Transportation investment has moved into the fast lane. Venture and growth investing in transport-related companies accelerated in the third quarter, fueled by momentum in the autonomous driving and ride-hailing spaces, as well as the prospect of big acquisitions.

VCs and seed investors poured more than $6.2 billion into more than 150 companies across the globe with transportation-related business models in Q3, according to Crunchbase data. That exceeds the $6.1 billion invested in the space during all of 2015.

Transport VC activity has been speeding up for a couple of quarters. The Q3 numbers were only a hair higher than Q2, which saw about $6 billion invested, most in the form of a single $3.5 billion round for Uber and the rest spread among remaining startups.

The number of big rounds also rose. In Q3, at least 13 companies secured $100 million or more in venture funding, up from eight in Q2 and just two in the third quarter of 2015.

Why the rise? The data points to four main drivers: Major disruption across multiple sectors, global expansion, a push for early mover advantage, and the potential for large and quick exits.

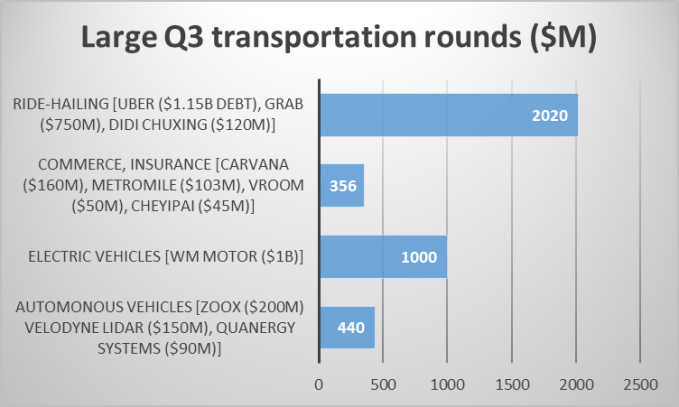

Let’s talk about disruption first. It’s common knowledge that ground transportation is facing a major shakeup in multiple areas. These include autonomous driving technology, electric vehicles, and ride-hailing platforms. At the same time, new e-commerce and mobile platforms for buying and insuring cars are quickly gaining market shares. These four areas account for about two-thirds transportation investment in Q3.

As usual, a few really big rounds accounted for the lion’s share of investment in each sector:

The prospects for a big exit also appear to be a driver. Companies in the autonomous driving space have been getting acquired early in their development — and are going for huge sums.

GM paid a billion dollars in March to acquire Cruise Automation, a three-year-old company with less than $20 million in venture financing. And in August, Uber shelled out a reported $700 million for Otto, a six-month-old developer of self-driving trucks.

Ride-hailing still offers the best route to a huge valuation. A single deal, Didi Chuxing’s $7 billion purchase of Uber’s China operations, accounted for the lion’s share of transport M&A dollars in Q3. It’s a particularly staggering sum when one considers that Uber’s China foray wasn’t even particularly successful, logging billions in losses and trailing far behind Didi in market share.

For now, venture-backed transportation startups still prefer to exit through acquisition. No companies in the space went public or filed to so in the third quarter.