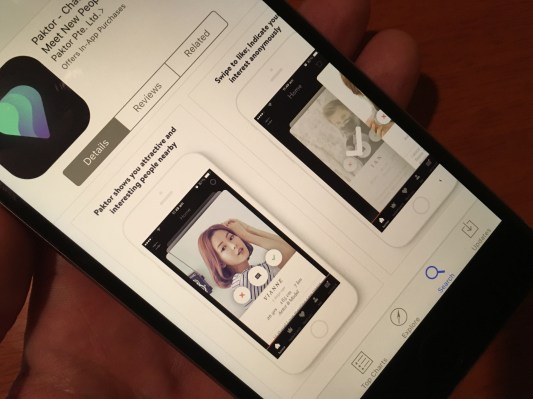

Dating app Paktor, often dubbed ‘The Tinder of Southeast Asia,’ just sealed up its move into live-streaming and media content after it announced a merger deal with Taiwanese startup 17 Media.

Under the deal, a new company called M17 Entertainment has been created with shares from both Paktor and 17 Media, company representatives confirmed. They didn’t, however, reveal a valuation for the transaction, although M17 claims to be Asia’s “largest social entertainment company.”

The deal makes plenty of sense in many ways. Paktor CEO Joseph Phua spoke of his desire to expand into social entertainment when his company raised its most recent $32.5 million funding round last October. In addition, Paktor, which is best known for a Tinder-like dating app in Southeast Asia, made a major investment in 17 Media last December, with Phua relocating to Taiwan to become its CEO. Following the merger, he has become M17 Entertainment’s Group CEO.

“This is a corporate move that allows for aligned interest among all shareholders and makes [the] structure clearer to investors,” Phua told TechCrunch in an interview. “That’s something that had been brought up when [we were] fundraising.”

On the strategic side, it brings some clarity to Paktor’s previous intention to move into “social entertainment,” a fairly nebulous term that encompasses any kind of entertainment on a smartphone. Something that, at least, goes beyond dating.

Paktor currently offers four dating apps — core service Paktor and acquired apps Down, Kickoff and Goodnight — while 17 Media’s runs its 17 live-streaming app, photo social network Swag and video group chat service Lit. The new entity will retain all, and expand many, of those services, which Phua told TechCrunch are collectively on course to gross $100 million in annualized revenue based on its most recent month of business, and the recently announced Paktor Labs division. That revenue — and there’s no word on profit; we did ask — is up ten-times over the past six-months. All together, the apps claim a combined 50 million users.

Revenue potential of live-streaming

Phua, who believes the firm can double its revenues before the end of this year, is particularly bullish around the potential of live-streaming.

“Live-streaming allows us to expand into numerous other areas, for example content production. Right now, we’ve only touched the content on live-streaming. With one small screen taking up 45 minutes [of a user’s] day, we can support a huge company,” he said.

“On the revenue side, $100 million in [annualized] revenue is sizable when you compare it to traditional media, which relies on advertising — something we haven’t done yet,” Phua added.

Beyond enabling consumer live-streaming, M17 plans to work with established media and high-profile media personalities to tap into mobile in a way that the firm believes they aren’t doing yet. Already, it has partnered with (its investor) MNC in Indonesia and Yahoo in Taiwan to explore new broadcast methods and monetization options, and Phua believes there’s much more to come.

“We want to explore ways to monetize with audiences with traditional media using both existing and new stars,” he said, adding that M17 has begun housing new stars under its own talent agent. “Celebs are finding monetization is very significant on live-streaming.”

Phua didn’t diverge specific revenues for his company’s live-streaming services — other that it is “significant” — but he did say that 17 (the app) claims 15 million registered users. Unfortunately, the company doesn’t reveal user activity data, although it claims 50,000 active streamers and top-three app store rankings in the live-streaming category in six Asian countries.

Battling established names

Even if engagement is high, there’s strong competition for attention. The list of established companies moving into streaming is nearly endless. Facebook, Instagram, YouTube, Twitch and then in China fellow dating app Momo, and fast-growing Kuaishou among others. Competing against destinations that already have audiences in the hundreds of millions, if not billions, is a tall order, but Phua said he believes that M17 has an advantage because it has been built for streaming from day one.

“Facebook and Instagram Live are great. Facebook has embraced live tech and we are all moving in the right direction, but different mediums have different purposes,” he said. “With 17, you build your fanbase and expose yourself to people who wouldn’t have already discovered you. People recognize brands for what they were not what they want to build to.”

That longer term challenge aside, Phua is stacking more cash in the short term even though he said the company is already suitably financed. Paktor has raised $77 million from investors since its foundation in 2013, according to Crunchbase, but now M17 is closing an undisclosed — but “significant” — new round with the KTB China Synergy Fund its first confirmed investor.

“I wouldn’t say it was difficult to raise this round, but I’m cautious about the environment and want to make sure we always have options,” Phua said. “We’ve not been stronger over the last four years. Our goal remains the same: building the largest social entertainment company in the region.”