Investment in European startups held up last year despite fears of a slowdown, with some $12 billion invested during the year, according to an annual report compiled by French investment advisors Clipperton, working with Digimind’s WhoGotFunded database.

The report notes the year as effectively on a par with 2015’s record level of European* startup investment.

However the looming prospect of Brexit is casting a shadow over the region’s future, given the UK’s key role in driving European startup investment — with the report noting 24 per cent growth for UK transactions in the first half of the year.

Brexit — aka the vote by the British public to leave the European Union — occurred in the middle of last year, and the report notes that the second half of the year was “a bit lower” for UK startup investment.

But it’s clearly too soon to know what Brexit’s impact will be, given the UK has yet to start the formal two-year process of leaving the EU (due to be triggered by the government by the end of March). It was only this week that the UK Prime Minister publicly confirmed the country would be leaving the EU’s Single Market as a result of the Brexit vote, for example.

“The dynamics will have to be monitored closely as the real impact of the Brexit is still ahead of us,” the report authors note.

Notable trends also flagged in the report include —

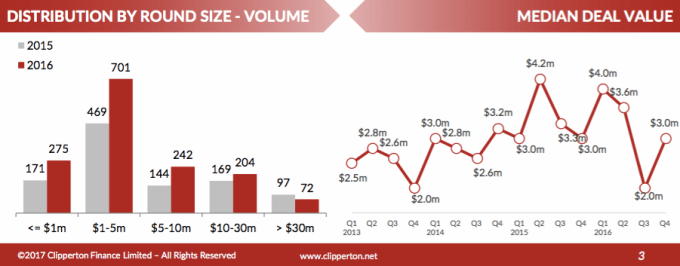

- an increasing volume of smaller deals (of sub-$30M), helping to offset a decline in larger rounds across the region — so, it looks like investors in Europe are spreading their bets further. “The number of transactions is clearly on the rise (+40% yoy in 2016) suggesting fewer large deals but a handful of start-ups which will seek acceleration rounds in the next 12 to 18 months”

- growing appetite for tech investment among private equity funds, with the report noting KKR made “landmark minority investments” in OVH (hosting) and Darktrace (cyber); and also that “several big players” launched significant new funds dedicated to technology and growth equity. They also note direct investment by corporates is on the rise

There were 943 deals between $1m and $10m announced in 2016, according to the analysis, an increase of more than 50 per cent vs 2015.

The report also notes the amount invested in the $1M to $10M segment was $3.6BN — the same amount for deals between $10m and $30m (aka acceleration rounds).

These acceleration rounds were also on a positive trend in the second half of the year, up 19 per cent in value vs 2015. So it was only the larger round size declining in Europe last year, which the authors suggest could be good news for a sustainable investment ecosystem in the region.

While the UK continues to dominate the European startup investment ecosystem, with $4.1BN invested into its startups last year, the report flags strong momentum in France — which saw a 22 per cent increase in investment value vs 2015, according to their data.

The report also notes that three deals in the top five for the European region went into French startups (web hosting company OVH; IoT connectivity platform Sigfox; and audio kit maker Devialet), with the other two going to UK startups (on-demand food delivery platform Deliveroo; and DNA sequencing firm Oxford Nanopore). Some $2.7BN went into French startups in 2016.

France also looks likely to be one of the European countries that will gain from Brexit in the coming years at the UK’s expense, via an influx of jobs created by banks headquartered in London moving roles to Paris as they seek to retain access to the EU’s financial services passporting mechanism.

Elsewhere in Europe the Nordics saw a decline in the value of investment vs 2015, with a 24 per cent drop — and just $1.1BN invested into startups there.

While investment in startups in Germany, Austria and Switzerland is described as “solid”, with deals for the year there valued at $2.6BN.

The report also goes on to highlight positive growth signs for the southern European countries of Spain and Portugal too, suggesting the former is showing signs of “real uptake” — with the volume of startup investment transactions up 150 per cent in H2 2016 vs H2 2015. Although challenges remain, with the report noting Spain still lacks a “favorable” regulatory framework for startups.

*NB: The report includes Russian startups but excludes investments in Israel