decide whether or not Yelp is going to be a valuable public company going forward.