DFJ Growth, the 11-year-old growth-stage arm of the 31-year-old Sand Hill Road firm, has closed its third vehicle with $535 million, slightly more than it was targeting when it began fundraising in the spring of last year. It had closed its previous growth fund with $470 million in May 2014.

The firm has invested in four new portfolio companies over the past year, including the games and “experiences” development platform Unity; Giphy, which provides a search engine for a vast library of GIFs; the connected doorbell startup Ring; and Katerra, an end-to-end design and construction platform co-founded by former Flextronics CEO Michael Marks.

DFJ Growth typically makes four to eight new investments per year.

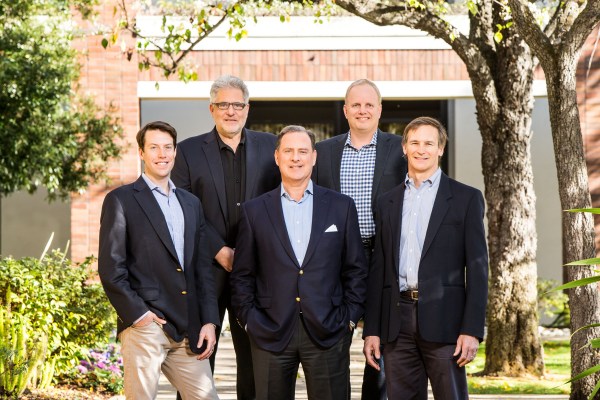

Yesterday, we had a quick exchange with firm co-founder Randy Glein about the market, the new fund and the firm’s team of five general partners, which includes co-founders John Fisher, Mark Bailey and Barry Schuler, as well as Sam Fort, who was promoted to partner in late 2015. (In fact, most of the firm’s partners started as associates or venture partners.)

DFJ Growth hasn’t seen any of its portfolio companies go public yet in 2017, but Glein said it has “several companies at IPO scale” in its portfolio, “including nearly a third of the companies in our most recent fund, [as] we feel it typically requires at least $100 million to $200 million in revenue before an IPO is a viable option.”

Perhaps unsurprisingly, the firm — which has invested in a string of winners in previous years, including Box, SolarCity, Tesla, Twitter and Twilio — seems to think it’s early innings for what looks to be a good year for IPOs. The main reason, in his view: tech companies are again “providing public market investors access to growth companies that have become scarce in public markets.”

It’s a rosy assessment, but Glein does have his concerns, he said, namely “things like the state of the global economy and unexpected events that might disrupt the market and adoption of new technologies for a period of time.” Still, these “tend to be short-lived,” he added, saying that “overall, I’m hugely optimistic about the role innovation and technological advancement continues to play in making our world and society better.”

Before we let Glein go, we touched on deal terms and whether they’re changing for later-stage companies. (We’ve gathered from conversations with other investors that terms are starting to favor them over management teams in a lot of cases.)

He said his team has seem “some level of moderating valuation expectations more broadly in the private markets over the past 16 months, as some of the late-stage investors have pulled back.” But he added that the strength of the public markets and recent IPO success stories are providing some “renewed buoyancy” across the board.

Naturally, as with any experienced VC, Glein said his team won’t stop funding companies either way. “We’re playing the long game, and we try to always keep that in mind when evaluating the risk-reward trade-offs of any opportunity.”