Automated savings startup Digit has long helped users squirrel away money for a rainy day. But today the company is rolling out a new feature that will make it easier to help its users save and pay their monthly bills.

Digit works by scanning users’ bank accounts to measure their cash flows, and algorithmically determining how much money it can save for them. Once a user has connected a bank account, every few days Digit will pull out a small amount of cash that it deposits into its own savings account which users can access at any time.

The goal is to hit a sweet spot between deducting so little that users hardly notice the money is gone, while saving enough that small amounts start building up to larger balances. And it seems to be working — since publicly launching two years ago, the company has helped users save more than $350 million.

Now the company is moving beyond just helping users create a rainy-day fund, with the launch of a new bills feature. Since the company knows how much money you spend monthly on various different things, adding bills to its algorithm seems like a natural extension of what Digit is already doing.

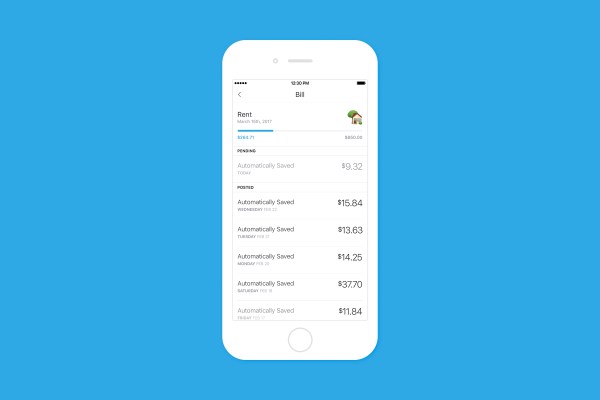

When Digit users open the app, they’ll see a new Bills feature in the keyboard, which will allow them to define the monthly bills they’d like to save for. By choosing “new bill” users will be able to set the amount to save and due date for the bill.

Two days before the bill is due, Digit will automatically remit the amount saved and send a text to alert users. The company will also let users know if for whatever reason a bill savings target can’t be met.

According to Digit CEO Ethan Bloch, the addition of bill savings came out of seeing how users took advantage of a feature called Goalmoji that the company soft-launched last year. That feature allowed people to create various “goals” where they defined the target amount and attached an emoji to it.

While only about 10 percent of Digit users noticed the feature and actively used it, those who did were frequently setting up goals related to their monthly bills. That prompted the company to focus on fine-tuning its algorithms to start saving for essential bills first before setting aside money for savings or other goals.

“A lot of people are living paycheck to paycheck,” Bloch said. With the new bills feature, he believes “they can have their rent and car payment taken care of and not have to worry about it.”

While Digit will help users save for their bills, they still have to actually be the ones to pay them. But in the future you could probably imagine a system where Digit — or a company like Digit — is able to automate your finances so you never have to worry about missing a payment or having an overdraft fee hit your account.

And to me, that future sounds pretty great.