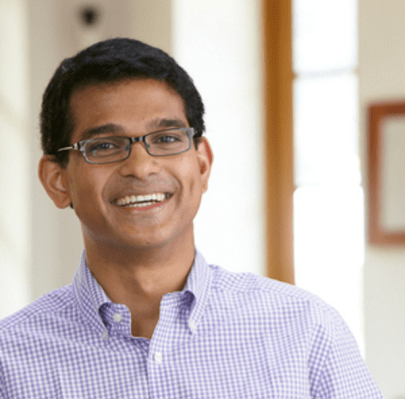

In May of last year, Ifty Ahmed was accused by federal regulators of conning his former employer — the venture capital firm, Oak Investment Partners — out of $65 million. Now, Ahmed suggests, Oak is doing the conning, and he says the stakes are even higher.

You might remember Ahmed’s sensational story. According to his former colleagues, Ahmed — who’d joined Oak in 2004 following short stints as a junior investor with both Goldman Sachs and Fidelity Ventures — began bilking the firm almost immediately. They say he doctored deal documents and faked invoices, among other ways he directed the Norwalk, Conn. firm’s monies into his own personal account.

The alleged fraud was discovered almost by accident. One month earlier, Ahmed, who lived with his wife and children in Greenwich, Conn., was arrested and criminally charged with insider trading. The reason: Federal prosecutors in Boston said Ahmed had conspired with longtime friend Amit Kanodia to profit from the planned acquisition of Cooper Tire & Rubber Co. by India-based Apollo Tyres, making $1 million from the deal before it was publicly announced. (Kanodia’s wife was Apollo’s general counsel at the time.)

In a civil lawsuit filed against Ahmed at the time (May 2015), the SEC identified at least nine companies in which Ahmed allegedly manipulated Oak investments for his personal gain, the most egregious of which appeared to be a Hong Kong-based online retailer. According to the SEC, in December 2014, Ahmed convinced his partners to write a $20 million check for a stake in the company when, in reality, it was buying a $2 million stake. Ahmed pocketed the rest, says the SEC.

With his name in the headlines, Ahmed fled to India, where he was quickly arrested by local authorities for entering the country illegally on an expired passport. (He surrendered his U.S. and Indian passports to U.S. authorities when he was charged with insider training.) In the meantime, the SEC froze all his assets, including his brokerage accounts, his investments in Oak’s funds and various properties, such as a home in Greenwich, and two Park Avenue apartments in New York.

Now Ahmed, who remains in India — he tells us he’s been prevented from returning to the U.S. by Indian authorities who’ve confiscated all of his documents — is trying to wage a battle of his own. To wit, earlier this month, he filed a motion in a U.S. District Court petitioning the SEC to include all of his “untainted assets currently held by Oak” and to direct them into a “joint untainted frozen bank account.”

According to Ahmed’s legal filing, these assets include four direct forms of investment and investment-related economic interests associated with his employment with Oak, including carried interest in four funds (Oak Investment Partners X, XI, XII and XIII), in which he says he was significantly vested. Specifically, Ahmed says that when he was terminated from Oak on May 18, 2015, he was fully vested in his Fund X; 91 percent vested in Fund XI; 83 percent vested in the carry of Fund XII; and 54 percent vested in Fund XIII’s carry.

“With very conservative assumptions, the total value of [Ahmed’s] carried interest across these funds is material and significant — easily in the $60 million range even with very conservative assumptions,” states his motion.

Ahmed’s motion also addresses a performance-based bonus plan at Oak called IPP that allocates a “manager” on a deal and supporting “buddies” with 100 points, with the manager often keeping 60 percent of the points and the buddies divvying up the rest. How it worked, per Ahmed: “For every $1 million of net gains generated by an investment, the responsible team would be paid $110,000.” He says that as a manager for eight portfolio companies and a buddy in another 10, his vested IPP earned — but not paid to him — “would easily be in the $15 million range.”

But there’s more. Ahmed highlights his direct investments in Oak’s funds as a limited partner. (All firms require their investing partners to chip in a certain percentage of their own assets into a new fund to show they have “skin in the game.”) Ahmed says in his motion that his direct invested capital in Oak’s funds is in the $8 million range and claims that it’s “100 percent untainted as it was directly and immediately invested in an Oak fund from his Oak salary.”

The fourth economic interest that Ahmed references centers on his equity ownership of the management company, which he says is in the “8 percent fully diluted ownership range.” Meaning what? Well, using comparably publicly traded companies like the Blackstone Group and Carlyle Group, Ahmed says in his motion, that stake would “likely be worth more than $50 million.”

The grand total for all the aforementioned? $133 million.

Presumably, there’s a bit of gamesmanship at play here. While the SEC continues its investigation into Ahmed, the motion makes it appear as though he expects to be fully vindicated at some point. He’s also casting Oak in the same light as he has himself been cast: as greedy and interested only in furthering its own financial interests. Perhaps unsurprisingly, Ahmed doesn’t mention those separate insider-trading charges that led Oak to investigate his behavior in the first place (charges that could reportedly land him in prison for up to 20 years if convicted).

Ultimately, Ahmed complains in his motion, Oak “continues not to make any of the distributions from its funds and any of the vested and earned carried interest and IPP payments that should have been made to [Ahmed] under ordinary course of business. These amounts are not only material and significant, but also could be accruing significant interest income were they to be held at a bank or any other financial institution versus being unjustly and improperly appropriated by Oak at this time . . .” He more pointedly accuses the firm of “flagrant self-help.”

Asked about the motion, an Oak spokesman offered a simple statement. “Mr. Ahmed’s assertions are baseless and false. There is no carry payable to him.”

Reached in India, Ahmed said he couldn’t call and expand on the motion that he submitted because it’s in sub judice at the moment (it’s under judicial consideration and therefore prohibited from public discussion elsewhere).

Asked what it makes of the filing, or whether there is a precedent for what Ahmed is requesting, a spokeswoman for the SEC would say only that the SEC declined to make any comment beyond what it has said in court and court filings.

A former SEC attorney meanwhile say that it’s “highly unlikely” that Oak will “pay him even a nickel” ever again, adding that if Ahmed feels he’s owed money, he’ll have to sue Oak for it, not appeal to the SEC for its help.

You can see the SEC’s case against Ahmed here.

You can read his full motion here.