Amazon has quietly made one more acquisition to build out the productivity services on its cloud platform AWS. The company has acquired Do.com, a startup that had built a platform to make meetings more productive by doing things like managing notes in preparation for them, and creating reports for those who were not there, as well as organising the meetings themselves. Amazon is rolling it into Chime, a new communications suite for businesses that it launched last month and offers via AWS.

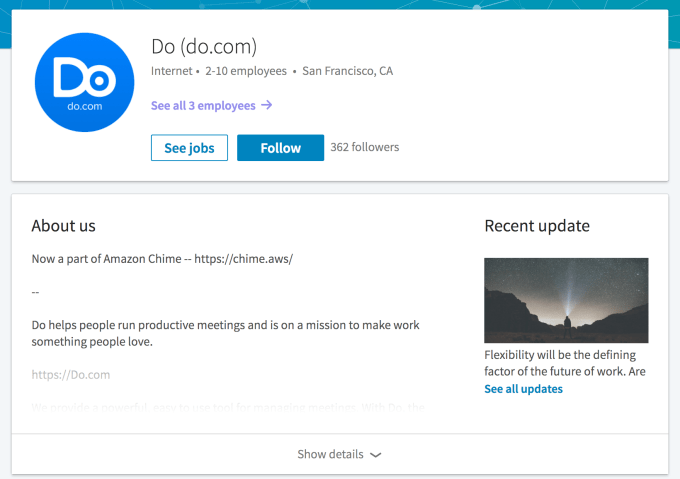

On February 15 (two days after Chime launched), Do announced it had been acquired and would close its service — including its web, mobile and Apple Watch apps — at the end of the month. Do didn’t name a buyer, but a reader tipped us off to the company’s profile on LinkedIn, which notes that the startup is “now a part of Amazon Chime.” Other Do staff also note the acquisition on their profiles.

We have reached out to several people at Amazon, as well as Do.com’s founder and CEO Jason Shah, who now says he is a product manager for Chime, for a formal confirmation. We will update this as we learn more. UPDATE BELOW.

It’s not clear what parts of Do.com are being used by AWS (although another former employee now works in engineering at Amazon) — or what price Amazon paid.

I wouldn’t be surprised if there were others having discussions. Do had raised only $2.4 million, but from a very long list of well-connected investors. They included Salesforce, which has a penchant for products with short names and, like Amazon, is working hard to expand the amount of value-added services it offers to users on its platform. (And here’s one for the tech brand watchers: Salesforce even once had its own task management service called Do.com, which it shut down in 2013. Maybe offering up the URL was its investment in the startup.)

Amazon’s AWS — which posted $3.53 billion in revenues last quarter — has been on a mini buying spree of late to expand the services it offers on top of its cloud infrastructure — specifically in areas like productivity and security.

Many of these are smart moves on the part of AWS: they can help it expand revenues per user and margins on basic cloud services, which Amazon prices lower to compete against others like Google, Microsoft and Rackspace for what is essentially a commoditized product.

This is the second acquisition we’ve been able to identify that Amazon has made to build Chime. The first was Biba, which it acquired last year for the videoconferencing piece of the service. That deal was never confirmed by Amazon directly at the time, although we found a lot of proof, and today the Biba site redirects its users to Chime.

And on Monday of this week, it was revealed that AWS had acquired Thinkbox Software, which makes tools for professional video editors. This capitalised on the fact that video is already a signficant part of the content already stored and distributed via AWS.

Other acquisitions that we may see turned into products down the line include cloud security services, by way of Harvest.ai, another acquisition we uncovered in January. And Cloud9, which was acquired in July 2016 and has already said that it is building developer tools for AWS to work between web and mobile.

Do.com was the first startup to come out of San Francisco-based Sherpa Foundry, an incubator-style outfit launched by the same people behind Sherpa Capital, Shervin Pishevar and Scott Stanford. Sherpa Foundry is run as a separate entity, focused on working with corporate clients to help them connect to and integrate with new startups (both those in Sherpa Capital’s portfolio and outside it).

Although the Do acquisition by Amazon might not have fit into the bigger Sherpa Foundry mission, its placement could have helped Do pick up more large customers.

In 2016, when Do.com was expanding to Android, Shah said in an email to us that the service had been used for more than 5 million meetings and it had 25,000 customers. The company had also built integrations with Slack, Zapier, Google Apps, Microsoft Exchange and Office 365, and Evernote.

Again, it’s not clear which parts of Do are going into Chime, but when you consider the groundwork, mechanics and general concept and aspirations behind the startup, it’s clear that Amazon now has a few angles to work into its own scaled-up ambitions.

UPDATE: Since publishing this article yesterday, we’ve had some developments.

An AWS spokesperson acknowledged my (Ingrid’s) email by phone but declined to give a comment.

Also, looks like AWS and Do.com have tried to put the genie back into the bottle. Do has removed its blog post announcing the closure and acquisition, as well as the note on its LinkedIn page (and the pages of employees who also noted the acquisition) about becoming a part of Amazon’s Chime. The mobile and web apps are still off the app stores.

You can see a screen shot above of Do.com’s LinkedIn page; and, because the Internet is not great at letting the world forget things, you can find a cached version of the blog post here.

It’s worth noting too that although we try every time, we never had formal confirmations about Biba, or Harvest.ai, or actually quite a lot of our Amazon scoops that have proven to be correct over time. ¯_(ツ)_/¯