Pandora will undertake a “strategic review” of whether it will sell itself to an acquirer. If not, it’s agreed to take a cash infusion to maintain “a strong balance sheet” as it struggles to shift from radio to the increasingly popular on-demand streaming model.

Private equity firm KKR has agreed to buy $150 million in Series A preferred Pandora shares a month from now and be paid a 7.5 percent or 8 percent quarterly dividend while KKR’s Richard Sarnoff takes a board seat. Meanwhile, two Pandora board members James M. P. Feuille and Peter Gotcher will resign as the board considers the music company’s options.

The news came alongside Pandora’s mixed earnings report, where its $316 million in revenue fell short of the $318 million estimate, though its delivered a loss of $0.24 EPS per share compared to an expected $0.34 EPS loss.

Total Pandora subscribers grew 20% year-over-year to 4.71 million in Q1 2017, with 500,000 trial starts of its new Pandora Premium on-demand service. 80% of trial subscribers came from upsells to its existing users. But total listener hours slipped from 5.52 billion in Q1 2016 to 5.21 billion this quarter, while active listeners fell from 79.4 million to 76.7 million. Ticketing revenue from its $450 million acquisition of Ticketfly came in at $27.8 million, up 25% year-over-year.

The KKR cash could help Pandora gain some momentum. Here are the nuts and bolts of the deal:

“KKR will purchase an aggregate of $150 million in a new designated Series A convertible preferred stock of Pandora. Pandora will pay dividends to the holders of the preferred stock quarterly at an annualized rate of 7.5% if paid in cash or 8% if paid in kind, at its option. The Series A preferred stock is convertible into common stock, cash or a combination thereof at a conversion price of $13.50 per share. The offering may be upsized to a total of $250 million should the Company determine to issue additional shares.”

Pandora bought the remains of failed on-demand streaming app Rdio back in 2015 for $75 million cash. But it took the company a year and a half to build that foundation into Pandora Premium, which launched in March. With a focus on simplicity, Pandora hopes to compete with Spotify, Apple Music and other streaming services. But its late start means it may need the extra cash to build out more attractive features and do heavy marketing to change what people think of when they hear Pandora.

Regarding KKR’s investment, Pandora’s CFO Naveen Chopra wrote, “A strong balance sheet gives us the ability to accelerate growth investments when appropriate and to compete aggressively in a rapidly changing, complex market.”

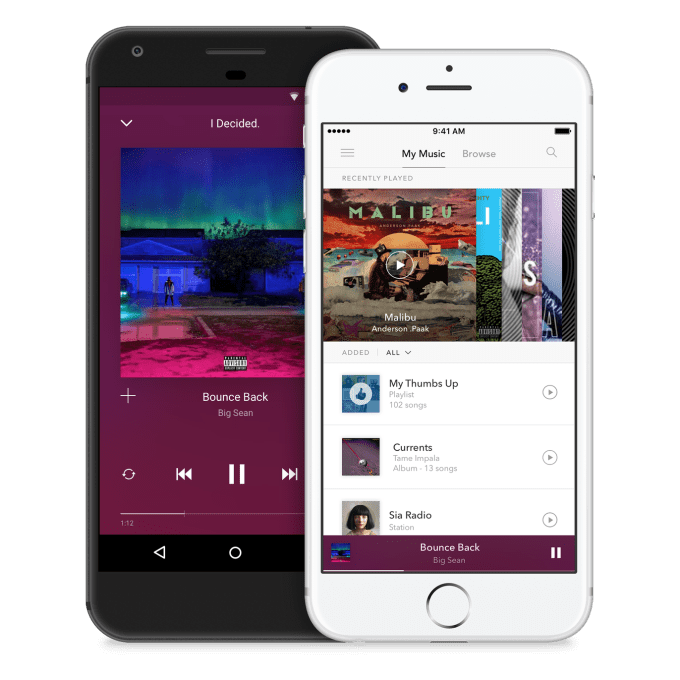

The new Pandora Premium on-demand streaming service

Pandora reportedly was approached for a takeover by Sirius XM radio, and was reaching out to other potential acquisition suitors, Bloomberg reported in December. Pandora apparently turned down a $15 per share offer from Sirius earlier in 2016. But in January this year, Pandora announced it was laying off 7 percent of its workforce to cut costs. It beat analyst estimates in its Q4 earnings report in February, yet its share price still dropped 4 percent. Today Pandora closed at $10.40 per share, but rose 3.85 percent in after-hours trading to $10.80 upon the KKR investment news.

With radio becoming merely a feature of other streaming services, Pandora must reinvent itself. That will take time and money, but also the kind of product innovation like the Music Genome Project that made it the premier online music app of the 2000s. Being a little bit simpler than Spotify isn’t going to cut it.