Between Venmo, Square Cash and even Snapcash, no one can argue that it’s hard to send money to a friend.

But it wasn’t always this way. Paper checks used to be the de facto method of repayment — and it was messy, time-consuming and nowhere near instantaneous — someone could wait a month to cash a check you wrote them, leaving you with an annoying surprise when the money is withdrawn after you forgot about even writing the check.

And the surprising thing is that most small business in the U.S. still use paper checks to remit and accept payments from other businesses. For example, a typical restaurant may end up cutting more than 100 checks a month to dozens of different vendors — and imagine how many checks the vendors have to deposit!

Enter Symple. Part of Y Combinator’s Winter 2017 batch, the startup calls itself Venmo for Businesses — and it pretty much is.

Here’s how it works:

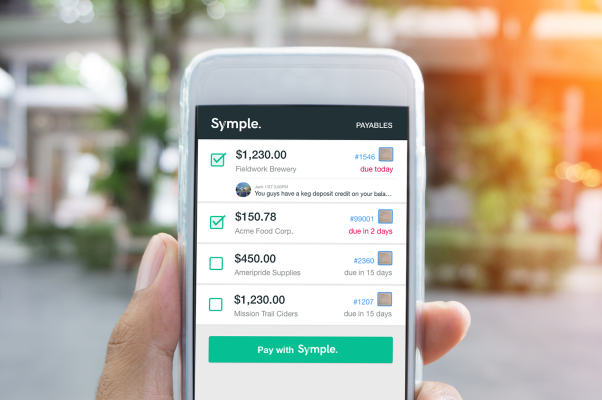

When a business gets an invoice, they snap a picture of it and send it to Symple (or forward them the email if it is a digital invoice). The startup then parses the amount, due date, etc. — and notifies whoever controls the budget that there is a payment pending.

With one click Symple will then remit a payment directly to the vendor’s bank account.

Of course, this means vendors need to sign up and provide the startup with their account information. But Steve Abraham, co-founder of Symple, explained that vendors have been receptive to this sign-up process because, at the end of the day, it will increase the speed and reliability of their accounts receivables.

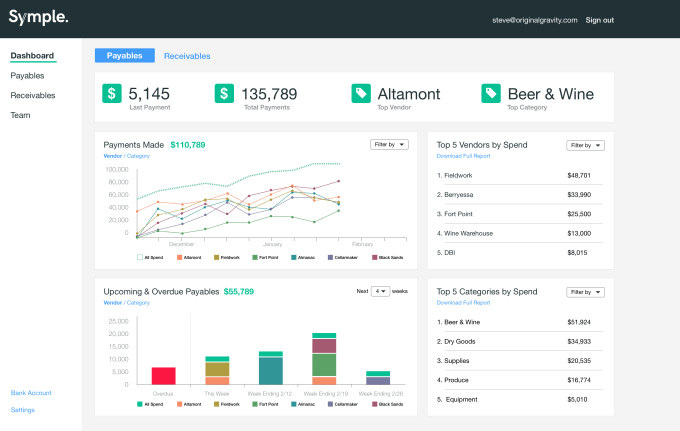

The platform also has some basic analytics built-in. They provide a dashboard to track payments over time, upcoming and overdue payables and even the top categories where your business is spending its money.

Currently Symple is focused on signing up restaurants and bars, mainly because the hospitality industry is known for having a lot of invoices to pay each week. But eventually they will expand into other industries, with the ultimate goal of becoming an online payment platform for all B2B purchases.

Right now, the service is free for all businesses to make and receive payments online and manage their invoices. Eventually they plan to introduce a premium tier that will provide more complex accounting features — like direct integration into QuickBooks and other accounting systems. This plan will cost up to $150/month, depending on the number of users and invoices processed.