Netflix is finally breaking off from its slowing subscriber growth trend as it posted a huge quarter that beat both its own, and Wall Street’s, expectations.

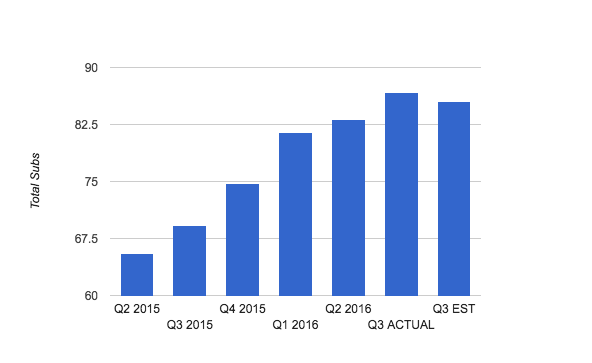

Here’s the money chart:

Shares of Netflix are absolutely blowing up, now up more than 20% in extended trading after the earnings report came out. With today’s crazy jump in its stock, the company added nearly $10 billion to its market cap.

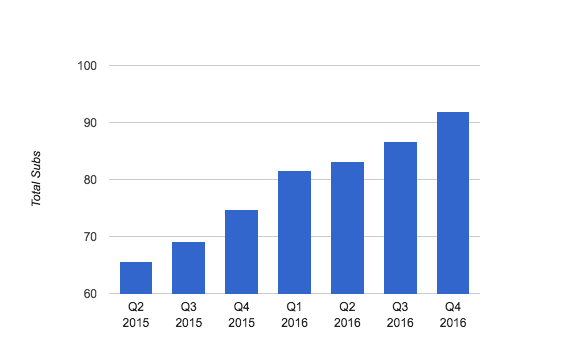

And here’s the chart including the company’s fourth-quarter estimates:

So, it looks like the company is not only stepping up its own expectations, but it’s looking at a huge holiday quarter for potential subscriber additions.

Last quarter, the company not only posted a soft gain on its subscribers — including international — but it also dropped back its outlook for the third quarter. By going that conservative, it raised a lot of concerns in Wall Street that the company would be able to keep tempo with its international growth as it rapidly expanded to new countries. But it looks like that target was conservative for Netflix itself (the company could have totally been sandbagging Wall Street, of course) and the current strategy in place may be working for the company.

Netflix added 3.2 million international subscribers, and 370,000 domestic subscribers. Total subscribers were up to 86.7 million. Wall Street was looking for the company to add 304,000 U.S. subscribers and around 2 million international subscribers. Analysts were looking for earnings of 6 cents per share on revenue of $2.28 billion.

The culprit was pretty much what we’d expected: people are getting excited about its new original content — and that might be enough to entice international consumers eagerly waiting to watch it and catching up on everything else int he mean time.

“Our over-performance against forecast was driven primarily by stronger than expected acquisition due to excitement around Netflix original content,” the company said in a statement.

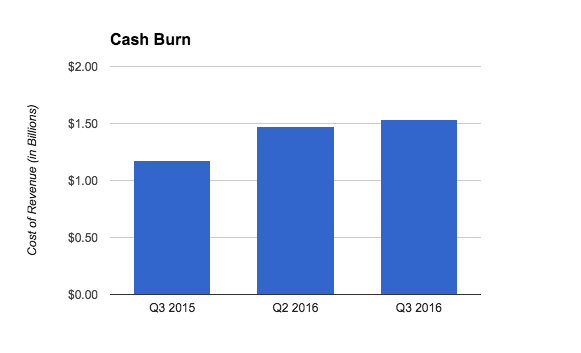

However, there’s another point that’s interesting in the report: its cost of revenue exploded year-over-year:

The company also posted a very wide beat on earnings, recording 12 cents per share. With today’s report, the company has reversed most of the losses the stock has incurred since January.

Slower-than-expected subscriber growth has recently dogged Netflix recently, as it’s made a huge push to try to expand internationally but has run into a series of hiccups. In particular, last quarter Netflix noted China’s regulations would be a significant issue as it continued to expand beyond the U.S. That’s put a heavy drain on optimism around the company as it missed its own expectations and had to pare back future expectations as a result earlier this year.

There’s also the issue of enough content being available abroad. Over the weekend, CBC reported that several un-blocker services that would allow international customers to view U.S.-based content — which is a big push for Netflix — were running into a lot of issues. While Netflix continues to deliver a lot of hits in the United States, particularly with its Marvel original series and over the summer, Stranger Things, it is still trying to get that content internationally.

Without that, despite expanding widely into new countries, it’s going to have trouble convincing people to shell out money for the service. It’s going to have to also figure out how to get the right local content available in those countries.

Netflix has had an extremely bumpy year to say the least. Since January this year, Netflix shares were down around 13% before the earnings report, while in the full year things were largely unchanged. Long-term, Netflix’s strategy seems to be working, but it still appears that there are some tweaks that need to be made in the near term as the company rolls out its expansion plans and places a focus on acquiring new subscribers.

With today’s report, however, the company has reversed pretty much all of the losses it’s incurred in the past 10 months.

[graphiq id=”3soU5hSoixv” title=”Netflix Inc. (NFLX) Stock Price – 1 Year” width=”600″ height=”463″ url=”https://sw.graphiq.com/w/3soU5hSoixv” link=”http://listings.findthecompany.com/l/16808888/Netflix-Inc-in-Los-Gatos-CA”]