Cuff, the smart jewelry maker that promised a line of fashion wearables capable of sending emergency alerts to trusted family and friends, shut down earlier this year leaving a number of customer orders unfilled and vendors unpaid. Now, the company is being named in a bankruptcy suit filed by five of its manufacturing partners.

In one case, the manufacturer Volume & Tone, LLC produced over 100,000 pieces of jewelry in order to fulfill Cuff’s customer orders, but was never paid. They alone were owed $65,000 for their work, which included sourcing and delivery of the product, but other vendors are owed in the hundreds of thousands, according to court filings.

Cuff founder Deepa Sood first met jewelry designer Lane Tabb, one of the vendors named in the lawsuit, through an accessories project Sood was working on for Restoration Hardware, where she was before starting Cuff.

Tabb’s background in brand management, creative direction, design, development and manufacturing has seen her working for brands like Kate Spade, Donna Karan, DKNY, Rebecca Minkoff, BCBG, and Herve Leger – work that made her consultancy Lane Tabb Accessories Group (owned by Volume & Tone LLC) a good candidate to partner with when it came to producing the jewelry for Cuff.

The Cuff device was meant to consist of a small, Bluetooth-connected component called “CuffLinc” that could be placed inside a varied line of attractive jewelry, like bracelets and necklaces, as well as keychains. When the Cuff was squeezed, anyone in the wearer’s pre-configured network would be alerted and sent the location of the Cuff owner. An app would also be offered.

Tabb created samples (non-working costume pieces) for Cuff in 2013 which the startup then used in a video shown to investors. Although asked to rush the sampling, the pitch worked: Cuff was able to raise seed funding in September 2013.

Sood again reached out to Tabb in September 2014, the jewelry designer says, to tell her she had pre-sold hundreds of orders, had done press, and was ready for production. The designer explained that Cuff was not production-ready.

“I reminded her that the pieces we had originally made for her video were just costume pieces — they didn’t have any connector for a chip, due to the chip not yet existing when we made them,” Tabb tells me. “I explained we could get her ready for production with proper sampling rounds once we had the actual removable chip, and real specs designed with the clipping mechanism perfected.”

But Cuff had committed to delivering the pieces to customers by mid-November 2014. Despite the rushed timeline, Tabb took on the challenge, and suggested that some pieces be produced locally in order to speed up the process, as others were made in China at the same time.

As the process began in 2014, Sood did press, attended events and sat on panels at conferences. In November 2014, Cuff was dubbed the most beautiful new wearable at Decoded Fashion’s competition. There were no production pieces at this time, however – just props.

Soon, the hype around Cuff paid off. In January 2015, the company announced $5 million in Series A funding in a round led by NEA along with seed investor Tandem Capital along with Tugboat Ventures.

The first pieces made in the U.S. – around 5,000 items – were shipped out February through April 2015, Tabb recalls. Cuff customers were informed about their pre-order delays via email. Many customers had pre-ordered the jewelry as far back as 2014 when it was first announced.

[gallery ids="1359275,1359276,1359277"]

Above: Cuff customer emails

One email sent in spring 2015 offered customers the ability to cancel their orders and receive a refund. Some customers were able to receive that refund. Others held off on getting their money back and instead chose to wait for the final product to ship.

In summer 2015, another round of emails was unleashed, apologizing for the continued delay and again offering refunds. But the email also included a status update on the project, and made the case for continuing to support the startup.

“It’s been a journey for our small team and we have weathered things like electronic components coming in flawed and shipments of other essential parts being delayed,” wrote Cuff’s founder, sounding very much like the typical startup underdog.

However, the parts were “delayed” because Cuff had gone through three rounds of false-start production, says Tabb, who was directly involved with the production process. Cuff scrambled to figure out details that should have been decided before selling the jewelry – things like which base metal should be used, for example.

“Each time they hired a new internal employee, the new person would come in and change something. Even when the order was almost through production,” says Tabb. “So we would have to throw away all of those pieces and start over. We have never worked with a company that changed their minds on details in the end stages of production,” she laments.

Pieces from China shipped in August 2015 with the final shipment in October 2015.

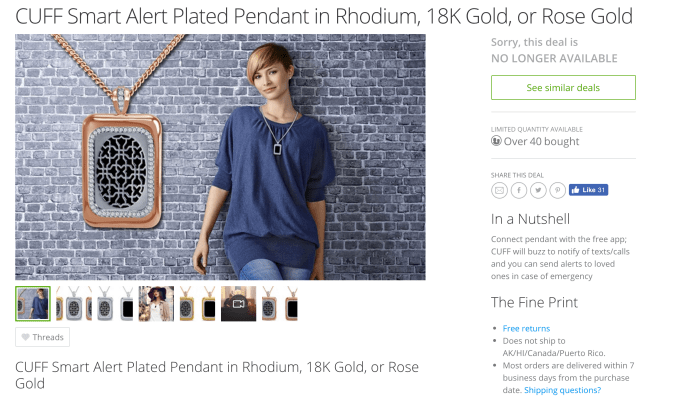

Above: A Cuff Groupon; Some of the devices were sold online through Kohl’s, Target and Groupon.

In October 2015, Cuff emailed unfulfilled customers with a promise that a new batch of devices was shipping that month or the next, and offered the option of choosing to receive the original device plus a 15 percent refund along with other incentives. These included a $15 credit for a jewelry box that wouldn’t ship until later, a free piece of jewelry, and a coupon for 20 percent off a future order.

The other option presented was to wait until April 2016 and take delivery on a new Cuff device that would include fitness tracking.

After the final shipment in October, Cuff asked Tabb for a few days to pay their final invoice. The startup had always paid on time over the two years of working together, says Tabb, so she wasn’t concerned. She paid her factory partners out of her own pocket, and waited.

In mid-October 2015, Cuff went dark. Tabb says the startup stopped responding to texts, phone calls and emails sent to the accounting department, the CFO/COO (Nandita Bhargava, the sister of Tandem partner Sunil Bhargava), Sood, and all the other VCs, requesting payment.

In December, Sood responded via email and a Tandem investor phoned to say that Cuff was out of business, and the firm was taking possession of the remaining assets.

Cuff had taken on an additional loan of $1.6 million from Tandem in 2015, which gave them an additional board seat. Tandem, controlling the board, decided to acquire assets through a secondary company called Bijoux Corp, created on the same day that Tandem moved to auction off Cuff assets. Bijoux was the only bidder at the auction.

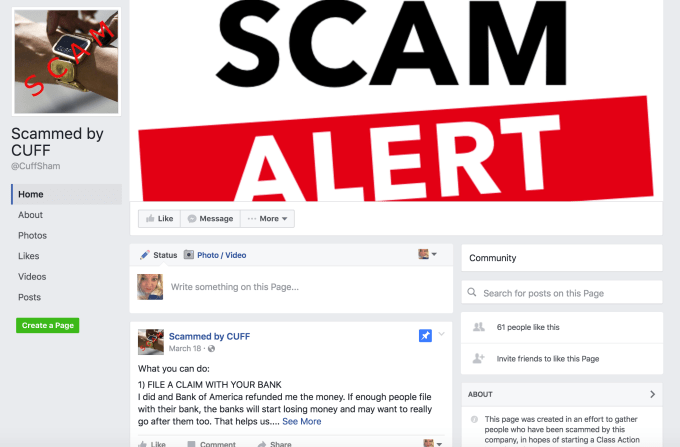

Customers start a “Scammed by Cuff” page

Tabb wasn’t the only one left in the lurch. Customers who didn’t receive their items contacted their banks to file fraud reports, and many had trouble getting a refund because of the delay between the order time and the report.

As one customer we spoke with complained, “because the order past the 130-days mark, Wells Fargo said there was nothing they could do about it. There are so many of us that have had the same problem. We paid a bunch of money for something we never saw and where is [founder Deepa Sood]?”

Others, including the person who started the “Scammed by Cuff” Facebook page, had better luck getting their banks to refund them.

She said Bank of America made an exception because Cuff emails promised the product was still shipping.

Since this spring, the “Scammed” Facebook page has been encouraging visitors to spread the word and file claims with the FTC and BBB; it’s sharing tips on how to get your bank to assist you. Members are also trying to find an attorney to take on their complaints as a class-action lawsuit.

[gallery ids="1375830,1375829,1375828"]

Above: Posts on ‘Scammed by Cuff’ page

Tabb, meanwhile, soon found she wasn’t the only vendor stiffed.

“I started getting phone calls from other vendors,” she says. “Cuff had used my company as a credit reference with these other vendors so they knew about us, and called us when they also hadn’t heard anything themselves, and were trying to get paid. We are actually owed the least of all the other vendors in the suit,” she notes.

Cuff had outsourced much of its business, it turns out. Other vendors had handled the app development, the engineering, the circuitry, the module casing and manufacturing, and the packaging/co-packaging. Another was making all the displays for Cuff’s Target launch.

REQUEST FOR ENTRY OF ORDER FOR RELIEF BY DEFAULT

Tabb’s firm, Volume & Tone, LLC, is owed $65,344.94. But other vendors were due much more.

According to a petition filed in California’s bankruptcy court, Sigma Connectivity is owed $549,714; Stephen Gould Corp. is owed $258,995.32; DUCO Technologies is owed $213,366.66; and Colony, Inc. is owed $104,872.38.

The lawyers had advised the vendors to force Cuff into involuntary bankruptcy. This would require them to open their books so a court-appointed third party could investigate if there was any wrongdoing or misappropriation of funds.

“We want to get paid for our work,” another vendor, Ola Möllerström, head of sales and marketing at Sigma Connectivity, told TechCrunch, as to why it joined the suit. “We were surprised that Cuff stopped their business and we have asked a law firm to support us.”

Other vendors never responded to repeated requests for comment.

REQUEST FOR ENTRY OF ORDER FOR RELIEF BY DEFAULT

As a small business owner, the impact on Tabb has been heavy – Cuff took so much time that she couldn’t take on other clients.

“It’s been very difficult. but we are getting through it. Unlike Cuff, our base running costs and overhead are reasonably managed, so that when things like this happen you don’t go totally under,” she says. “We are a company that is resourceful, skilled and capable, rather than so many companies now that are just smoke and mirrors – that is becoming more and more prevalent these days,” she continues.

“It’s unfortunate that investors are rewarding this kind of irresponsibility with large capital infusions on startups that have no actual results to show…I have no problem with companies investing in an idea, but not to this extent,” Tabb adds.

Seemingly putting more of the blame for Cuff’s failure on the investors, Cuff founder Deepa Sood had this to say about the suit:

“Right before Thanksgiving of 2015, Tandem decided to stop payment on the loan for reasons that are in dispute. I put in $200,000 of my own money to buy the company some time and keep employees — we had just started shipping first product and had orders from Target and Amazon, as well as our direct consumers that we had been working around the clock to fulfill. During this time, the intention was for the Board to figure out alternative fundraising options. Instead of that happening, Tandem, as the loan owner, moved to auction off CUFF assets,” she says.

“After CUFF was shuttered, Tandem, as two-thirds of the Board, took control of all communications between customers, vendors, etc. I did not (nor do I now) have any access to email, contacts, website etc. nor was I involved in outreach to vendors, if any,” adds Sood.

Reached for comment, Tandem co-founding partner Doug Renert offered the following statement on the Cuff lawsuit:

Tandem was an early equity investor in Cuff and ultimately provided the company with some secured bridge loans as it began having cashflow problems. When Cuff became insolvent, an affiliated Tandem holding company, Bijoux, acquired the bridge loans and exercised its rights under the loans to acquire the few remaining Cuff assets. Bijoux is not an operational entity, and the Cuff business is dead. The bankruptcy court will govern Cuff creditor claims from here.