German hotel booking site Trivago updated its plans for a U.S. IPO in a filing that came out on Monday. The company expects to price its shares between $13 to $15, a $428 million offering at the top end of the range.

Officially named Travel B.V., the company will change its name to Trivago to match its popular web property, before completing the IPO later this month. Expedia will still own a controlling stake.

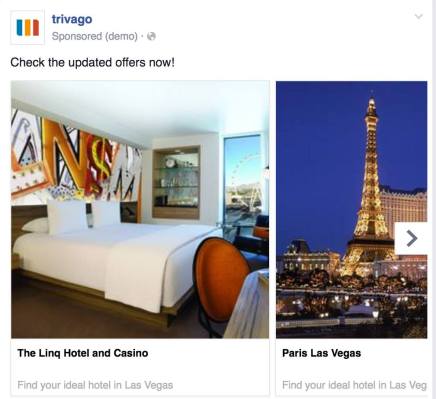

A competitor of Kayak and TripAdvisor, Trivago says its mission is to “be the traveler’s first and independent source of information for finding the ideal hotel at the lowest rate.” They currently showcase 1.3 million hotels in over 190 countries.

The company makes money by charging hotels and travel agents on a “cost-per-click” basis. Trivago said its users accounted for 487 million “qualified referrals” in the previous year.

Trivago is experiencing rapid revenue growth, bringing in $425.6 million in the nine months ending in September 2016, up from the $324.6 million seen in the full prior year. Their 2015 net loss was $42.8 million.

Founded in 2005, Trivago previously raised funding from London-based HOWZAT Media. Expedia bought a majority stake in 2012 for $632 million.

This year has seen few tech IPOs, but their performance has been mostly strong. We’re hearing that there will be a wave of companies going public in 2017.

Trivago will list on the Nasdaq under the ticker, “TRVG.”