San Francisco-based LendingHome has spent the last several years building technology that would help real estate investors get mortgages in what has been an otherwise constrained lending market. Now the company is looking to expand its addressable base, by offering more traditional mortgages to consumers — specifically first-time homebuyers.

LendingHome’s new home financing product will allow consumers looking to buy a home to get a rate estimate and apply online without having to fill out any physical paperwork or go through any of the hassles associated with using an offline loan officer. As a result, the company believes it can speed up the process and make things more transparent, all while lowering the costs associated with originating a mortgage.

Founded in 2013, LendingHome began issuing loans about a year later. At launch, it focused specifically on bridge loans, mostly serving real estate investors who bought residential property to fix and flip. According to founder and CEO Matt Humphrey, that filled a customer need in a market where borrowers were unable to get financing.

Because it was providing capital in an otherwise underserved market, Humphrey says LendingHome had to develop its own infrastructure and create its own risk models to determine creditworthiness of borrowers and originate mortgages. It then was able to partner with institutional lenders to purchase those loans.

Now that LendingHome has proven its technology by issuing more than $1 billion in loans to date, the company is looking to go after the much larger consumer mortgage lending market.

With its new mortgage lending product, LendingHome is going after the 15.8 million home buyers projected to be in the market by 2025. Increasingly, that customer base will be made up of millennials buying their first homes.

But while 90 percent will use online resources to research homes before they purchase, very few will know how mortgage lending works. Today, more than 80 percent of mortgages are issued offline, according to Humphrey, which means there’s a huge opportunity to capture borrowers as they move online.

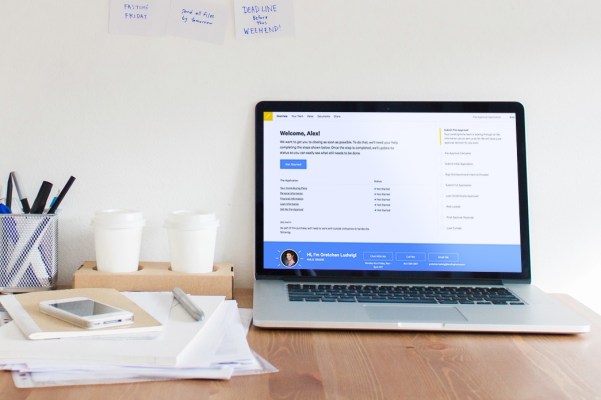

LendingHome has streamlined the process of finding out what mortgage terms a borrower might qualify for, locking in a rate and applying online. Rather than going back and forth with a loan officer, borrowers will be able to choose from a variety of loan products and track the process of their application through a personalized dashboard.

The idea is to bring a new level of transparency to a pretty antiquated industry. Humphrey also believes that by moving the process online, LendingHome will be able to make things much more efficient.

On average, it costs banks $8,000 to originate a loan, with the majority of that going to sales, operations and people expenses. LendingHome believes it can substantially reduce costs and pass savings on to consumers.

To start, LendingHome will offer consumer mortgages in Arizona, California, Colorado, Florida, Georgia, Nevada, Oregon, Texas and Washington, but the company expects more states to come online soon.

In just four years, LendingHome has grown to 250 employees and has raised more than $100 million in venture funding. Investors include Renren, Ribbit Capital, Foundation Capital and First Round Capital, among others.