Spotify may be the reigning leader when it comes to the largest number of paid subscribers for a streaming music service, but it’s Apple that comes out on top when their respective audiences translate into monthly unique users, specifically on mobile.

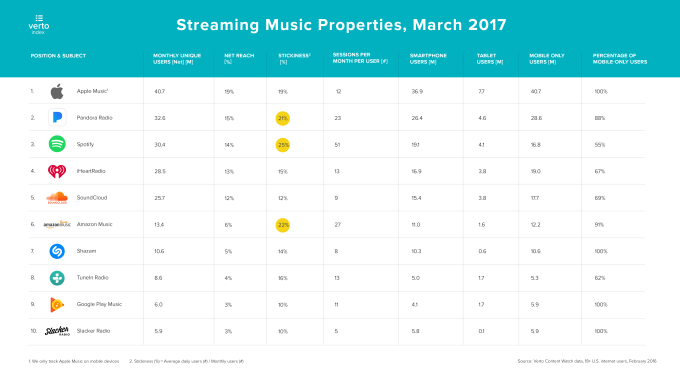

A report published this week from mobile analytics firm Verto has found that Apple Music attracted 40.7 million monthly unique users to its service in the U.S. in February. In comparison, Pandora came in at number two with 32.6 million users, and Spotify took third place with 30.4 million unique users for the month. Others ranking highly among music apps include iHeartRadio, SoundCloud and Amazon Music. iHeartRadio took the fourth slot, while SoundCloud, which last week secured a $70 million credit line, took the fifth slot.

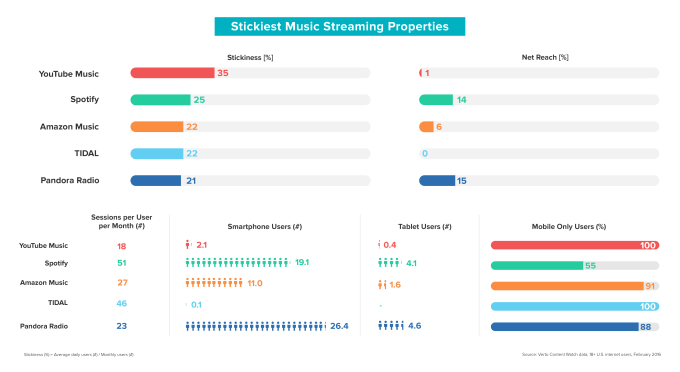

Verto also found that YouTube, which has a relatively small number of monthly unique users on mobile in the US — just 2.6 million users — had the “stickiest” service, with a 35 percent “stickiness” rating (dividing daily by monthly active users). Doing the math, this gives YouTube 875,000 daily active users on mobile in the US. Spotify also scored strong here, grabbing the highest number of listening sessions per month, at 51.

(Google’s music properties, in fact, are not huge winners in terms of active users on mobile: Google Play ranked ninth among music apps in terms of monthly uniques in the US, with around 6 million.)

Verto — a competitor to companies like ComScore that has raised around $24 million — says that it bases its figures on data is pulled from 20,000 SmartPanel users, people in the US and UK who opt-in to Verto’s on-device metering app on their phone, tablet and computer, letting it measure their usage on across devices, apps, and sites. This measurement data is then combined with calibration data that Verto collects from analytics and advertising platforms across nearly half a billion devices monthly. (Customers include Universal Music Group, EA Games, Johnson&Johnson, Microsoft and others.)

The reason why Apple Music brought in the most monthly uniques on mobile in the US is an interesting surprise. According to Verto’s Connie Hwong, it comes down Apple Music’s three- month free trial, which more than doubles the amount of people who are listening using its app in the US: Apple last reported 20 million paying subscribers globally (not just the U.S.) for Apple Music in December 2016.

Update: In a later enquiry several days after this post was published, Verto told Musically that in fact these numbers also included “on-screen engagement of the app,” which includes both streaming and music stored on the device. In other words, the 40.7 million figure is not just due to streaming and a sole boost from free downloads, but to other music that is run through the Apple Music app.

The takeaway from this for me is that while this is not as huge a leap for Apple Music the streaming service, it shows the pull that Apple’s native music app continues to have on mobile, which — whether it’s through free trials, or paying streaming users, or people listening to their own collections — are still representing a higher number of monthly unique users than Spotify and the rest, according to Verto’s figures.

Over time, this pull can help it gain more users for its paid streaming services, as users open and use the app for their own music become natural and open targets for Apple to promote its other services.

Original article continues below.

While paying users tell one story about a company, and registered users tell another, active users is still a third. In the cases of Spotify and Pandora, which are older services, there is a pretty wide gulf between registered (and paying) users and people who actively open an app on their phones.

Spotify earlier this month said that it had passed the 50 million mark for paying users globally; it hasn’t updated its overall users (including free) since last June, but at the time it said it had over 100 million. Verto’s figure of 30.4 million active users in the US in February is one-third the size of all of Spotify’s global registered users, and two-thirds the size of all paying users.

Pandora today has 81 million users, but only around 4 million of them are paying for its Pandora Plus tier, which gives users some control over the music that is played, but without being a full on-demand service. The premium tier, which will have an on-demand component, was announced earlier this month. Verto’s figure of 32.6 million users is just under one-half the size of all users; and eight times as many paying users — a proportion that Pandora is under a lot of pressure to grow with the introduction of that $9.99 premium tier.

What’s interesting to me here is how Apple Music’s free tier seems to be doing so well here. There are a few reasons why that might be the case.

For starters, Apple Music is preloaded on all iPhones, making the service that much easier for users to try out. Then, there is Beats 1, Apple’s radio service.

In a profile in the Verge, Apple Music executive Larry Jackson described Beats 1 as “the biggest radio station in the world” (although Apple declines to give actual usage numbers). Robert Kondrk, another Apple exec, pointed specifically to its strength as an onboarding tool for Apple Music (incidentally eating into SoundCloud’s business in the process), specifically around exclusive content that’s streamed on Beats 1 that then links to streams in Apple Music:

“Now an audience which once went to SoundCloud to hear the latest Drake music heads to Beats 1 first.”

Kondrk describes the relationship between Apple Music and Beats 1 like an amusement park — once you’re inside the Apple Music app to listen to Beats 1, it’s only natural you’ll stay in it to stream the songs afterward.”

There’s also the novelty aspect of a new app: users download apps but often stop using them after a while, and perhaps the same may go for a certain proportion of people who have downloaded older music apps. Conversely, there may be some curiosity about the newer Apple Music app and people’s interest in trying it out.

But the same can’t be said for every new entrant music app. Tidal, the streaming service co-owned by Jay Z and with a roster of other big music artists among its backers, hasn’t been entirely forthcoming about how many users it has: Verto cites just 100,000, while a report in January, near the time when Sprint disclosed a 33% stake in the business, said the number was closer to 850,000, and Tidal itself has said it’s 3 million.

Whatever the actual global number is, Verto said that the users Tidal tend to be dedicated, with a “stickiness” rating of 22 percent, the same as Amazon Music, with an average number of listening sessions for the month at 46, just behind Spotify’s 51.

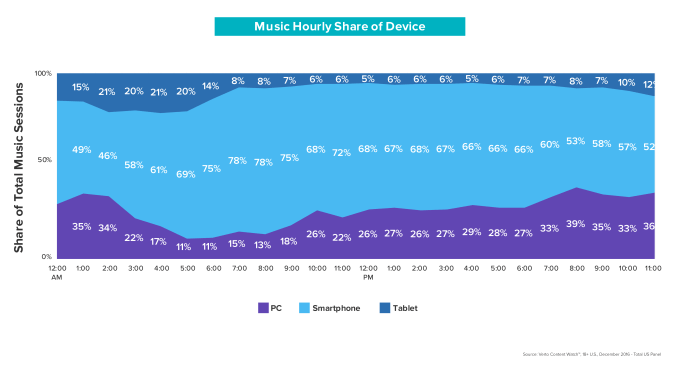

The focus on mobile in this report partly comes out of the fact that mobile — and specifically the mobile phone — represents the most popular platform for digital music at the moment:

The message for music app developers seems to be fairly clear: if you are a music app that wants to continue to grow your user base, you need a mobile app that’s pulling in active listeners on a very regular basis. It points to why we are seeing the likes of Spotify launch so many different variations on the concept of recommendation and discovery services, and why we’ll continue to see more of these from the rest of the field. “For streaming music services that offer on-demand music libraries, a vast catalog is no longer a selling point,” Verto writes. “It’s a given.”