When Snap went public earlier this year, it revealed a break-neck level of growth in its nascent advertising business — and a dramatic burn rate along with it. But while it’ll be important for Snap to continue growing that business and get its costs in check, it’ll be nearly as important to convince Madison Ave. that it can be a mainstay ad buy alongside the big two (Facebook and Google).

Snap, like Pinterest and Twitter, faces a steep challenge of convincing advertisers that they should be part of those regular ad packages that include other platforms like Facebook and Google. While all of these companies have hundreds of millions of users and hundreds of millions of dollars in revenue, there’s a big difference between getting that kind of money from a curiosity budget and ensuring that they are constantly in those conversations. Twitter’s revenue declined in its most recent earnings reports, and Pinterest it would seem lagged behind much earlier revenue projections. That means eyes will be on Snap this week when it reports its first earnings to see if it’ll continue that insane growth (about 6x from 2015 to 2016) and show that it’s convinced advertisers it’s the real deal.

All of these products offer something different from Facebook and Google. Google in particular is an absolute advertising juggernaut because it can catch people right at the moment they are considering buying them and nudge them to that check-out button. The former offers a massive audience and scale to drive awareness and potentially move them down the advertising funnel toward an app download or a purchase. These have years of evidence they can throw in blog posts and in pitch decks to advertisers to demand huge portions of their digital ad spend.

Pinterest’s pitch, for example, is that it can tap into its 175 million monthly users at all parts of the buying cycle. That would give a brand an opportunity to find a new customer and follow them around straight to the point of conversion. Pinterest’s strength is helping users discover products they might not have wanted and give brands that opportunity to build up awareness over the course of months all the way down to showing a product for purchase. It’s supposed to be a more complete access to the funnel.

Yet as the numbers show, these companies haven’t started to reach the same heights as Facebook and Google. In the first quarter this year, Facebook generated around $8 billion in revenue. Google brought in nearly $25 billion in revenue. And even these companies — in particular Google — are already trying to diversify into new businesses that are funded by its massive advertising budget. In a time when competition for eyeballs is higher than it’s ever been, Facebook and Google are able to say to advertisers, “here’s a group of people we think will buy products from you, and we can guarantee that we can get in front of them and deliver results.”

Digital ad revenue grew to $72.5 billion in 2016, up 22 percent from the year before, according to the latest Internet Advertising Revenue Report from PricewaterhouseCoopers and the Interactive Advertising Bureau. And those budgets will continue to grow as more and more eyeballs shift away from television and onto smartphones (or voice assistants like Alexa and Google Home). But Facebook and Google dominated that, giving Snap and others a much smaller slice to pick away at for now.

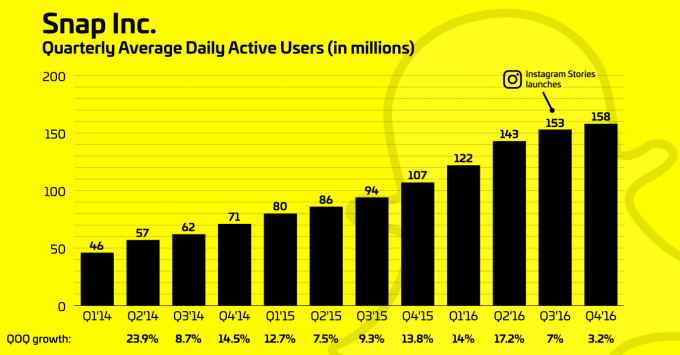

To make matters more difficult, Facebook has been rapidly copying some of Snap’s most popular features — and doing so across multiple platforms. In April, Instagram said its Stories product hit 200 million daily active users. Snap in its IPO said it had 161 million DAUs, and following Instagram’s release of stories, Snap’s growth stalled. While we can’t say directly that one caused the other, the timing syncs up pretty neatly. So once again, Facebook can go to advertisers and say that they can equally tap into so-called “innovation” budgets and apply them to new products like Instagram down the line. And, once again, they’re clones, making the case harder for Snap.

Earlier this week, Snap launched its self-serve ad manager, which will open up advertising opportunities to a broader audience. But it’s not clear if the audience and product lines up to be a mismatch with small- to medium-sized businesses that can spend their smaller budgets on advertising campaigns that have been around and can deliver a more reliable outcome. Snap ad campaigns may show an enormous amount of engagement, but with only around two years of advertising history, the exact pathway from that ad to a return on investment may not be as hammered out and easy to pitch as it would be for Facebook and Google.

All this represents a big challenge to Snap, which Wall Street expects to bring in around $158 million in revenue with a loss of 19 cents per share. Snap generated $38.8 million in revenue in the March-ended quarter last year, and $3.9 million in 2015. So it’s still a pretty immense jump in revenue. If Snap is able to keep Wall Street happy and keep that revenue growth up and continue adding highly-engaged users, it may show that they’re still on track to grow into a more consistent advertising purchase. So Snap’s guidance, if it ends up giving one, may be even more important than the actual numbers themselves.

But Snap’s problems, if it ends up whiffing, may show as much a challenge for all these more nascent and otherwise smaller advertising products across other companies like Pinterest or Twitter. Snap is the clear rocket ship, building a massive ad business in around two years and hitting a nearly $27 billion valuation. But Twitter, too, seemed quite healthy and promising when it went public. Snap has to avoid the fate — as do the rest of the companies — that the products lose their trendiness and those innovation budgets start going elsewhere.