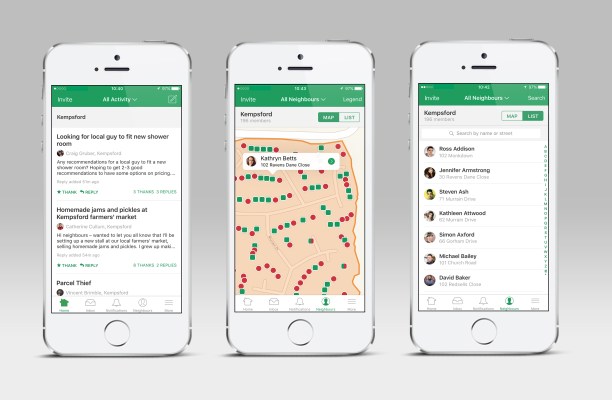

In what is being billed as a “multi-million pound” acquisition, San Francisco-headquartered Nextdoor is purchasing the “assets” of U.K. local social network Streetlife.

The deal, of which further details are scarce, will see Streetlife’s 1.5 million registered users invited to sign up to Nextdoor’s fairly recently-launched U.K. version, before Streetlife itself shutters. “No member data will be transferred without the explicit approval of a Streetlife member,” say the two companies.

Furthermore, I understand that the acquisition is for cash and certainly less than £10 million, while Streetlife’s employees are not transitioning over to Nextdoor as part of the deal.

In a call earlier this week, Streetlife founder Matthew Boyes, who is staying on to advise during the handover, assured me that staff are being well looked after regards the sale. “Nobody in the office is crying,” he says.

Whether or not investors are quite so content is hard to judge based on the limited disclosure. Streetlife had raised around $5 million, according to CrunchBase.

Backers include Archant Digital Ventures (the incubator and investment arm of regional U.K. media company Archant), Shohet & Cie, and SDVentures, amongst others. In fact, I count nearly 90 shareholders, according to the startup’s most recent regulatory filing.

What is clearer, however, is that local social networking in the style of both Streetlife and Nextdoor is incredibly reliant on network effects, creating a winner takes all market.

The experience of using either service would be considerably poorer if your direct neighbours were split across two competing platforms, something Boyes concedes, noting that the last thing both companies wanted to do was treat its users as pawns in a battle between Streetlife and Nextdoor.

“Nextdoor members have quickly established thousands of online communities in towns and cities across the country, including over 40% of London neighbourhoods. Before today’s announcement, Nextdoor was already growing ten times more quickly in the U.K. than when the company launched in the United States,” Nextdoor is expected to say on Tuesday.

Asked if Nextdoor entering the U.K. just four months ago would have made it harder for Streetlife to raise another funding round, Boyes denied that was the case, arguing instead that the very existence of Nextdoor, albeit across the pond, had always helped validate the startup’s existence amongst prospective investors.

However, it’s well-known that European VCs don’t always have the stomach or deep pockets to battle it out with a much better funded U.S. company — in early 2015, Nextdoor was given a post-money valuation of $1.1 billion by investors, making it a so-called ‘unicorn’ — and the sale of Streetlife’s assets settles that dilemma conclusively.